Hedge Fund of Funds

Post on: 2 Август, 2015 No Comment

What is a Fund of Hedge Funds?

Fund of Funds are individual investment partnerships that are made up of investments into multiple different underlying hedge fund partnerships. A majority of the assets under management in the alternatives industry is under the management of fund of funds. Hedge Funds have traditionally been structured as private investment partnerships, where the underlying general partner or investment advisor implements a single strategy to generate alpha. The first hedge fund was started in 1949 by Alfred W Jones. Mr. Jones was the first person to employ the use of leverage and short sales to generate returns. He then proceeded to convert his general partnership into a limited partnership, thereby allowing him to invest into additional portfolio managers. Essentially creating what is known today, a fund of hedge funds.

Hedge Fund of Funds Types

There are two main types of fund of hedge funds. The first would be a single-strategy fund of hedge funds. These were set up to gain access to the best managers of a single-strategy, and gain the diversification benefits of not being exposed to any one manager. For example, a market neutral fund of funds or long-short fund of funds. The manager would select a group of market neutral hedge funds to allocate capital. Each manager is free to employ whatever strategy, timing, or methodology that they choose, as long as they remain in the individual sector. For example, a long-short single strategy fund of funds, should not have any manager that is invested into real estate. And a real estate fund of funds, should not be invested into any long-short managers. That would be known as style drift and is a violation of the intended purpose of the fund.

The second type of fund of hedge funds, is what is known as a multi-strategy fund of funds. Here, the partnership is attempting to gain the benefits of diversification and obtain a mix they believe to be generating the highest returns. The mix, or allocation to different managers, may be in any combination or form decided by the general partner. Thereby allowing the manager to create a product that could have a market neutral, arbitrage, long-short, fixed income, options, commodities, and/or real estate mix.

Benefits of Fund of Hedge Funds

There are highly touted benefits to investing with fund of hedge fund managers. The first is the outsourcing of manager talent. For the typical investor, they lack the resources, experience, tools, and connections to perform the effective due diligence required to evaluate each manager. By investing into a Fund of Hedge Funds, the investor is outsourcing this decision making to the fund of fund manager. This is one of the main value-add propositions and requirements to be performed. During a typical due diligence evaluation, there are extensive examinations of the underlying managers fund structure, history, offices, and implementation. It is common practice to have due diligence questionnaires filled out, contacting each and every underlying service provider, and even conduct on-site visits with the manager. There is no limit or minimum amount of due diligence that must be conducted. However, an investor must expect that their manager is conducting the required diligence, or this would not be a value-added proposition. Also, many potential problems can be identified before any allocation is made.

The second benefit to fund of hedge funds is diversification. As an investor in a fund of funds, you get a piece of the returns for all of the underlying managers. This reduces your exposure to any one manager. And in a multi-strategy product, reduces the exposure to any one sector through diversification. However, this reduction is up to the discretion of the manager and the limits that are stated in the fund’s private placement memorandum (PPM) or offering memorandum (OM). Each individual fund may have a target allocation to certain strategies, with a minimum and maximum number of both strategies and number of managers. For example, a maximum allocation to any one strategy or any one manager. Also, a minimum percentage or minimum allocation to include the diversification benefits. It is really up to the individual needs and risk preferences of each investor and their adviser, to determine what is correct on an individual basis.

According to Andrew Schneider, Managing Partner and Founder of HedgeCo.Net, fund of funds are,

A great way to achieve diversification and outsource manager decision, while entering the hedge fund industry arena. We have seen a great deal of interest from high net worth and family office investors into hedge fund of funds during the first two quarters of 2009.”

Drawbacks to Fund of Hedge Funds

The main drawback to fund of hedge funds is what is known as the double-layering of fees. There is no requirement as to the minimum or maximum that any hedge fund may charge. They are private investment partnerships, and are therefore free to decide what is right for each partnership. One of the most common forms of fees, is what is known as the 2 and 20. This is a 2% management fee and 20% performance fee on all assets in the partnership. The fees can be paid out in any combination that is set forth by the partnership. The criticism here, is that the capital is allocated to individual managers, who charge a 2 and 20, whose returns are then sent to the fund of funds to be charged an additional 2 and 20. The capital is charged twice, and amounts to what is known as the double-layer of fees. Also, because the fund of fund manager is not really producing anything. The value proposition is that the fund of fund manager is better than the individual investor at selecting hedge fund managers, thereby warranting double-layer of performance fees.

Another drawback to fund of hedge funds is the lock-up period associated with most strategies. In an individual fund, the manager may liquidate positions much more quickly and redeem the investor when there is a request. A fund of hedge funds may have a longer wait to redeem all capital allocated, as they need to redeem the capital from all of the managers that the capital was placed with. This could prove to be troublesome due to underlying managers with illiquid strategies, such as real estate or restricted securities.

According to Evan Rapoport, CEO of HedgeCo Securities, “We have seen an increasingly larger amount of fund of funds moving towards managed account structures. After the events of 2009, investors were no longer as willing to lock-up capital in illiquid structures. Fund of Funds have been moving towards the manged account structure to provide for increased transparency and liquidity on behalf of the investor.”

A third drawback to fund of hedge funds is the over-diversification. This is possible when either the fund of funds has too much size, and/or too many underlying managers to generate a good return. The assets are invested over so many managers, that they underlying returns start to become weighted down from the performance of both good and bad performing funds.

What makes up a Fund of Funds

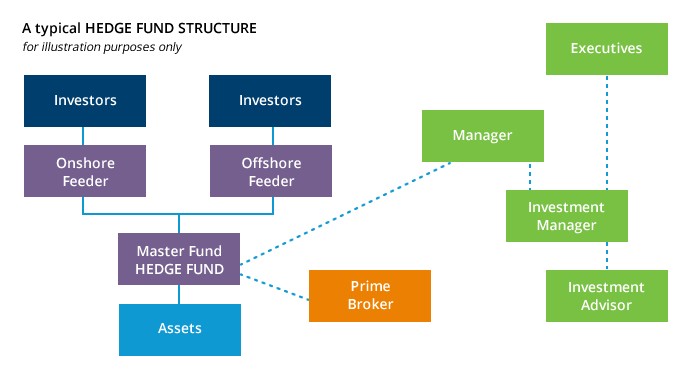

There are four main structural components to a fund of funds. You need an administrator, auditor, legal counsel, and in some cases, a prime broker. Marketing, offices, and staff are all up to the discretion of fund management.

Hedge fund of funds have increasingly been turning to fund administrators as independent third party verification of returns. There has been a definite increase in the need for fund of funds to provide independent verification of their assets.

Joe Goldstein, Co-Founder and CFO of GS Fund Services stated, “As an administrator of Fund of Funds, we agree that it is an excellent way to employee strategies of successful managers in manner that can provide less volatility and more diversification. The challenge in administering fund of funds, is getting the monthly NAV’s from the underlying funds in a timely manner, therefore we always hope that all the underlying funds use administrators and set reasonable delivery date for the monthly results.”

Proper due diligence involves contacting the underlying service providers of the fund of funds. Benefits to potential third parties are an independent verification and valuation of assets. And benefits to the fund are the outsourcing of essential duties not relating to selecting managers and increase of investor confidence.

Proponents against hedge fund of fund administration may argue against the expense of administration or argue for in-house administration. However, this is a baseless argument as fees are much lower due to economies of scale. A large administration company’s fee is generally less cumbersome and expensive than hiring in house. Also, in a post-Madoff world, it is not wise to even look at ANY fund that does not have an independent administrator.

Fund of Hedge Funds need to be analyzed on an individual basis. There are many added benefits and problems that may be associated with each type of product, and each individual fund of funds. As an investor or researcher, you need to determine what your individual needs and risk tolerances. It may be a good idea to contact an industry professional or database, to assist in research regarding this topic.

Related Hedge Fund of Funds Links:

www.HedgeCo.Net

www.HedgeFundLounge.com

www.HedgeCoSecurities.com