Health Care REITs Maybe Being On The Government Dole Isn t So Bad

Post on: 20 Август, 2015 No Comment

Summary

- Health care REITs have a bright demographic future, but there are risks with any investment.

- One of the biggest health care REIT risks is answering the question, “Who’s paying the bills?”.

- If the answer is the government, you need to pay close attention to the government’s reimbursement plans. but self pay isn’t a sure bet either.

Health care real estate investment trusts (REITs) are set to see a swiftly growing customer base. Unless a significant change takes place (a plague, perhaps), demographics pretty much dictates this will be the case. However, that doesn’t mean all health care properties will prosper. In fact, those reliant on government payments through Medicare and Medicaid could find the going gets tougher even as demand increases. But even private pay facilities, the hot spot today, could be in for a demographic surprise over the longer term.

Getting old, fast

The United States is getting old. Industry giant Ventas, Inc. (NYSE:VTR ) puts some compelling numbers to this fact. The under 18 population is set to grow by 20% between 2015 and 2060. The 18 to 74 cohort will expand by 25%. This is where it gets exciting, the 75 to 84 group is projected to increase by 120% and the 85 and up group by 188%! That’s a massive difference and one that virtually ensures increased demand for medical services and the properties that house such care.

And while we, as a people, are living longer lives, age takes it’s toll no matter how you cut it. For example, Brookdale Senior Living (NYSBKD ), a growth-focused owner and operator of senior facilities that isn’t a REIT, explains that 15% of those between the age of 75 and 84 need help with at least three activities of daily living. A massive 40% of the 85 and up ground has such needs. Living alone without assistance becomes virtually impossible when you can’t dress yourself, eat, or bathe.

However, not all property types are created equal. For example, assisted living facilities are more often than not paid for out of pocket. Nursing homes, on the other hand, frequently get paid for by Medicare and Medicaid. Such payments, however, can, and often do, change. For example, according to the Center for Medicare Advocacy. . the Centers for Medicare & Medicaid Services reduced reimbursement by $3.87 billion, or 11.1%. for fiscal 2012 (years start in October).

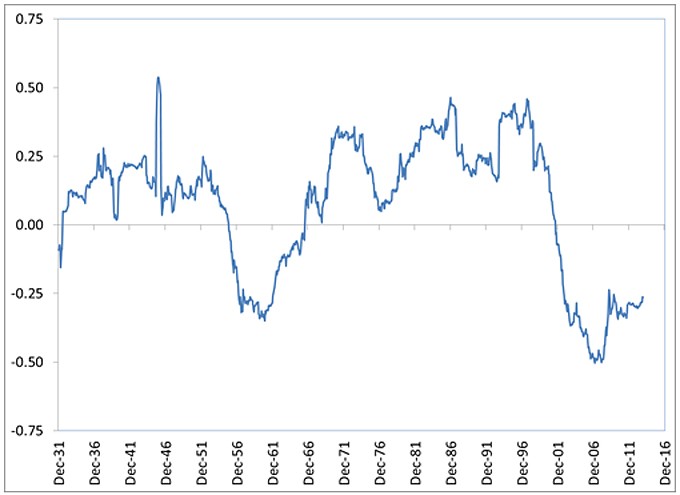

BKD data by YCharts

That change, by no means small, and the uncertainty leading up to it caused ripples through the senior care market. Brookdale’s shares, for example, took a steep hit. When reporting full-year 2011 results, CFO Mark Ohlendorf noted that the company’s outlook for 2012 was, . one of very slow, steady economic improvement during the course of the year. Why? Because, . increased occupancy, modest pricing increases, the accretion from the Horizon Bay acquisition and returns from capital re-invested in our portfolio will offset an estimated $25 million aggregate of Medicare-related reimbursement rate reductions and service delivery changes. In other words, the good things it was doing were merely offsetting the change in reimbursement rates.

Private pay

This is why so many senior property owners focus on private pay facilities. Right now Brookdale Senior Living’s private pay customers account for 80% of its business. Ventas clocks in at 75%. Health Care REIT, Inc.’s (NYSE:HCN ) total for private pay is the best of this group at 87%. These companies should be relatively well-insulated from reimbursement shifts.

But not all health care REITs are so well-situated. For example, HCP, Inc.’s (NYSE:HCP ) number is closer to a third. The other companies make a point of showcasing this information; HCP doesn’t highlight it. Omega Healthcare Investors Inc (NYSE:OHI ) doesn’t focus on that information either, but its recent merger announcement with Aviv REIT (NYSE:AVIV ) isn’t going to help it, since it will increase the number of nursing homes in the company’s portfolio.

Commenting on the acquisition, Brad Thomas, always a good read. quoted SNL Financial analyst Jake Mooney:

The difference is that while the seniors-housing facilities that REITs typically buy are private-pay, with more affluent tenants, skilled nursing properties mostly depend on government reimbursement through Medicare and Medicaid, adding a layer of risk in an era of uncertain federal policy.

Avoid it or double down?

Interestingly, Omega is basically doubling down on the reimbursement risk. Why? Because these properties tend to be less expensive to buy, thus boosting returns. Unless of course reimbursement rates get cut — then a good price could quickly turn into a mediocre or bad one. However, being in the private pay space isn’t a permanent safe house. According to Ventas, the 75+ age cohort has an average net worth of over $650,000. These folks can afford to pay out of pocket.

Baby Boomers, the next demographic tidal wave that’s only now cresting into retirement, aren’t nearly as wealthy. Fidelity took a look at the Boomers as a group last year and found that they had, on average, around $120,000 total in 401k accounts. Boomers are, for the moment anyway, materially less wealthy than their parents — those now paying out of pocket to live in the majority of the properties owned by Brookdale, Ventas, and Health Care REIT. Although Brookdale CEO Andrew Smith recently told the audience of the 2014 Baron Fund Conference that boomers affording self pay care is a problem that’s a decade away, it’s one to keep an eye on.

In fact, it could make Omega and HCP, with more risk today from reimbursement changes, better long-term investments. That’s because major industry players are actively avoiding government pay facilities, while Omega and HCP are still playing in the space. That means less competition for the best properties and better acquisition pricing. And while they may take a hit from reimbursement shifts, competitors that have hung their hat on private pay could find the next round of seniors (baby boomers) simply can’t afford what their parents could. In a decade, Omega’s doubling down on nursing homes could look prescient since someone will have to take care of sick elderly people. And there’s ten years or so for providers to figure out the balance between cost and payment that allows them to at least afford to pay Omega rent.

HCN data by YCharts

A massive wealth transfer to the boomers could change everything. But that wild card is just about as big as the government reimbursement wild card. (What if the boomers’ parents spend all their money on early bird specials and cruises to Alaska?) Although it’s probably a good idea to focus on companies with less exposure to government reimbursement right now, that doesn’t mean you should avoid those with higher government reimbursement rates. For example, Omega and HCP both have long histories of regular dividend hikes despite the increased exposure to Medicare and Medicaid.

A balancing act

If you’re looking at the health care REIT sector, the best course of action, in the end, may be to own a little of each. (I own HCP and Health Care REIT.) I’d recommend more exposure to self pay for now via REITs like Ventas and Health Care REIT. But balance that with at least some exposure to well-run REITs like HCP and Omega that have more reimbursement risk and offer a little extra yield. Just make sure to keep your eyes on the demographic changes taking place on the one hand and the government’s response on the Medicare and Medicaid fronts on the other.

Disclosure: The author is long HCN, HCP. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.