Harvesting Capital Losses

Post on: 18 Июль, 2015 No Comment

A popular year-end tax strategy. Find out how it works.

If you own investments such as stock and other securities, real estate, or a business, you have capital assets. You incur a capital loss when you sell a capital asset for a loss—that is, for less than you paid for it. You realize a capital gain if you sell a capital asset at a profit—that is, for more than you paid it. Until you sell a capital asset, you have neither a gain nor a loss.

Losing money on an investment isn’t a lot of fun, but it does have some tax benefits. First, if you have some capital gains and some capital losses during the year, you can use your losses to offset your capital gains and thereby reduce your tax due on such gains. If you had no capital gains during the year—only losses—you can use up to $3,000 to reduce your regular income from other sources such as a job, interest, or dividends.

EXAMPLE: Dave purchased 100 shares of XYZ Corp. a few years ago. Unfortunately, the stock has steadily gone down in value. However, Dave has also picked some winners: his shares in the ABC Mutual Fund have shot up in value. Dave sells his XYZ shares for a $10,000 loss and realizes a capital loss. He also sells the Acme shares for a $7,000 capital gain. Come tax time, Dave has a $7,000 capital gain and an $10,000 capital loss. His loss wipes out his gain and he has $3,000 of the loss left over. Dave may deduct the $3,000 from his salary income for the year. Dave is in the 33% income tax bracket, so this saves him $990 in taxes.

If you’re unfortunate enough to lose more than $3,000 during the year with not offsetting gains, you can carry forward your unused losses indefinitely to future years when you have gains to offset. Each year, you get to first apply the carried forward losses against capital gains, and then use any remainder (up to $3,000) to reduce your ordinary income.

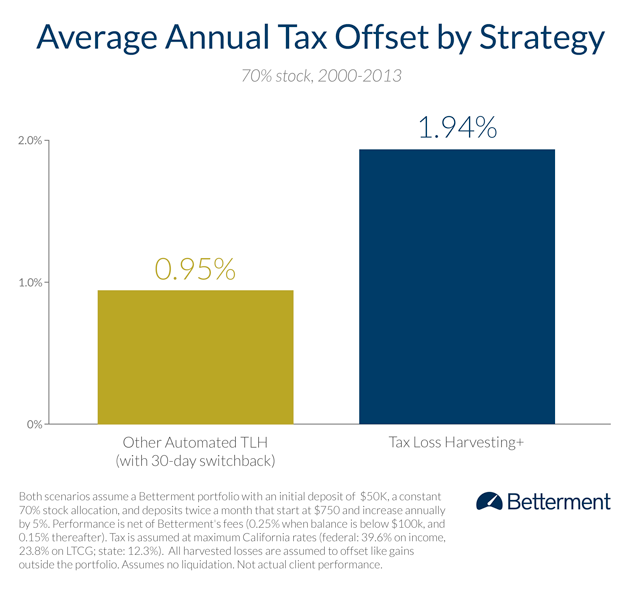

Using capital losses to offset capital gains is called tax loss harvesting, and is a commonly used year-end tax planning strategy. Sometimes when investors harvest their losses at the end of the year they buy back the same stock or other securities. This way they benefit from their capital loss, but can continue to own the security.

If you do this, however, you must be careful not to run afoul of the wash-sale rule. Under this rule, if you buy back the same stock or other security within 30 days after the sale, you cannot claim the losses on your tax return for the year. The wash sale rule also applies if you buy shares within 30 days before you sell them.

Tax loss harvesting is purely a strategy to save on taxes without regard to the underlying value of the investment. Even if a stock you’ve purchased has gone down in value, harvesting your loss this year may not be your best long-term investment decision.

Also, remember that capital gains or losses do not apply to tax-deferred accounts, such as your 401(k) or IRA, so tax loss harvesting is not possible for investments held in these accounts.

January 2013