H1 2014 Global IPO performance reached record amount says PwC

Post on: 18 Сентябрь, 2015 No Comment

- Total amount of money raised via IPOs in H1 2014 stood at US$125.4bn, largest amount since H2 2010

- Key drivers were increased European IPO activity as well as substantial amount of PE-backed IPOs, which almost tripled in terms of money raised relative to Q2 2013

- The two largest global IPOs of the year so far come from Asia, and in Singapore REITs and Mineral, Oil & Gas listings continue to perform well

SINGAPORE, 16 July 2014 — The first half of 2014 has been lively for global Initial Public Offerings (IPOs), starting very positively in Q1 with an even stronger second quarter. Most equity indices closed the quarter above their year-end levels and volatility remained relatively low.

Global IPO activity for 1H2014

The Dow Jones and S&P 500 again reached all-time highs in the second half of June, while leading Asian markets are still down for the year. The Nikkei lost 5.9% YTD as the outlook for Japan became gloomy since efforts to reinvigorate the economy seem to lose momentum. The Hang Seng (-0.5% YTD), Shanghai (-3.1% YTD) and Shenzhen Stock Exchange (-10.1% YTD) composite indices were negatively impacted by concerns about China’s debt levels and slower economic growth. On the flip side however, the Straits Times Index (STI) has been faring more positively, up close to 4% year to date.

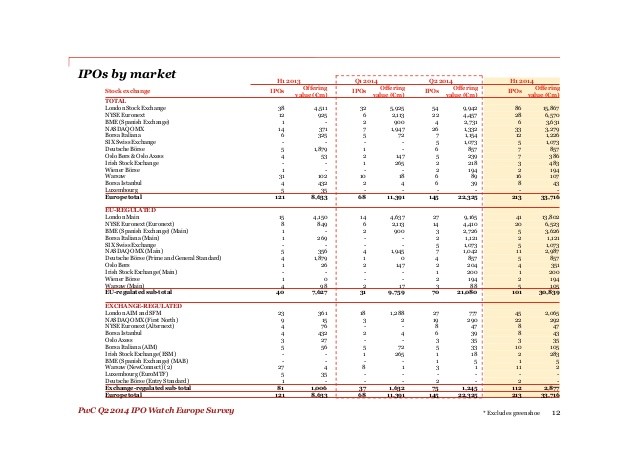

Total global IPO money raised was US$74.8bn via 308 deals in the second quarter of 2014, compared to US$56.2bn via 210 deals in the second quarter of 2013. Europe was the leading IPO region in the last quarter, accounting for almost 44% of the total amount of money raised and over 34% of the number of deals. So far this year, the number of IPOs raised globally (547) is 56% higher compared to H1 2013, with total amount of money raised in these transactions (US$125.4bn) about 41% higher. Private equity (PE) was a key driver of IPO activity in the first half of 2014, with PE-backed IPOs accounting for 25% of the total number of deals and 46% of the total amount of money raised.

The average global IPO returns to date remained strong at 26.6% in the first half of 2014. This was particularly driven by Asia and the US, while European IPOs showed a more modest average return of 3.3%.

Said Clifford Tompsett, Head of IPO Centre, PwC:

“The global IPO market was bolstered by continued strength in the equity markets and low volatility levels. After a healthy 2013, the market upheavel in the second quarter of 2014 could act as a strong catalyst for new deals, but the increase in IPO activity is still at an early stage and performance of new listings as well as the macro environment are being closely watched.”

By sector, Financials (including Closed-End Funds and Real Estate) holds the leading position both in terms of total money raised and number of global IPOs this year. The amount of money raised in H1 2014 by Financial IPOs was US$34.4bn via 115 IPOs. Consumer Services is the second largest sector in terms of money raised (US$25.8bn) and number of global IPOs (86). In terms of money raised, Industrials rank third with US18.1bn raised via 77 IPOs, and in terms of number of deals, Healthcare ranks third with 84 IPOs raising a total of US$6.9bn. This was mainly driven by a large number of Biotechnology companies mainly listing on the NASDAQ.

Continued Clifford Tompsett, Head of IPO Centre, PwC:

“In the face of increased regulatory pressure, the Financial sector continues to tap the capital markets in an effort to restructure their business or balance sheet. The continued supply of Biotech IPOs has been a substantial contributor to IPO activity in terms of numbers of deals.”

Asia IPO activity for 1H 2014

In Asia, the total amount of money raised via IPOs stood at US$9.3bn in Q2. After being the most active region in the first quarter, Asian IPO activity declined in Q2 2014. The six largest Asian IPOs on a year to date basis were all executed in Q1. Although this was partly due to the closure of the Chinese IPO market during most of the quarter, none of last quarter’s twenty largest IPOs were executed in Asia.

During Q2 2014, the Asia region accounted for only 12% of the total amount of money raised and 25% of the number of deals. Nonetheless, the two largest global IPOs of the year so far come from Asia, they are Hong Kong electric utility HK Electric Investments (raising US$3.1bn on HKEx in January) and smartphone and tablet screen maker Japan Display (raising US$3.1bn on Tokyo Stock Exchange in March).

While the reopening of the Chinese IPO market in January 2014 contributed to the strength in the region, the market was shut down again since several Chinese companies that started trading were halted after gains exceeded limits set by the exchange. In addition, some companies postponed their listings after the China Securities Regulatory Commission (CSRC) stated concerns on high offering prices and high percentages of sales of secondary shares.

The CSRC restarted the Chinese IPO market once again in June after some key amendments to the new listing rules. Ten companies were allowed to list on the Shanghai and Shenzhen stock exchanges. The reopening of the Chinese IPO market and the very strong pipeline of companies ready to go public bodes well for Asian IPOs in the remainder of 2014.

The Singapore Exchange (SGX) continues to maintain its niche position in the IPO market in the Southeast Asian region, which was reinforced through a series of initiatives over the recent years, including the world’s fastest trading engine, new and higher admission standards for its Mainbaord, and dual currency trading, just to name a few. With more than 40% of its listed companies originating from outside of Singapore, the SGX continues to be Asia’s most international exchange.

The SGX’s traditional strength continues to be in REITs and Mineral, Oil and Gas listings. We are expecting more REITs to come onto the market in the second half of 2014, with Fraser Hospitality Trust Reit being the first one to list in the second half of 2014.

In the area of Mineral, Oil & Gas IPOs, we have seen five listings in the last year alone, with combined funds raised of US$0.48 (S$0.6bn). This was followed by two listings in H1 2014 with combined funds raised of US$0.32 (S$0.4bn). This is no surprise given that SGX is home to Asia’s largest cluster of listed companies in the marine, oil and gas services sector, with close to 60 listings including established brands like Sembawang Corp and Keppel Corp.

Said Tham Tuck Seng . Head of Capital Markets at PwC Singapore:

“The Singapore Exchange will always remain relevant in and be the gateway to the region, because of the way it has traditionally positioned itself in the Asian market. Backed by strong governance and a progressive and transparent regulatory regime, we should continue to see high levels of interest from companies looking to raise capital, as well as trade securities and derivatives products in Singapore.

Investors recognise and trust Singapore as a global financial and wealth management centre, as well as a market-oriented business hub.”

−ENDS−

Media Contacts