Grow Your Dough Throwdown My Dividend Portfolio

Post on: 17 Апрель, 2015 No Comment

Im using Jeff Roses investing challenge to grow my dividend portfolio this year.

In the past, Ive dabbled a bit with dividend investing. I have a few dividend aristocrats as part of my emergency fund, and my Roth IRA at Betterment contains DRIPs. However, my dividend portfolio is far from organized.

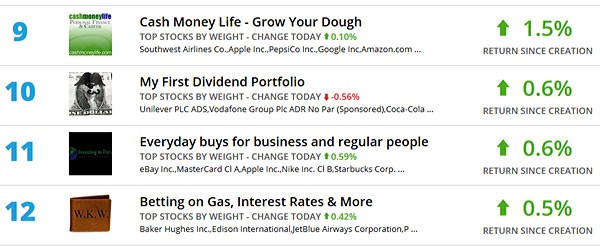

When Jeff Rose decided to make investing the focus of his next movement, and when he announced the Grow Your Dough Throwdown. I decided this was my chance to change things up a bit. The challenge includes a number of bloggers, including buddies of mine. investing $1,000 now at the beginning of the year, and then seeing where we all stand at the end of the year without adding new money to the account.

Ive decided that now is the time for me to get serious about building an income portfolio. Or at least building the foundation for my dividend portfolio, since $1,000 isnt a whole lot of money to use to get started. But this is something Ive wanted to do for a long time, and so Ive decided to make this my main financial goal for the new year. January 2, and Ive already accomplished one of my resolutions!

Whats in My Dividend Portfolio?

So, to start, I decided to put the bulk of my $1,000 in funds that pay dividends. This is a strategy suggested by Mike Heroux in Dividend Growth: Freedom Through Passive Income. If you are starting small, he suggests funds so that you arent breaking up your money into less efficient individual investments.

Its usually fairly easy to find low-cost funds. so thats what I did as part of my effort.

- I know one of the founders and I used to write for him.

- I already had an account, even though Id never used it, so I didnt have to do anything to open a new account, and Im lazy like that.

- They offered me 10 free trades, which is great because they charge $7.95 per trade (unless you hit up one of their Happy Hour promotions) and thats even more than Sharebuilder charges.

Ive already used five of those free trades to put together my initial portfolio. Ive included a couple of individual dividend aristocrats, but I might need to trade a little later on if a fund is doing particularly well. The bummer, too, with Kapitall is that they dont offer an affiliate program, so I dont get a kickback for signups. (Not that I do well with affiliate programs. anyway.)

So, here you go. Heres what Ive invested in, and why. On this, the first trading day of a new year, its kind of depressing because the market is down. But that might be good, because, hey, it means that I got things just a little bit cheaper.

My biggest holding is a high-yield international dividend fund. When putting together this dividend portfolio, I also took into account my holdings elsewhere. I dont have a lot of geographic diversity, so I decided that Id pick a fund with no U.S. stocks in it. Hopefully the high-yield nature of the fund helps out.

Also, Ive long wanted to try out a REIT, so I decided to go with one of those. EXR focuses a great deal on storage units and properties. I like this because, well, people are almost always looking for places to stick their stuff. I decided that if I was ready to add a little real estate to my portfolio, a Real Estate Investment Trust would be the way to go. If I decide to sell shares of something else, Ill likely use the money and buy more EXR.

Now, its true that I do have a very small percentage of my overall portfolio in bonds already, but its mostly in TIPS funds. So I decided to give a high-yield bond fund a whirl. Just because. It wont screw up my asset allocation, since its not a very large chunk, so Im just going for it.

The other two are dividend aristocrats with high yields for dividend aristocrats. I picked AT&T because its a telecom and I dont have much in the way of telecoms anywhere in my portfolio, and Sysco because its food service, I see it everywhere, and it has been doing well. Hell, right this second (my screenshot is already outdated), its the only one of my investments thats actually in the black today.

Im excited because dividends should help my returns, and since I cant add in outside money for this portfolio, its nice that I should be able to earn a little bit extra to reinvest.

I suspect as the year moves forward, Ill consolidate more in favor of the stock fund and the REIT, but well see. I expect an interesting outcome, since this is the first time Ive put real thought into creating a portfolio like this. Up until now, its been all-market funds and letting Betterment do its thing.

What do you think of my portfolio? Am I about to crash and burn?