Fundamentals And Technicals Together At Last

Post on: 16 Март, 2015 No Comment

As a fundamental investor, it’s easy to eschew charts in favor of real, rock-hard numbers. But that’s a big mistake. Taking a look at a chart can add a huge edge to your investment gains when used in conjunction with solid fundamentals. Here’s what you need to know to become chart smart.

An Investor Necessity

Don’t write off technical analysis – while using patterns to make investment decisions might sound dubious, it’s hard to argue with the fact that skilled technicians can turn their diagrams into dollars up to 90% of the time. And while the rift between fundamental and technical analysis might seem enormous, it’s actually far from it. (For more, check out our Technical Analysis Tutorial .)

At its core, technical analysis is really a way to look at qualitative factors – like investor psychology – from a quantitative standpoint. Behind every pattern you’ll see in a stock chart, there’s a fundamental justification.

Technical analysis fills a necessary gap in the fundamental investing toolbox as well. While fundamental analysis can point out a potentially undervalued investment, the old quote from John Maynard Keynes still rings true: The market can stay irrational longer than you can stay solvent. With technical analysis, an adaptable investor can read the market’s rationality to know when to get into a fundamentally sound play.

Technical Basics

It’s not easy for fundamental investors to accept technical analysis at first. But when you consider the mechanics of technical analysis it quickly becomes clear that, contrary to popular belief, technicals and fundamentals aren’t mutually exclusive – they’re actually quite complementary. While I can’t go over every element of technical analysis here, this article serves as a primer on blending your fundamental investing approach with charting. Let’s take a look at some of the precepts of technical analysis from a fundamental point of view.

Taking on Trend

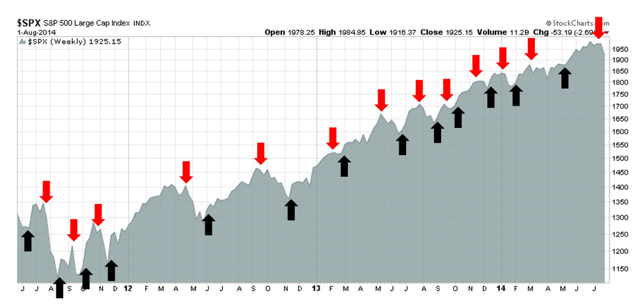

Trend is perhaps the most basic concept for any burgeoning market technician. Trend is just the general direction of a stock’s price movement. If a stock is trending up, that’s a bullish signal, whereas a downtrending stock is generally showing a bearish signal.

As a fundamental investor, you might not want to put your money in an uptrending stock out of concern that you’d already missed the boat on a price movement, but that could be a very bad move. That’s because a stock is far more likely to move in the direction of its overall trend on any given day.

One of the best ways to confirm a trend is with volume. As volume increases, the chances that a trend will continue to hold are far greater.

From a psychological standpoint, trends make quite a bit of sense. As a rising stock begins to catch investors’ eyes, it’s only natural for the share price to increase as more and more investors – and traders – try to repeat others’ success (pushing volume higher in the process). While some suggest that technical analysis can be a self-fulfilling prophecy, technicians argue that it doesn’t matter why a technical phenomenon occurs, only that it occurs in a predictable manner.

Two important concepts related to trend are support – the price level that a stock has trouble falling below – and resistance – the price level that a stock has trouble rising above. Both of these come into play when we talk about reversals.

Watch the Reversals

It’s clear that no trend lasts forever, which is why reversal patterns are so important. Reversal patterns are signals to technical analysts that a trend is about to end, and that it’s time to either get out of a stock or take the opposite position on the play. Reversals also make quite a bit of sense from a fundamental perspective.