Fund of funds offering provides hedge fund access manager selection and monitoring capabilities

Post on: 16 Март, 2015 No Comment

The Northern Trusts Hedge Fund Group is focused on providing comprehensive hedge fund solutions to its investors. The team utilizes a three pronged due diligence process built on investments, operations, and compliance to discover hedge funds focused on capital preservation and lower correlations to traditional asset classes.

Since 2001, the group has managed a series of fund-of-funds and separate accounts for wealthy families and institutions. Leveraging the Northern Trust platform, the team seeks to produce outstanding risk-adjusted returns utilizing the best hedge fund talent from around the world.

3 — Strong risk management and oversight implemented at several levels

Investment Strategy

Northern Trust currently manages three distinct hedge fund-of-funds strategies: Diversified, Alpha, and Equity Long/Short. The profile of each strategy differs based on target volatility and style, but our philosophy of seeking to preserve capital and being positioned defensively against market volatility, while capturing alpha in up markets, remains consistent across all. Additionally, we have the capability of creating Custom Hedge Fund Portfolios tailored to specific investment goals or to complement current strategies in place.

Hedge Fund Strategies

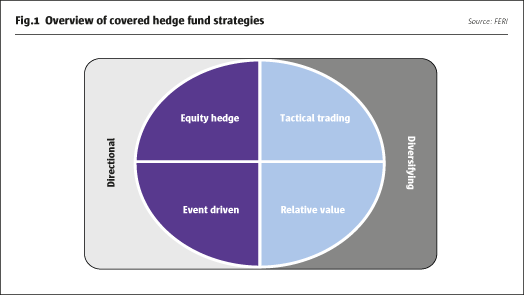

There are a broad array of hedge fund managers that cover different strategies that have different risk/return characteristics

(Click image to view enlarged version)

Diversified Strategies Fund. Low volatility target. Conservatively managed and used primarily as a fixed income alternative. It is constructed and actively managed to provide diversification across markets, managers, instruments, and strategies with continual portfolio monitoring and risk management.

Alpha Strategies Fund. Medium volatility target. Multi-manager fund with increased risk/return profile over that of the Diversified Strategies Fund. The fund targets a return more similar to a balanced portfolio but with less volatility, and can be viewed as either a fixed income alternative or a more conservative equity substitute. It provides a cost and risk efficient means of gaining broad hedge fund exposure accomplished through sector allocation changes and manager selection.

Equity Long/Short Strategies Fund. High volatility target with higher beta exposure. Positioned as a complement to long only equity exposure with lower volatility. For investors seeking more equity-like returns with less risk over a full market cycle.

Custom Hedge Fund Solutions. Designed to achieve unique hedge fund and overall portfolio objectives by addressing specific investment and risk needs. Examples of how clients have taken advantage of our custom hedge fund solutions include building a new hedge fund allocation, restructuring a current hedge fund portfolio, and implementing a completion strategy.

Benefits of a Diversified Hedge Fund of Funds Portfolio

Hedge Fund of Funds invest in other hedge funds rather than investing in the markets directly. The hedge fund of funds manager seeks to add value through expertise in evaluating single hedge fund strategies as well as through portfolio construction.

(Click image to view enlarged version)

About Northern Trust’s Hedge Funds

The Hedge Fund Group was established in 2001 with the launch of its first multi-strategy hedge fund-of-funds. Since then, the team has launched two additional fund-of-funds offerings and services many custom advisory programs for private bank and institutional clients. To date, the group manages $2B+ in hedge fund assets and is supported by a strong team headquartered in Chicago, with key members sitting alongside other asset class partners in our Connecticut office. Today, we are a part of Northern Trust Alternatives Group, which oversees more than $3.6 billion across multiple alternative asset classes.