FRB Housing Wealth and Consumption

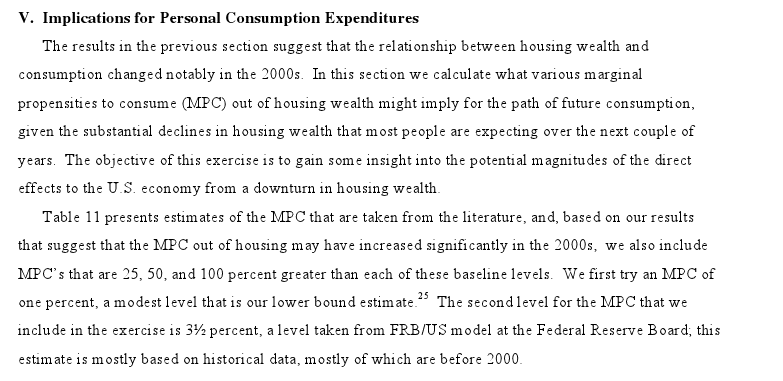

Post on: 9 Апрель, 2015 No Comment

Matteo Iacoviello 2

www.ssrn.com/. You are leaving the Federal Reserve Board’s web site. The web site you have selected is an external one located on another server. The Board has no responsibility for any external web site. It neither endorses the information, content, presentation, or accuracy nor makes any warranty, express or implied, regarding any external site. Thank you for visiting the Board’s web site.www.ssrn.com

Abstract:

Housing wealth is about one half of household net worth, and consumption is a considerable fraction (about two thirds) of Gross Domestic Product in the United States. Empirically, movements in housing wealth are associated with movements in consumption in the same direction. This observation has led many economists, commentators and policy makers to study how housing wealth and consumption are linked together. A sizeable portion of the comovement between housing wealth and consumption reflects common factors driving both variables, rather than the wealth effect of the former on the latter; however, a growing body of evidence suggests that the comovement is larger in developed financial markets and in the presence of liquidity constraints.

Keywords: Borrowing constraints, consumption, consumption function, household budget

JEL classification: C2, E2, G1, R2

At the aggregate level, housing wealth measures the market value of all the residential assets located in a particular country. According to this definition, housing wealth of U.S. households at the end of 2008 was 25.4 trillion dollars. Housing wealth is about one half of total household net worth (which is 52.9 trillion dollars), and is larger than the Gross Domestic Product (14.4 trillion dollars). Moreover, since financial wealth is more unequally distributed than housing wealth, housing wealth accounts for almost two thirds of the total wealth of the median household. Table 1.1 lists the balance sheet of the household sector in the United States at the end of 2008 using data from the Flow of Funds Accounts of the United States (FOF), using a breakdown of total household assets that differentiates housing capital from other forms of wealth. A large fraction (80 percent) of housing wealth is made up by the stock of owner-occupied homes. The remaining 20 percent (residential real estate held by nonfarm noncorporate businesses) is made up by the rental housing stock.

Figure 1 plots household consumption expenditures in the United States along with wealth divided into housing wealth and non-housing wealth. The series have been converted in 2005 billions of dollars using the deflator for personal consumption expenditures. The stock of housing wealth is large and moves slowly over time, but it exhibits a sharp increase between 1997 and 2005, followed by a bust between 2005 and 2008: size and persistence explain why changes in housing wealth are potentially an important candidate for understanding trends and cycles in aggregate consumption expenditures.

Figure 2 plots annual changes in housing wealth and personal consumption expenditures in the United States from 1952 to 2008. The two variables tend to move together in post-world war II U.S. history. Their contemporaneous correlation is 0.47. This correlation is larger than the correlation between consumption and the residual components of household wealth: for instance, the contemporaneous correlation between changes in financial wealth and consumption equals 0.38.

The comovement between housing wealth and consumption poses a challenging question for macroeconomists, policymakers and commentators. Do fluctuations in consumption reflect fluctuations in housing wealth, or are both variables determined by some other macroeconomic factor that moves them, such as technological change, movements in interest rates, or other factors that contribute to business cycle fluctuations?

Table 1.1: Composition of Household Wealth in the United States

U.S. Households’ Balance Sheet