Foreign ownership of estate common questions

Post on: 11 Май, 2015 No Comment

Purchase transaction methods vary by state but LLCs are most commonly used to hold real estate as a foreign owner.

What type of entity do I need to purchase residential real estate in the U.S.? The most common structure used to purchase real estate in the U.S. as a foreign buyer is the LLC (Limited Liability Company). There are no restrictions on foreign ownership of an LLC and the taxes “pass through” to the owners so there’s no double tax as there would be with a C Corporation. An LLC will protect the owner from liability and is simply an all-around good way to purchase real estate in the U.S. Costs vary by state but in Arizona there is a one-time cost of around $125 plus the cost of having an attorney or CPA set one up. Total cost should be around $300 to $400. There are no annual dues in Arizona. Some states charge every year (namely California) and this can get expensive but, again, many do not.

What are management costs? Having a professional management company manage a property will be one of the primary expenses involved. Costs for this vary greatly depending on type of rental property. If a residential rental is rented annually expect that costs will be somewhere between 8% and 12% of the rental amount. For this the management company finds the tenant(s), screens their credit, and collects the monthly rent. If, however, one chooses to rent the property as a short term furnished vacation rental, perhaps by the week, then expect the rental management fees to increase all the way up to the 40% level or more. The reason for this is that weekly rentals are much more of an active business than a passive investment. Someone must continually market the property, arrange for housekeeping, meet the short term tenants, collect and distribute keys, do inspections, and so forth. Also note that tax issues are different for short term rentals than longer term rentals (at the national level).

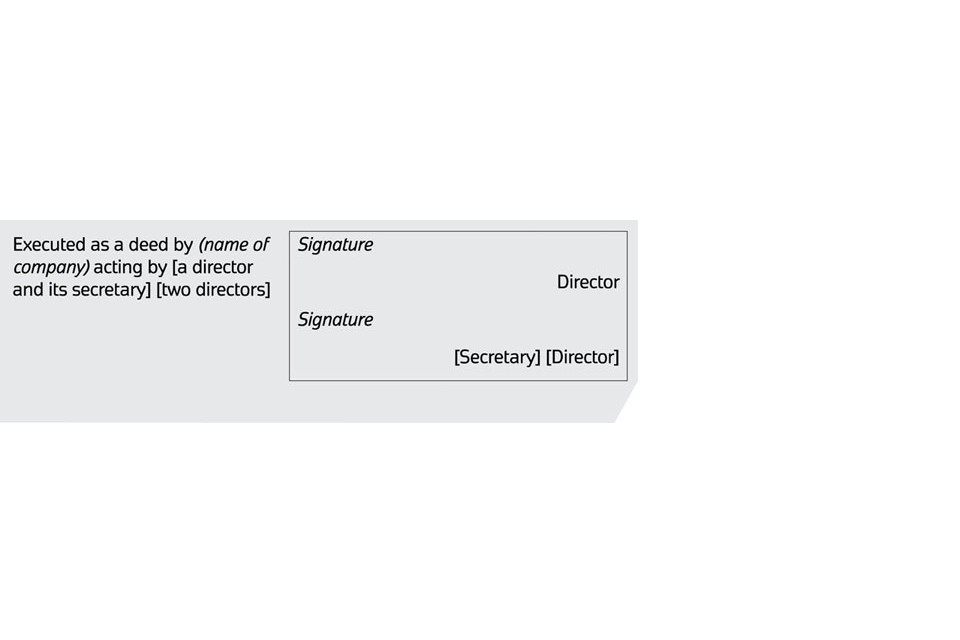

Do I have to be present in the U.S. to close (finalize) the purchase? It is very common to buy and sell real estate “long distance” in the U.S. You will hear escrow company employees (for definition of escrow company see below), closing attorneys, and others in the business refer to these transactions as “mail aways”. This means that documents are sent back and forth via FedEx, UPS, DHL, mail, fax, etc. This is quite common.

What is an escrow company? An escrow company is a neutral third party that handles the closing of the real property sale. They operate via “escrow instructions” which are followed in order to account for everything in a transaction so that monies are not given to the seller or title to the property given to the buyer until all steps are completed. Not all U.S. states use escrow companies. Some use real estate closing attorneys. Arizona commonly uses licensed escrow companies for most residential transactions.

What do condo association dues typically cover? This can vary depending on the property. One distinction worth noting is an “original” condo complex vs. a “conversion”. If an apartment complex is converted into individual private ownership of the units then this is called a “condo conversion”. These can be different in that the utilities (electric, water, sewer, etc) were likely originally set up for common billing among all of the units. It can be difficult and expensive for the developer who converts the complex to separate these out per unit. For that reason the condo dues may include one or more of these items. A condo complex originally built to be condos is much more likely to have these items separately metered “per unit”. If so, the owner will be responsible for these items individually. Regardless of type of condo, commonly items like property maintenance, blanket insurance coverage, exterior structure maintenance and repair, roof maintenance, etc. are covered as part of the condo monthly or quarterly dues. Additional insurance, for this reason, is very inexpensive (because it’s mostly covered in the condo dues). Fees and coverage vary widely however. Always check.

What about visas (E-2, EB-5, L-1)? For visits less than 90 days visas are not necessary for the 35 countries that participate in the visa waiver program (see travel.state.gov ). For other countries the common visa types are B-1 (business) and B-2 (tourism). There are other types of visas available to investors in the U.S. which can lead to some type of immigrant status, if desired. These vary and are too detailed to discuss here but can be worked on via an immigration attorney.

EasyRentalTools helps you both manage your rental property AND prepares you for tax time! By simply entering your monthly expenses and income in an easy calendar format EasyRentalTools builds all of your tax entries in the background plus provides you with a printable journal that makes excellent backup for your tax deductions! EasyRentalTools will even track your mileage for all of those rental property related tasks – mileage that is deductible at over 50 cents per mile! Create a free account and see for yourself — today !

Disclaimer — Legal and tax information is not legal or accounting advice.