Foreclosure Short Sales

Post on: 10 Июль, 2015 No Comment

Definition

Homes that are sold for a value less than what is owed by the homeowners on the loan. These are usually accomplished with the consent of the lender to avoid foreclosure.

What is a Short Sale?

Foreclosure short sales have become the norm rather than the exception in the last several years. Ten years ago, many people had never even heard the term short sale . However, it has now turned into a viable option for many homeowners who find themselves in a desperate situation of not being able to keep up with their monthly mortgage payments.

The short sale definition simply refers to the process by which the lender agrees to take less than the amount that is owed on the mortgage. The process can take several weeks or months to complete. On the homeowners end, doing a short sale avoids the embarrassment and financial devastation that a foreclosure can cause. Although they will likely have late payments on their credit report, they won’t have the sting of a foreclosure showing up and causing them grief for years to come. Many sellers find themselves looking at the option of foreclosure or short sale each and every month.

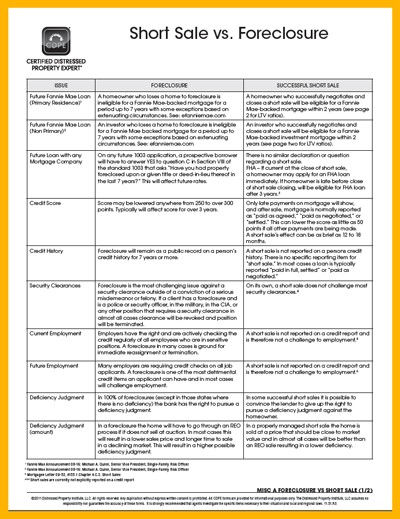

Foreclosure VS Short Sale

There are notable key differences between short sales and foreclosures from the perspective of a buyer. A foreclosure is a property that has been repossessed by the lender because a homeowner could not make payments on the mortgage loan. It is sold at auction to pay for the remaining debt plus other costs and fees. A short sale is a property that is still owned by the homeowner, but is being sold to a buyer for less than what is owed on the remainder of the loan.

The ownership of the property – who the buyer will work with – is one primary difference between foreclosures and short sales. To further complicate matters, the buyer must work not only with the seller in a short sale, but with the lender as well. Both the lender and the owner must sign off on any agreement. With a foreclosure, the buyer does not deal directly with the bank (unless it is an REO home ); rather, they buy the home at auction by bidding on it competitively. In this case, it is more advantageous to pursue a short sale if the buyer wants to directly negotiate with the seller – again, unless it is an REO home, meaning it did not sell at auction.

Another difference is the price that is paid. Typically, a buyer can receive a larger discount on a short sale than a foreclosure. The asking price on a short sale is less than what is owed on the loan. A foreclosure asking price is what is owed plus any additional costs and fees. So, for a $200,000 home that has $150,000 of debt remaining but is only worth $125,000 in present market conditions, a short sale would cost a maximum of $150,000. At a foreclosure auction, the same home could sell for well over $125,000 and would likely exceed $150,000 as well. As a result, buyers may notice bigger deals with short sales than with foreclosures.

Of course, foreclosures are generally easier to buy than short sales. Short sales must be actively negotiated with the lender and seller. Foreclosures, by comparison, require no negotiation; one merely has to be the winning bidder at an auction and meet all relevant requirements for the auction.

The Traditional Short Sale Process

Every situation is unique and can vary, but there is a traditional short sell process that most borrowers go through.

- Contact the lender for information. It may take a few calls to find the right department to handle short sales. You are looking for the decision-maker in the short sale department who can help explain the process that you need to go through in order to start down the road to finding a short sale buyer for your home.

- Market your property and find a buyer. Most lenders are going to require that you get a real estate agent who can market your property in the listing services. Find a real estate agent who is familiar with the short sale process and has a lot of experience handling the package of paperwork that must be done in order for the process to move forward. There are certain short sale procedures that must be followed, and a competent real estate agent can help you with that.

- Negotiating an agreement. It must be clearly spelled out in your purchase and sale agreement that the home is set for a possible short sale. In other words, the potential buyer needs to understand that there are certain short sale rules that the bank or mortgage company is requiring you to follow. Most buyers will be able to understand because their own agent should have provided them with help and information about the process of buying a pre-foreclosure short sale .

- Put together a short sale package for your lender. Many homeowners get confused about this process unless they are using a real estate specialist who understands the foreclosure short sale procedures. Remember that you are hiring an agent so that they can be a negotiator on your behalf, but also because they are experts at managing these short sale lists of paperwork. Here are some examples of the types of paperwork you will need in your package:

- Letter of authorization

- Preliminary net sheet

- Hardship letter

- Comparative market analysis

- Copies of your bank statements

- A financial statement with proof of your income and assets

- A purchase and sale agreement (offer from a qualified buyer)

- A listing agreement showing that you have listed the home for sale with an agent

When you’re looking at a foreclosure vs short sale, there is no question that a short sale is usually the best move for a homeowner to make. Instead of having to go through the crisis that foreclosure can bring to your financial and emotional life, a short sale allows you to maintain your dignity and have more time to move out of your house. Foreclosure and short sales are certainly not an enjoyable time for any homeowner, but being able to maintain some of the control over the process can help you get through it easier. The main idea is to start over and be able to once again purchase a home in the future.

FAQ about Foreclosure Short Sales

Why Do Banks Accept Short Sales?

Why would a lender do this? First of all, it could be because the homeowner has found themselves falling behind on their mortgage payments. Rather than having to go through the lengthy and costly process of foreclosure, many lenders will opt to take less than what is owed so that they can relieve themselves of the obligation. The foreclosure process can be very expensive for lenders as they have to hire attorneys, pay holding costs, pay agent commissions and have the liability of a property sitting vacant for weeks or months on end.

Another reason why some lenders will go through the short sale process is because the home may not be worth what it once was. With the shaky real estate market being what it is, many people found that their home values dipped down under what they actually paid for the property. Obviously, taking one of these properties back in foreclosure would not be extremely helpful to a lender because they would still have to take a loss in the end.

What Are The Benefits or Positive Aspects Of Agreeing To Sell a Home With a Short Sale?

Many homeowners have started to pursue the short sale process simply because it has a lesser effect on their ability to bounce back financially. It also allows the homeowner to feel less of the stigma that can be associated with foreclosure. After going through a home short sale, borrowers are able to qualify again under Fannie Mae guidelines in about two years rather than the 5 to 7 years it can take after a foreclosure.

Can You Make Multiple Offers on Homes That Are Listed as Short Sales?

When it comes to foreclosure short sales situations, some sellers are not sure if they should submit more than one offer on their short sale foreclosure property to the bank. The decision is up to the property owner. Real estate agents, when consulted about short sale foreclosure, often recommend sellers do not submit more than one offer for their pre foreclosure short sale. This is because additional offers often slow the short sale process or cause the bank to begin the process again. If the seller consults the bank about multiple offers, the bank will probably ask to see them all, and the seller must comply with this. In addition, there is the risk that additional offers may cause the seller to lose a short sale investment buyer or buyers.

Is Short Sale a Better Option Than a Deed in Lieu of Foreclosure?

If you’re a homeowner behind on your mortgage and looking at a possible foreclosure, you may already have heard the terms short sale and deed in lieu of foreclosure. In fact, a short sale foreclosure and a deed in lieu are similar. The former means that the bank that holds your loan will let you pay the loan for less than you owe to settle it as a pre foreclosure short sale. The latter, deed in lieu, means you give your home back to the lender and take any loss. Foreclosure short sales take longer than deeds in lieu, which are more likely to be acceptable to the lender. Likewise, when it comes to short sale investing. it can take longer for a buyer to close on the home.

Can a family member buy a short sale property from another family member?

The vast majority of lenders do not authorize family members or close associates of the property owner to purchase the property through a short sale. This violates the concept of arms-length transactions, which basically means parties involved in the process are independent, acting in their own best interests, and have no substantial connection to one another.

In other words, you cannot arrange a short sale with your relative (or a friend, or a business associate, or an contractual agent). This is to prevent the seller from fraudulently benefiting from the short sale, which would make it easy to defraud the lender. For this reason, lenders will almost always require that the buyer and seller both sign an arms-length transaction affidavit testifying that the buyer and seller have no relation to one another.

Some lenders reportedly allow non-arms length transactions with short sales as long as it is fully disclosed. Virtually every reputable lender, however, enforces the standard and does not approve of such an arrangement. And since a lender must sign off on a short sale in order for it to happen, this means short sales to family members are virtually prohibited.

Will the Bank accept less than the homeowner owes if it is a short sale?

Yes. A short sale is an arrangement that allows the homeowner to sell the home for less than what is owed on the property’s mortgage if the lender, homeowner, and seller all agree to the terms. This is frequently done as an alternative to foreclosure, which damages a homeowner’s credit, often prevents them from purchasing another home and remains on their credit report for seven years. The lender also benefits because foreclosures involve fees and are expensive to process. Buyers likewise benefit because they are allowed to buy a property for significantly less than what it is worth.

In order for a short sale to occur, all three parties must agree. Typically, a seller facing foreclosure will be approached by a buyer, who will then communicate with the lender and propose the offer. The bank’s loss mitigation department (or equivalent) will usually handle the offer and evaluate whether or not it is in the bank’s best interest to accept. They incorporate Broker Price Opinions (BPOs) into the process to assess the home’s true value versus what is owed on the loan.

Short sales also involve the approval of any junior lien holders or creditors, such as government agencies or tax lien holders. The buyer may have to pay off these junior creditors in order to obtain their formal approval for the short sale to proceed. Once approved, the homeowner does have a negative hit to their credit report and cannot obtain financing for a home for two years – a much more preferable consequence than foreclosure.

What do you do if a bank refuses a short sale offer?

Banks routinely refuse short sale offers because they likely cost the bank more money than the short sale is worth. Or, the bank may believe the property is more valuable as a foreclosure or REO than letting it go for a significant discount below the original purchase price. In this instance, what one does depends on his or her role: either as a homeowner, or as a buyer.

For a homeowner, the bank’s refusal to accept a short sale offer does not necessarily mean that foreclosure is inevitable, or will occur immediately. If the bank is interested in selling the property before foreclosure, it will likely entertain further offers. Also, a homeowner and a buyer have the right to revise an offer and resubmit it to the bank for approval. Basically, the timeline for acceptance of a short sale offer ends only when the home is foreclosed and the home is placed up for auction.

For a buyer, another offer can be resubmitted to the bank, provided it addresses the bank’s concerns (if they delivered any when they rejected the offer). The most common reason a short sale offer is declined is price. Therefore, if the buyer revises the asking price through a counter-offer, the bank may accept.

Can a lender accept multiple offers on a short sale of a home?

A lender can accept multiple offers on a short sale of a property, but a short sale transaction must ultimately involve not just the lender, but the seller as well. In a short sale, the homeowner (or seller), lender, and potential buyer all work in conjunction with one another to orchestrate the sale of the distressed property for less than what is owed on the home loan. This is because banks want to cut their losses (which is why short sales are usually handled by a loss mitigation division within the bank). Buyers want to purchase a discounted property, and sellers want to avoid foreclosure. In exchange for the sale, a seller’s remaining debt obligation is forgiven.

It is not uncommon for lenders to receive multiple legitimate offers on a property. It has the discretion to accept or decline any number of these offers; no law stipulates that a bank must accept a short sale offer. Any offer that is accepted is passed along to the seller; any offer that is rejected is not. That is because an offer must gain the approval of both the seller and the bank; any offer that the bank deems unacceptable is simply rejected. Naturally, any offer that is accepted by the lender and the seller is the one that goes through, even though the lender may have approved others that the seller in turn rejected.

Is it bad to buy a short sale property?

No; in most cases, for investors and homebuyers alike, buying a short sale property is viewed as a positive thing. This is because short sale properties are almost always purchased for amounts lower than the fair market value of the home (what the home is worth in normal conditions, if it were to sell for the full value today).

A short sale is an arrangement between the owner of the distressed property and the lender or owner of the mortgage in which the home is sold for a price less than what the owner owes on the mortgage. For example, if a home’s mortgage is worth $150,000, and the owner has paid off $25,000, then a short sale would be for less than $125,000 in order to satisfy the remainder of the balance. In turn, the bank forgives the remaining debt for the owner, and the owner avoids foreclosure. The buyer gains a property that is worth more than what he or she paid to obtain it.

This usually occurs when a home is underwater. Falling home prices can result in a home being worth less on the open market than what is owed on the loan. Normally, if the homeowner can afford the monthly payment and wait it out, he or she can see home values return to normal. But if a homeowner cannot make the payments, he or she faces foreclosure. Initiating a short sale is a good move, then, for a buyer because the buyer will receive the property for less than what it would ideally be worth once home values return to previous levels. So, if the $150,000 is how much the original mortgage was, but the home has a fair market value now of $125,000, and the asking price is $100,000, the buyer can obtain a $50,000 profit simply by buying the property in a short sale then selling the property once its fair market value rises.

No penalties are associated with buying a short sale property, only with selling a short sale property.

If a property is sold short with taxes owed who is responsible?

Generally speaking, tax liens will need to be satisfied by the owner of the home prior to a short sale. Many lenders will not finance the purchase of a short sale property – or any property – that has an active tax lien on it. In that case, it is the responsibility of the homeowner to discharge any tax lien before a short sale is initiated.

If a short sale has begun, and it was revealed that tax lien is on the title, the seller should be the party responsible for paying the taxes owed. If they cannot, it is likely that the tax lien will be purchased by a tax lien certificate investor, who then would have a claim to the property that would supersede yours. Any tax lien payments or discharges should be discussed as the short sale is being negotiated. If the lender really wants the home to be sold, it often will discharge the tax lien or pay for its removal. If not, and if the seller cannot afford it, the buyer will have to pay the owed taxes in order to receive a clear title to the property.

Can a property purchased as a short sale or foreclosure be refinanced?

Yes, it is possible to refinance a property that was purchased as a short sale or foreclosure. This is because the property, from your lender’s perspective, is like any other property. The key exception is if the property is in poor condition or requires significant renovations and repairs. If a lender deems the home to be unfit or unacceptable, it may reject refinancing. Equity is generally dissipated by foreclosure, so any equity-based refinancing of the existing mortgage would be dependent on the buyer assuming the original loan and having the equity to cover.