Forecast Phoenix Housing Market Could Outpace Most Metros in 2014

Post on: 16 Март, 2015 No Comment

Find out how much you can afford to borrow:

Its that time of year again. November marks the official start of prediction season here at the Home Buying Institute. A couple of weeks ago, we offered a forecast for the U.S. real estate market as a whole. Today we turn our attention to Phoenix, Arizona, a city that was hammered by the housing crisis but is now outpacing most of the nation in terms of price gains.

Here is our 2014 real estate prediction and housing forecast for the Phoenix metro area.

Looking Back: How the Phoenix Housing Market Has Changed

Phoenix generated a flood of housing-related headlines in 2013. Its easy to understand why. This was one of the areas hit hardest by the national housing crisis and subsequent recession. Home prices in and around Phoenix began plummeting in the summer of 2006 and didnt hit a firm bottom until five years later, in the fall of 2011. Foreclosures surged as homeowners watched their equity levels sink into the red. The local real estate market ground to a halt.

Flash forward to the present. Its November 2013, and Phoenix is now one of the most rapidly rebounding housing markets in the country.

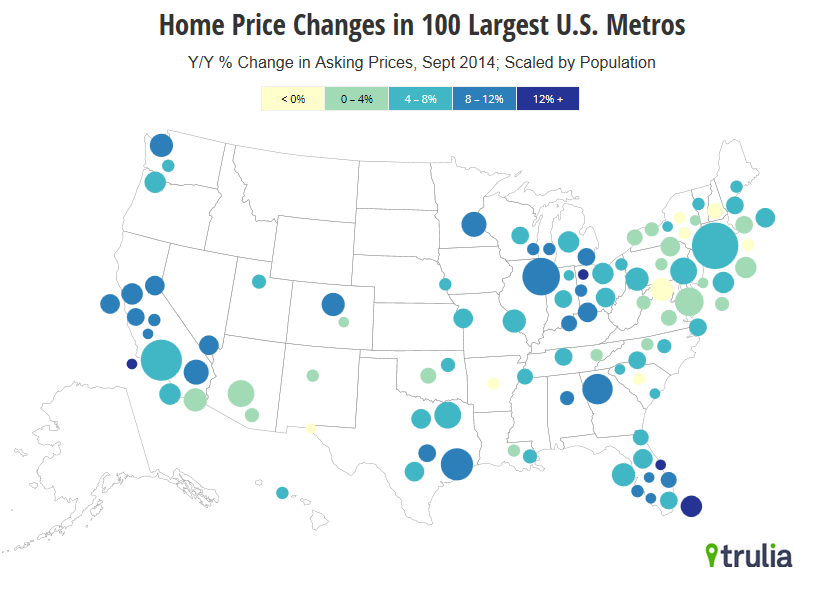

Based on data provided by S&P/Case-Shiller, Clear Capital and others, we predict that home prices in the Phoenix metro area will rise by nearly 20% in 2013. That would put it among the top-performing metro areas in the country (most of which are in California), in terms of year-over-year price gains.

Our 2014 Phoenix housing forecast is mostly positive. We expect much of the current momentum to carry over into 2014, driving additional, but more modest, home-price gains.

Prediction: Phoenix Home Prices Will Outpace the Nation in 2014

No one can predict the future of Phoenixs housing market with complete accuracy. But theres one thing most housing analysts agree on. Home prices in the Phoenix metro area will almost certainly continue rising through 2014. The question is, by how much?

Our prediction: Dont expect the sharp price increases seen over the last 12 18 months. Supply-side changes will likely decelerate appreciation for this housing market in 2014, leading to smaller annual gains.

According to a recent report by Clear Capital, the real estate market in Phoenix is an extreme example of a broader national pattern. The pattern is this: sharp upward corrections in the short term will eventually give way to more modest and sustainable growth:

Phoenix, for example, is now seeing quarterly growth [in home prices] that supports a yearly growth rate more in line with 10.0%, as opposed to the current yearly gains of 23.3%. (Clear Capital market report, Aug. 6, 2013)

Despite the expected slowdown in housing appreciation, there is still plenty of good news coming out of this market.

Its hard to find a lot of fault with the recovery in Phoenix, said Daren Blomquist, vice president at RealtyTrac. He cited a laundry list of positive factors that are driving the real estate recovery in this metro area, including population growth, shrinking inventory, and a reduction in foreclosures. These trends bode well for the Phoenix housing market in 2014, as well. They will support additional gains in home prices, much to the delight of local homeowners.

The bottom line: Based on current trends, its reasonable to predict that Phoenix will outpace much of the nation in 2014, in terms of home prices. It would not be surprising to see annual appreciation of 9% 12% by the end of 2014, within this particular market. See disclaimer below.

Job Market Will Bring Buyers, Boosting Real Estate Demand

Jobs mean population growth, and population growth drives housing demand. The Phoenix housing market will probably have plenty of all three in 2014.

The outlook for the areas job market is positive, to say the least. Last month, Moody’s Analytics did a state-by-state analysis and projection for job gains. By their estimation, Arizona will soon have the fastest rate of job growth in the country, averaging 3% annually over the next five years. This would be a huge turnaround for a state that had one of the highest job-loss rates during the recession and a major boon for the local real estate market.

Jobs bring people. Population growth, in turn, creates more demand for housing and puts upward pressure on home prices. This is one of several factors driving our positive predictions for the Phoenix housing market in 2014. Phoenix is currently the fifth-largest city in the United States. It is expected to climb to #4, or even higher, within the next six years.

According to estimates by the U.S. Census Bureau, the citys population could reach 2.2 million by 2030, while the greater metro area could climb to 6.3 million. Its no wonder economists are predicting an increase in new-home construction.

The Greater Phoenix Blue Chip Real Estate Consensus Forecast is provided by a panel of economists and real estate analysts within the metropolitan area. The groups latest report forecasts a steady rise in the number of single-family residential building permits over the next couple of years. The panelists were unanimous on this subject. Every member predicted a rise in permits in both 2014 and 2015.

Here are their expectations for single-family construction permits in the greater Phoenix area:

- 14,640 units in 2013

- 20,657 units in 2014

- 25,000 units in 2015

This prediction is yet another sign of a strong local economy in general, and a robust housing market in particular.

Bubble Fears Are Overblown, Says Real Estate Professor

The rapid home-price gains seen within the Phoenix real estate market have led some to warn about price bubbles in 2014 and beyond. But one notable expert believes such fears are unwarranted. Morris Davis, a real estate professor at the University of Wisconsin-Madison’s Wisconsin School of Business, feels that housing in the U.S. might actually be undervalued today.

He bases this assertion on land-based valuations. Land is telling you what’s going on with demand, Davis told Bloomberg Businessweek .

Take Phoenix for example. In 2006, the land share of house values in the Phoenix area was 65%. It dropped like a stone after the housing crisis, falling to a mere 5% by 2011. Land share has regained some lost ground since 2011, but it was still only 26% in the first quarter of 2013, according to Davis.

Forecast: Inventory Turnaround Will Affect Prices in 2014

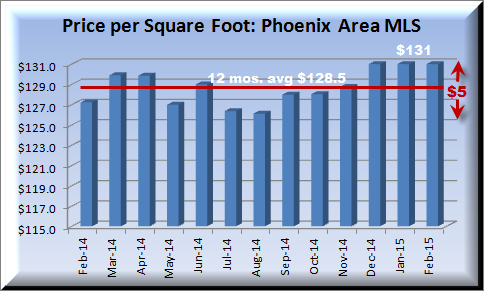

Theres one area where experts agree: Home prices in Phoenix cannot rise at their current rate for much longer. Demand for housing will likely continue to rise in 2014, as a result of job and population growth. But this could be offset by significant changes on the supply side of the equation.

The inventory crunch of 2012 2013 is now starting to ease. In fact, data from Realtor.com suggest that this market is now growing. Six months ago, Realtor.coms monthly housing summary showed a significant decrease in the total number of Phoenix homes listed for sale. In contrast, their most recent summary (published on October 8, 2013) showed a 7.4% increase in total listings, from Sept. 12 Sept. 13.

The Realtor.com housing report also showed a 24.34% increase in the median list price for the Phoenix real estate market. But most of these gains occurred while inventory was falling, year over year. The recent increase in listings (year over year) is a relatively new trend that could continue over the coming months. How this trend will affect home prices remains to be seen. But it will almost certainly put downward pressure on prices in the metro area.

Still, there are many factors in place that hint at strong price growth in the months and quarters ahead. The bottom line is that homes in the greater Phoenix area will continue to appreciate through 2014 but at a slower pace. We probably wont see year-over-year gains approaching 20%, as we did in 2013. But overall, the news is still good for homeowners.

Disclaimer: This story contains forward-looking statements (predictions, projections and forecasts) regarding the Phoenix, Arizona real estate market. Such statements are based on ever-changing trends and data. As a result, these statements should not be viewed as facts or financial advice. We make no guarantees or claims about the future of this or any other housing market.