Find Alpha And Diversify Your Portfolio As Asset Correlations Converge To 1

Post on: 26 Апрель, 2015 No Comment

Over the last 7 years the five main assets classes: equities, commodities, bonds, real estate and the hedge fund index have become increasingly correlated. In this new world of binary risk on and risk off it has become more and more difficult to find pure non-correlated alpha in a legitimate investment that diversifies an existing portfolio. But there is one still one strategy that creates alpha, finds diversification and can profit in falling asset markets as easily as rising.

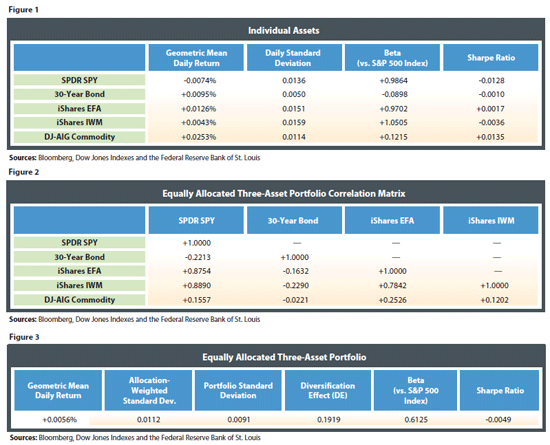

In his book Leading indicators for the 1990s Dr Geoffrey Moore found that over 8 business cycles between 1948 and 1990 that bonds led the business cycle by an average 17 months, stocks on average followed 10 months behind and commodities a further 1 month after that. But in our new world of instant access to real-time market information. increased liquidity pressures and tighter margin requirements, the main asset classes now move as one. We often hear market commentary describe risk on or risk off where the main asset classes all move together, and we can see from the table below that from the beginning of 2005 correlations have converged towards 1 at an increasing pace. The S+P 500 Index now has an 87.8% correlation to the S+P Global Property Index, surprisingly also an 86.6% correlation to the HFRX Global Hedge Fund Index, and a 77.2% correlation to commodities (from near zero in 2005). Bonds have performed well, but now, influenced by QE and LTRO-type operations, offer their lowest ever yields, with both German and French 6 month government bonds yield negative rates.

This has increased portfolio risk tremendously, especially in the current environment of;

- The European debt crisis, austerity and dramatically slowing growth.

- China’s increasingly likelihood of a hard landing.

- U.S. ; S+P at key resistance levels, Ben Bernanke’s speech at Jackson Hole, PMI falling and the looming fiscal cliff.

The fear of a bear market exposure is highlighted by the rate at which investors are fleeing stocks. Since the beginning of the year, active investors have pulled $58 billion from U.S. stock mutual funds (by comparison they bought $6.4B in the first 5 months of 2011, and sold just $18B during the first five months of 2010). These investors are not running to the safety of gold, which is well below the recent highs of 1921$/oz, they are sitting in cash, generating no returns and suffering from diminishing purchasing power day by day.

Passive investors also leave themselves over-exposed to highly correlated markets, and in this environment have to take increased responsibility for their portfolios by searching for diversified exposure.

So what are the options? Where can we find alpha and still diversify our portfolios in the binary world of risk on and risk off?

The answer is systematic CTA-type strategies (Commodity Trading Advisor). Don’t get me wrong, these are not high frequency algorithms, but automated, program trading funds that give low risk, consistent returns. Since January 2000, CTA’s have generated monthly average returns of more than 2% in periods when global equities were experiencing strongly negative monthly returns of at least 5%. They have also enjoyed annual average returns of 7.1% since 2000 and incurred only one year of losses — 4.3% in 2009 — according to the Newedge CTA index .

With their disciplined, automated risk management procedures they also have low volatility of returns. Usually non-discretionary, there is no human emotion involved in the trading process. Trade entry signals can be programmed on a whole host of different filters; technical analysis and mathematical pattern recognition are common options. The computer scans the market continuously for trades, initiates positions, balances risk-size, enters stop & take profit levels and continuously manages the positions. It’s a numbers game, no one trade is expected to make a huge profit, but over time losses are cut and winning trades are left to run to optimal take profit levels (measured using extreme standard deviations, key DeMark exhaustion levels, reversal patterns, or changes in volatility). The chart below of the Newedge CTA Index plotted against the S&P since 2000 highlights the consistency of such strategies. While the S&P is still below it’s January 2000 levels, the Newedge CTA Index has risen over 100%, not only with consistent returns, but also without significant draw downs.

The beauty of such strategies is they can be profitable in falling as well as rising markets, they can follow trends, mean revert, and identify trading patterns. They will never hit huge short term returns, but that is not the purpose; rather the goal is consistent, low risk returns, non-correlated to the main asset classes. These strategies generate both pure alpha and also diversification for existing portfolio strategies.

There are many such ETF’s to choose from; (NYSEARCA:LSC ) Elements S+P CTI ETN, (NYSEARCA:TRND ) US Large Cap Trendpilot ETN, (NYSEARCA:ALT ) Diversified Alternatives Trust Fundamentals. As well as Powershares DB ETF’s in; Agriculture (NYSEARCA:DBA ), Precious metals (NYSEARCA:DBP ), Base metals (NYSEARCA:DBB ) and Energy (NYSEARCA:DBE ).

In fact, foreign exchange is becoming an increasingly popular focus for such strategies. While S+P volume has fallen back to levels not seen since 1999, average daily global currency turnover has risen from $3.98 trillion in 2010 (Bank for International Settlements) to $4.71 trillion in July 2012 (Dow Jones Newswire).

What continues to surprise is investors’ fear of program trading strategies, fearing the unknown they prefer to hold more tangible assets. But this blinkered thinking is leaving them highly exposed to downside risks and blissfully ignorant to potential gains. As U.S. equities are struggling at key resistance levels, and nervously awaiting Ben Bernanke’s speech at the Jackson Hole Economic Symposium on 31st August, this may be an optimal time for those Seeking Alpha and true portfolio diversification to look to Systematic Strategies.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.