Financial Statement Red Flags

Post on: 3 Май, 2015 No Comment

Financial Statement Red Flags

November 19, 2014

Steven Buccigross, CPA

Principal

Nancy Gregory, CFE

Director

Kimberley Train, CPA/ABV

Partner

The last 15 years have produced some of the most notable financial statement frauds in U.S. History, including: Enron, WorldCom, Tyco, HealthSouth and AIG. The magnitude of the losses associated with recent accounting scandals continues to inform users of financial statements about the importance of recognizing financial reporting red flags. These red flags are often indicative of underlying operational or economic distress.

When analyzing financial statements, it is important to remember that one year of data is not indicative of a trend. Whenever possible, at least three years of data should be reviewed period over period when performing horizontal analysis.

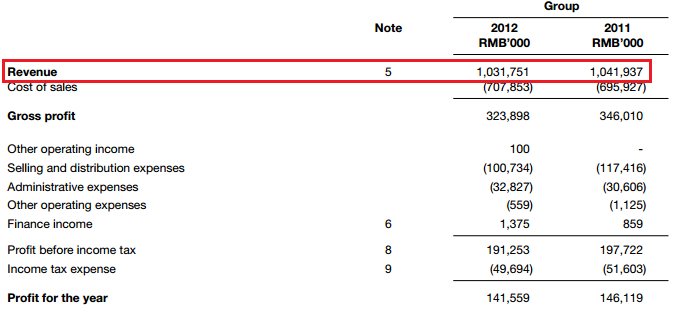

Declining Sales Revenues and Profit Margins

Business basics teach us that sales drive financial growth. Conversely, multiple years of decreasing sales cause financial deterioration. If a company also suffers multiple years of losses while sales are declining, there is even more cause to be concerned. In conjunction with such trends, eroding profit margins in the midst of a robust economic climate would also be indicative of financial distress given the lack of external downward pressure on margins.

Decreasing Cash

Cash is king is an oft-touted phrase in business school. A business long-term prospects are questionable if its cash flow statement reflects that its cash outflows consistently outpace its cash inflows period over period. Furthermore, if the business is generating more cash from investing than it is from operations, it is financing its operations through debt, the servicing of which could become problematic.

Working Capital Ratio

The Working Capital Ratio or Current Ratio is one measure of a companys liquidity. It is considered one of the best indicators of a companys ability to pay its bills. The ratio is defined as:

Current Assets

Current Liabilities

Current assets are generally comprised of cash and cash equivalents, accounts receivable, inventory and prepaid expenses, while current liabilities are comprised of short-term borrowings, accounts payable and accrued expenses. Many business turnaround practitioners believe that a 2:1 ratio should be the minimum. No matter the industry, it is inadvisable to fall below a Working Capital Ratio of 1, i.e. $1.00 of current assets to cover every $1.00 in current liabilities, which translates to a breakeven scenario; anything less than a dollar-for-dollar ratio would be indicative of a working capital deficit and a company unable to meet its financial commitments. In turn, an inability to meet current obligations is considered one of the precursors of business failure. A high current ratio could also be a red flag, though, as it could signify obsolete inventory or uncollectable accounts receivable. A Working Capital Ratio should be considered in conjunction with earlier year results and in juxtaposition with comparable companies within the same industry.

Debt to Equity Ratio

The Debt to Equity Ratio is a measure of a companys leverage. As the name implies, it compares the amount of financing obtained from debt instruments vs. stock issuances. It is defined as:

Total Debt

Total Stockholders Equity

A high Debt to Equity Ratio can be risky insofar as it reflects a substantial obligation to lenders who, unlike investors, require scheduled payments. Excessive leverage is one of the leading causes of business failure. Debt service can be a drain on cash. Increasing Debt to Equity ratios could be a reason for alarm since they suggest that a company could be assuming more debt than it is able to repay from ongoing operations particularly if sales are on a downward trend. A high Debt to Equity ratio can be considered an indicator of default risk. As with the Working Capital Ratio, Debt to Equity Ratios must be analyzed in the context of historical performance and industry comparability.

Increasing Accounts Receivable or Inventory Values

While rising accounts receivable or inventory values can be associated with fictitious revenue and profit manipulation schemes, they can also be indicators of more fundamental financial fissures. When assessing rising accounts receivable and inventory line items over a multiple-year period, it is helpful to consider these numbers in the context of sales trends. If sales are increasing at a lower rate than accounts receivable, customers may not be paying for product in a timely fashion. This could also be an indication of service issues. In general, satisfied customers who perceive value pay more quickly than those clients who are not happy with the goods or services received. If sales are increasing at a lower rate than inventory, production is exceeding demand. If these scenarios exist for protracted periods, they will inevitably give rise to a cash crunch that will impede a business ability to fund its operations, meet its obligations and reinvest in itself.

One-Time Line Items

So-called one-time line items, such as restructuring charges, should always give a reader pause. The fact that a company is restructuring suggests that it has already suffered significant financial distress. The question should be raised as to whether there will be additional restructuring charges in the coming years. It is also important to determine if the company under review has a history of including one-time charges on its financial statements, such that the one-time charges are actually recurring charges that bear different titles each year. These charges may be a mechanism for concealing continually weak financial performance.

Business lending and investing will always be fraught with risk. Understanding some of the fundamental red flags in financial statement reporting can mitigate some of that risk.

Steven Buccigross, principal at BlumShapiro, has 13 years of public accounting experience specializing in audits of privately held businesses in the construction, manufacturing, technology and real estate industries as well as non-profit organizations.

Nancy Gregory is a director in BlumShapiros Litigation Services and Business Valuation Group. She specializes in forensic accounting, fraud investigations and bankruptcy and insolvency.

Kimberley Train is a partner in the Litigation Services and Business Valuation Group of BlumShapiros Boston and Quincy, MA offices. Kimberley has over 15 years of litigation support and forensic accounting experience.

BlumShapiro is the largest regional accounting, tax and business consulting firm based in New England, with offices in Connecticut, Massachusetts and Rhode Island. In addition, BlumShapiro provides a variety of specialized consulting services such as succession and estate planning, business technology services, employee benefit plan audits, litigation support and valuation, and financial staffing. The firm serves a wide range of privately held companies, government and non-profit organizations and provides non-audit services for publicly traded companies.