F1 preparing consolidated financial statements

Post on: 16 Март, 2015 No Comment

Velocity August 2010

20images/August%202010/3%20ppl%20with%20docs.jpg /%

This article explains how to prepare basic consolidated financial statements for a group with one subsidiary. It’s the second in a two-part series by the F1 examiner.

Consolidated financial statements were not examined at the equivalent level in the old syllabus. They have now been included in F1 as an introduction to consolidated financial statements in preparation for the F2 exam.

The F1 syllabus excludes non-controlling interests, all subsidiaries must be 100% owned by the parent entity. Questions could include one or more subsidiaries. The syllabus includes associated entities but we will not be able to consider them in this article.

The F1 syllabus specifies that you should be able to prepare a consolidated statement of financial position and a consolidated statement of comprehensive income for a group in relatively straightforward circumstances. Questions could be set requiring either one of these consolidated statements or both of them.

Preparing consolidated financial statements

IAS 27 ‘Consolidated and separate financial statements’ defines a subsidiary as an entity that is controlled by another entity. An entity has control if it has the ability to direct the operating and financial policies of another with a view to gaining economic benefit. If an entity owns 100% of another entity it will usually have control.

When preparing consolidated financial statements:

- We are replacing the cost of the investment in the holding entity’s accounts with the fair value of the assets and liabilities of the subsidiary.

- Goodwill is likely to arise on acquisition. Shares purchased at the market price may not reflect the fair value of the assets and liabilities of the subsidiary. Any difference between the amount paid and the value of the assets is goodwill.

- There must be no double counting. All items that relate to transfers within the group must be eliminated on consolidation.

Pre-acquisition and post-acquisition reserves

When preparing consolidated financial statements it is important to distinguish between pre-acquisition reserves and post-acquisition reserves. Pre-acquisition reserves are retained profits and other reserves that exist in a subsidiary’s statement of financial position at the date of acquisition. Pre-acquisition reserves are capitalised at the date of acquisition by including in the goodwill calculation. They must not be included in the consolidated income statement or consolidated statement of financial position.

Profits/losses (including unrealised gains and losses) made after acquisition that are shown in the subsidiary reserves can be included in the consolidated statement of comprehensive income and in reserves in the consolidated statement of financial position.

Intra-group activities

The impact of any intra-group activities must be cancelled out in the consolidated financial statements.

- Inter-entity trading. Sales and purchases figures need to be adjusted on the income statement to remove double counting of the sales. Any goods in closing inventory at the year end will include unrealised profit in the inventory value, this must be removed.

- Current accounts should be reconciled, making adjustments for any items in transit and then cancelled out on consolidation.

- Intra/inter-group dividends received are cancelled on consolidation against dividends paid.

Consolidated financial statements use the same underlying format as single entity financial statements, so you do not need to learn new formats for consolidated financial statements.

Consolidated financial statement preparation — checklist

- Calculate group holdings and establish the status of each entity in the question (subsidiary, associate or investment), W1

- Establish fair value of assets acquired and calculate net assets of the subsidiary, W2

- Calculate goodwill arising on acquisition, W3

- Adjust for any intra-group activities, W4

- Calculate balance carried forward on consolidated retained earnings, W5

- Calculate balance carried forward on consolidated reserves, W6

- Prepare consolidated financial statements, statement of financial position and/or consolidated statement of comprehensive income.

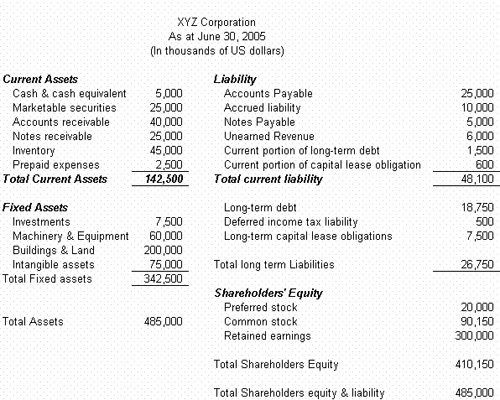

Now, let us use this approach in answering a typical question. X holds shares in Y. On 1 April 2006 X purchased 600,000 shares in Y at a cost of $1.60 per share. The fair value of Y’s tangible assets at 1 April 2006 was $126,000 more than book value. The retained profits of Y at 1 April 2006 were $120,000. The excess of fair value over book value was attributed to buildings held by Y. At 1 April 2006 the buildings had an estimated remaining useful life of 21 years. The draft summarised financial statements for the two entities as at 31 March 2010 are given below:

Summarised statement of financial position at 31 March 2010