Eye risks on highyield bond funds

Post on: 13 Апрель, 2015 No Comment

By Gail Liberman

Special to the Daily News

We were doing great. We had a high-quality bond yielding more than 5 percent. Unfortunately, though, it recently was “called.”

In other words, the issuer, not wishing to shell out that kind of money to us anymore, returned our money. Getting a comparable yield today requires taking on a lot more risk.

One tempting option: A high-yield bond fund. These invest in bonds issued by companies with poor credit ratings. The issuers are rated below BBB by Standard & Poor’s and below Bbb by Moody’s.

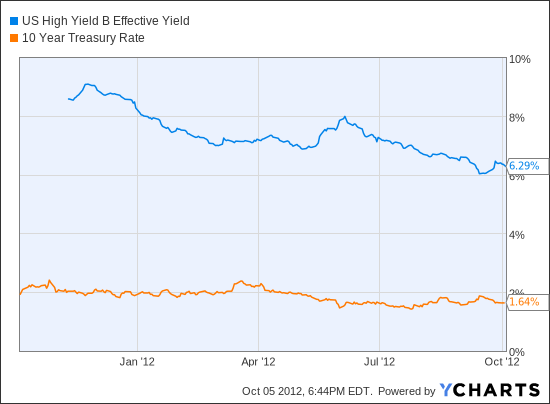

They pay high yields — currently running more than 6 percent. Otherwise, nobody would invest in them. But they’re too risky. Not only do you stand a greater risk of default with a high-yield bond fund, but you also risk losses if interest rates rise. Anytime you risk your principal, you need to get paid accordingly.

In the 1990s, high-yield bond funds registered double-digit losses when the economy went into a recession. Just recently, amid concerns that Fed chairman Ben Bernanke would stop his “Operation Twist” bond-buying program, investors withdrew in droves from corporate high-yield bond funds. In June alone, total returns of high-yield bond funds were down 2.39 percent, based on data of Morningstar Inc. of Chicago. So, is it a good time to invest?

High-yield bond funds tend to track the performance of the stock market. If stocks are doing well, there’s a good chance the price of your high-yield bond fund also is rising.

Unfortunately, if the stock market falls, as we recently saw, the opposite is true. Meanwhile, as investors try to cash out, a fund manager may have to liquidate bonds at a loss, which could further drive down the fund’s value.

That’s why it’s so important to make high-yield bonds and bond funds just a small part of a wide variety of bond holdings.

Because of their high risk, don’t overly rely on your high-yield bonds for high income. The issuer may not pay.

If you decide to invest some of your money in a high-yield bond fund, here’s what to consider:

* Make sure the bond fund manager invests in companies with quality assets, such as real estate, plants and equipment, and popular products.

* Call the fund manager and ask how much the investor typically gets paid if a bond in the fund defaults. You want to invest in bonds that are capable of paying you back close to $1 for each $1 you invest.

* A company that issues a bond should be able to survive five years of poor business conditions.

* The rates on high-yield bonds should yield about 2 to 3 percent more than Treasury bonds. Otherwise, why take the risk when you can invest in bonds guaranteed by Uncle Sam? At this writing, 10-year U.S. Treasury bonds were yielding nearly 2.5 percent.

* A high-yield bond fund should own a large number of issuers in a large number of industries. So if a few bonds default, the overall holdings won’t suffer.

* Review the track record of the bond fund at morningstar.com. Seek a four-star or five-star rating, which means the fund delivers the best return with the least amount of risk in its category.

* Check the fund’s fees and expenses. Your goal: A no-load mutual fund that charges no commissions. Make sure the fund’s expense ratio is in line with the average bond fund expense ratio — around 1 percent.