European realestate market in 2014 What to expect Simply Luxury Homes

Post on: 16 Март, 2015 No Comment

In our coverage of last years real estate market overview. Berlin was firmly placed in the top 3 of European cities, in terms of attractiveness for real estate investors.

Strong and healthy foundations of the countrys economy show that there were no signs of a real estate bubble in Berlin.

This year we decided to have a look at the predictions for 2014 for the German capital, also considering the European market overall.

Last year Berlin was the third most active city in Europe with transactions of 4 billion Euros in 2013, following London and Paris. However, considering transactions per capita, Berlin is ahead of London and Paris. In addition to the latter, the purchase and rental prices, vacancy rates and Berlins economic outlook give analysts a valid ground to regard the real estate market in Berlin as an attractive place for investments.

Furthermore, Berlin the preferred city in Germany for transactions, ahead of Munich, Frankfurt and Hamburg that have an active market of 3, 3 and 2 billion respectively. Another evidence of Berlin as an attractive city for real estate investors is that 44% of all transactions in the German real-estate market were made in Berlin. The relatively high market share of other cities is explained by higher purchase prices (in particular in Munich and Frankfurt), which do not always match the actual demand in these cities.

Major Trends in the European Real Estate Market in 2014

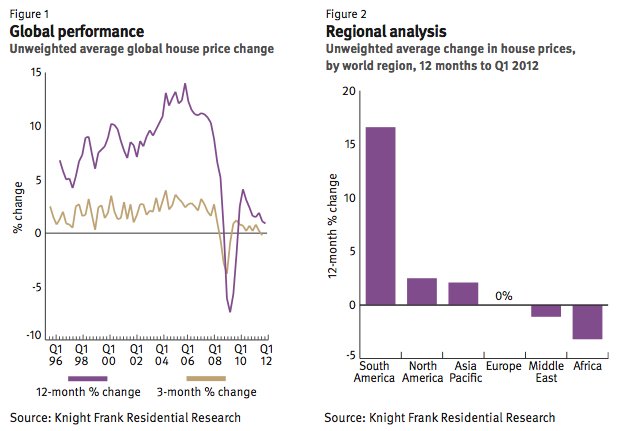

Looking at the 2014 edition of the report Emerging Trends in Real Estate by PwC, several investors said that further property price increases are likely throughout Germany. Nonetheless, this trend is not common everywhere in Europe. Many areas in Europe are still recovering from the past crisis and Standard & Poors showed examples of slow recovery in one of its latest publications in 2013 entitled House Prices Are Still Falling In Most European Markets As The Recession Bites. France, Holland and Spain are still facing a crumbling of prices (both purchase and rental), while other markets such as the English, Belgian, Italian and Irish are stabilizing. Residential property prices in Germany continue to gain momentum. Why?

PwC classified the top 28 cities in Europe in terms of real estate market size. Apart from ranking the cities in terms of new developments, existing and new investments, the table shows also how rents, amount invested and capital value are valued by investors. The city is performing well in all three categories: it is ranked second in Europe in terms of rental prices and appreciation of capital (after Dublin) and third in terms of capital needed for making a good investment.

Considering the economical side, S&P also confirmed that the real estate market, in particular in its top 4 cities, will continue to rise in Germany. In fact, a favorable high income and a positive employment outlook together with low interest rates, will continue to drive prices up and increase a strong national and international demand for safe capital investment. S&P also forecasts a price increase of at least 3% in 2014, confirming a stable tendency rather than a bubble.

The level of confidence of investor in a country or a city is important for driving transactions. EY with its report Building Confidence 2014 evaluated the expectations towards the most important real estate market with a pool of investors. The consulting company and its experts evaluated Germany positively in all estate market segments (office, retail and residential). Moreover, for the residential property prices, analysts expect a weaker growth across Europe, except for Germany, Switzerland and partly France.

So what is the general forecast for the year 2014 in Berlin compared to other cities? Out of 28 cities, Berlin is ranked at third for new investment and development projects, while for existing investments and the second hand market Berlin is placed in the fourth position. Not only does the report express a favorable opinion about Berlin’s real estate market, but also indicates that the projects that have more value for investors are those related to new off-plan projects and developments.

Berlin is Here to Stay

Real-estate investments in Berlin have very good long-term prospects, especially, considering that the city is regaining its place among Europes most important cities.

The residential market is driven by the young population and Berlin’s growing influence as a European media and technology hub and as experts confirmed to PwC: making it a hotspot, with steadily rising rents, especially in recently modernized buildings Residential investments in Germanys top locations are a must. To find out more about real estate opportunities in Berlin, click here.