Europe REITs ETF As A YieldGenerating Alternative

Post on: 25 Июль, 2015 No Comment

Dividend ETFs News:

The Europe real estate investment trust-related exchange traded fund has been outperforming as income-starved European investors scrambled for higher yielding assets in response to the European Central Banks aggressive easing and falling rates.

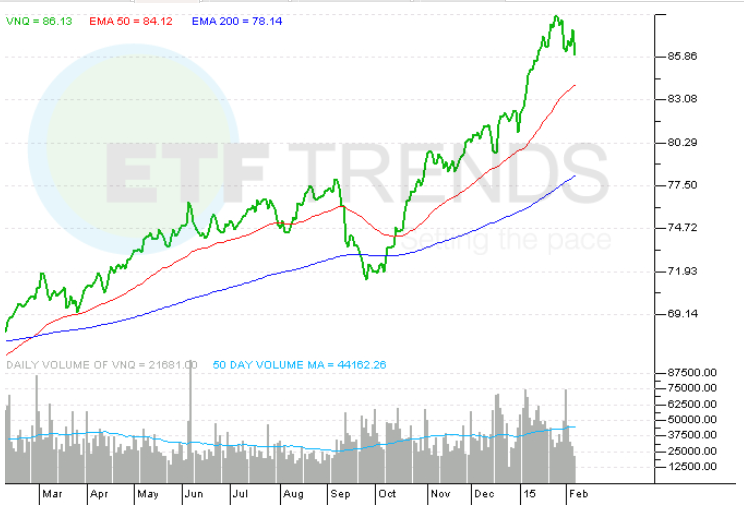

Over the past month, the iShares Europe Developed Real Estate ETF (NYSEArca: IFEU ). which tracks European real estate stock sand real estate investment trusts,jumped 12.8%, whereas the Vanguard REIT ETF (NYSEArca: VNQ ) rose 6.1%. [More Upside Seen for a Popular REIT ]

The European real estate market is also more cheaply valued relative to U.S. REITs. For instance, IFEU shows a price-to-earnings ratio of 19.7 and a price-to-book of 1.2, whereas VNQ has a 39.4 P/E and a 2.4 P/B.

Real estate assets have strengthened so far this year, following the ECBs 1 trillion euro bond-purchasing program and subsequent wave of central bank easing, as investors turned to the relatively attractive yield opportunities in REITs. For example, 10-year German bund yields recently dipped below Japanese bond yields for the first time and were hovering around 0.37% Friday. In contrast, IFEU has a 2.52% 12-month yield and VNQ has a 3.37% 12-month yield.

Quantitative easing will lower interest rates for an extended period of time to support real estate investment in the euro zone, while the weaker euro may attract more international investors to buy assets, Simon Mallinson, RCAs managing director for Europe, the Middle East and Africa, said in a Reuters article.

With global monetary policies weighing on interest rates, investors will turn to other assets, like REITs, to meet their income needs.

Europe has attracted $213.1 billion euros, or $241.7 billion, of commercial real estate transactions in 2014, or 13% higher year-over-year, with investors targeting safer French assets.

IFEU tracks real estate assets across Europe, including United Kingdom 38.1%, France 23.6%, Germany 14.8%, Sweden 6.4%, Switzerland 5.6%, Netherlands 2.9%, Belgium 2.7%, Austria 1.6%, Spain 1.3% and Finland 1.2%.

iShares Europe Developed Real Estate ETF

For more information on real estate investment trusts, visit our REITs category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.