ETF Investing In Europe Finding The Right Strategy

Post on: 5 Май, 2015 No Comment

Buy and hold investors should always focus on long term healthy asset classes. In regards to investing in Europe, the key question is whether or not Europe will be a financially healthy asset class over the next ten years.

With the onset of the European debt crisis, Eurozone nations pose a significant risk due to political uncertainty. Political leaders continue to avoid solutions aimed at root causes, making future investing in Eurozone companies unsuitable.

So what choices do investors have with this bleak outlook? European investment risk may be reduced by investing away from European Union nations, or by remaining invested but hedging currency exposure.

Featured below are two strategies that highlight solutions for investing passively in European and international markets, while protecting portfolios against the increased systematic risks of the European continent and falling currencies.

Strategy One — Separating Asset Classes

In recent months, the European Union governments have developed special risks that have not been realized to the same extent among other international developed nations, such as Switzerland, Great Britain, Canada, Australia, and Singapore. Considering the international developed category in less-broad terms when modeling and building portfolios may allow for more efficient allocations.

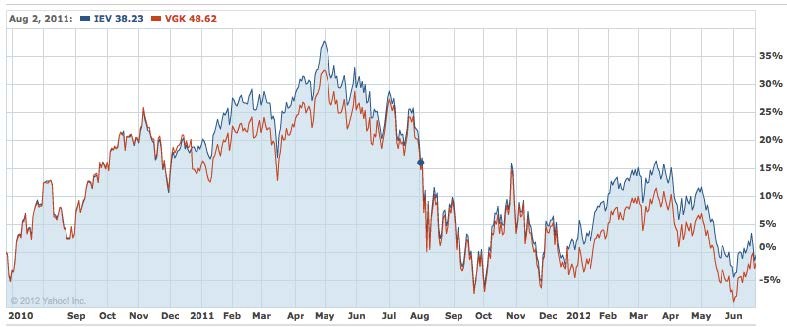

(click to enlarge)

In market environments when a falling US Dollar is the main concern, investing as broadly as possible into the international market is rewarded when lower correlations lower the risk. However, in an environment when a rising dollar becomes a main concern, there are benefits to separating international investments so that each can be studied for its effect against a rising dollar. In this current environment we can also diversify political risk by allocating a larger percentage of our international allocation to non-european countries.

Which ETFs?

For the European space, which accounts for about 25% of the world’s market capitalization, the iShares S&P Europe 350 Index, IEV, is a solid choice. The fund has 50% non-eurozone investments; 37% and 14% of the ETF are invested in British and Swiss companies, respectively. Morningstar reports that currency has given the US investor the main boost in returns over the last 10 years — 6% versus 2% in local currency returns. Morningstar also reports that this ETF has had a 91% correlation to the S&P 500 over the last 10 years.

A comparable fund is the cheaper Vanguard MSCI Europe ETF, VGK, with an expense ratio of 0.14% compared to iShare’s IEV’s 0.60%. Also, Morningstar reports that VGK has a yield of 4%, but 20-30% of those dividends are not considered qualified, potentially causing the ETF extra tax expenses. IEV, however, has had 100% qualified dividends over the last two years with a yield of 3%.

(click to enlarge)

The Non-Europe Asset Class

To represent the asset class of non-european, international developed countries (which are mainly Asian markets), the Vanguard MSCI Pacific ETF, VPL, is a preferred choice with limited competition in the ETF space. Over the last 10 years, according to Morningstar, VPL has had a 70% correlation to the S&P 500, though it is mainly caused by its 60% holding in Japanese companies (Japan has its own economic concerns and major national debt issues). Over the last 3 years, currency has given this fund a 10% annualized boost for US investors against local currency investors. Yields are around 3% according to Morningstar.

Strategy Two — Hedging Against The Euro

The WisdomTree International Hedged Equity Fund, HEDJ, is an ETF giving an alternative perspective on International markets. Through hedging the foreign currencies against the US Dollar, HEDJ, gives investment access to international developed markets while neutralizing currency fluctuations.

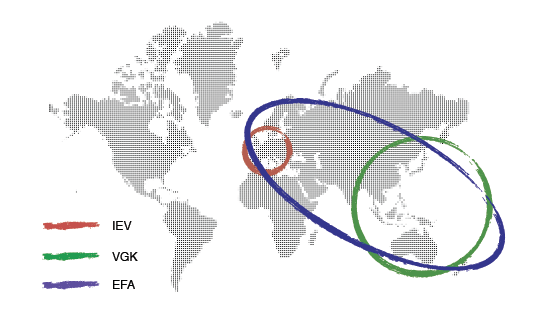

The ETF and index seek to give exposure to Europe, Australasia, and the Far East (EAFE) while aiming to minimize currency fluctuation in the ETF relative to the US dollar. This fund can be compared to a local currency investment, benefiting the US investor when the US dollar rises and hurting returns when the US dollar falls on a relative basis against foreign investments included in the ETF.HEDJ appears to be a good match against iShares MSCI EAFE Index Fund ( EFA ) for a

currency hedging strategy.

The above ETFs compare fairly closely to covering similar countries, though HEDJ seems to be slightly more diversified and carries less of the slow growth economy of Japan.

The chart below compares a Euro/USD index against EFA and HEDJ. As the Euro/USD began to sink in August 2011, both EFA and HEDJ dropped nearly 15% (signifying the start to the European Debt Crisis). But as the weakened Euro fell against the already weak dollar, HEDJ allowed for much more upswing during the bailout talks in the first quarter of 2012.

The above graph shows a perfect scenario where a currency hedged ETF works well. However, below, a March 2012 graph comparing the same ETFs and currency index shows that having a currency hedged fund does not protect in any way against loss in the underlying stocks.

An exchange-traded fund like HEDJ is extremely useful for a specific market outlook — a rising dollar against currencies represented in the index. Making long-term tactical decisions such as to limit currency exposure can be done as a conservative approach to international investing. Also, since this fund closely matches asset classes found in EFA, a simple adjustment can be made by switching between an MSCI EAFE Index and HEDJ, allowing portfolio allocations to the international developed asset class to be maintained.

Choosing Strategies

If you are not willing to make a currency play, simply reducing your Europe allocation would lower your political risk. Reallocating the reduced EFA can also be challenging. Perhaps taking the approach in Strategy One, reallocating to global real estate or incorporating a US large cap high dividend play would be good options. In the long term just holding Europe without a strategy does not seem like it will work out well.

*All data comes from Morningstar Advisor Workstation and charts have been taken from Yahoo Finance. All opinions are the analyst’s unless stated otherwise. Kyle Waller, Research Analyst and Mitchell Williams, Intern Research Analyst contributed to this article.