Equity Trust Company Complaints

Post on: 3 Май, 2015 No Comment

Posted by Equity Trust Company Complaints on October 25th, 2012, No Comments

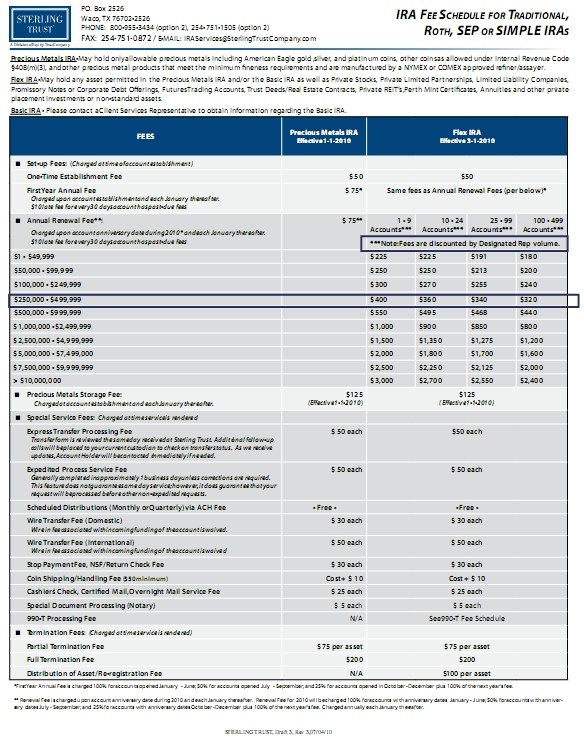

For the professionals who work at Equity Trust Company, complaints are far from uncommon. These are not complaints about the company itself, but rather about the retirement options that currently exist. They are complaints about the limited investment opportunities afforded by traditional IRA and 401(k) accounts. For Equity Trust Company, complaints like these are plentiful, but they are also easily answered.

Equity Trust Company is a custodian of self-directed IRA and 401(k) plans. For the investor zealous to save for retirement, but frustrated with the restrictive options currently available, these self-directed options can prove highly advantageous.

Even so, many financial planners around the country are not aware of what self-directed IRAs and 401(k)s entail. That should not keep savvy investors from looking into these options, and discovering the benefits they afford. For Equity Trust Company, complaints about traditional retirement accounts are put to rest when the benefits of these other options are fully detailed.

About the Company

But what about the company itself? Equity Trust Company stands as a national leader in the provision and administration of self-directed IRAs and 401ks. The company has the numbers to back up this claim, with over 130,000 clients, in all 50 states, currently enrolled. This encompasses roughly $11 billion dollars of retirement plan assets under this company’s administration.

The company’s focus is on self-directed retirement accounts. Why self-directed accounts? Truly self-directed IRAs and 401(k)s allow the investor to experience unparalleled freedom. Indeed, the “self-directed” descriptor is for real: These are retirement funds where you call the shots and make the decisions about where and how to invest.

According to Equity Trust Company, complaints about traditional retirement accounts often stem from the narrow options available. That is not the case here. With self-directed plans, investors can choose how their IRA funds are invested. This means investors can choose traditional retirement investments such as stocks and mutual funds. They can also diversify their plans with assets like real estate, private placements, notes, deeds of trust, tax liens, foreign currency, and others.

What is the benefit of this? The main benefit is the choice that you, as the investor, receive. You can invest your money in many different ways. You can pick a field that you know well or have previous experience in, and invest there. Contrast this with traditional IRA and 401(k) models, in which you do not get this kind of say.

Here is an example. Let us say that you have worked for your whole life in real estate. Real estate is something you know well, and feel comfortable discussing. If this is the case, you may decide that real estate is how you wish to diversify your retirement accounts—and why not?

A slight word of caution is necessary, however. It is crucial to remember that Equity Trust is a passive custodian of these retirement accounts. The company does not provide you with financial advice, or tell you where to invest. They provide basic education, but you are the one who calls the shots, as far as your investment goes! At Equity Trust Company, complaints about a lack of options are quickly cast aside.

Where the Company Came From

According to Equity Trust Company, complaints from taxpayers often highlight inexperience in other professional management firms. The company was not always so prestigious. It has come a long way in a short time.

A real estate investor founded what would one day become Equity Trust Company in 1974. Initially, his interest was only in beginning a federally regulated securities brokerage. Then, in 1983, he put together an investment that enabled his clients to use their IRA funds to invest in real estate.

Almost immediately, he was heralded for his pioneering work in the field of real estate IRAs. He became an in-demand authority on the subject. All of this experience and renown ultimately led to the more official formation of Equity Trust Company. In 2001, a bank/trust charter was applied for and then granted, establishing Equity Trust Company formally.

As we have seen, the company has come a long way since then and now stands as an authority in self-directed retirement funds.

Equity Trust Company: Complaints about Retirement Planning Refuted

Like most companies, this one is driven by a set of core values. Understanding those values can go a long way toward understanding the company itself. Here are a few of the virtues that Equity Trust Company prizes, and seeks to do business by.

- One of the company’s watchwords is innovation. They seek to constantly change and move forward, honing their services and better serving clients. This does not mean they are seeking to reinvent the wheel—just make sure they are always getting better at what they do.

- Likewise, the company values knowledge. Equity Trust Company does not offer financial planning services, but rather delivers education to its investors. The company is zealous for empowering clients through the expansion of their knowledge.

- The company understands the importance of reliability in all industries and niches—but in this one, in particular. Equity Trust Company strives to offer total reliability to its clients. You never have to worry about this company proving difficult to reach or unwilling to help.

- Finally, the company strives to exemplify teamwork. That does not just mean teamwork among the company’s many employees. Equity Trust wants to stand as a part of your team. and to work with you toward your success.

More about Equity Trust Company

At Equity Trust Company, complaints about limited retirement investment options are prevalent. The company stands firm against them, and offers a better way. For Equity Trust Company, complaints like these are quickly stricken. For Equity Trust Company, complaints like these find easy answers in the superior options afforded by self-directed retirement plans.