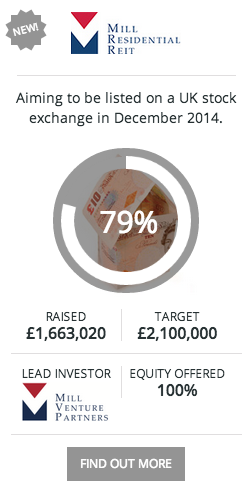

Equity Crowdfunding Investment Opportunity in Mill Residential REIT

Post on: 23 Май, 2015 No Comment

Investment Summary

NOTE: Due to demand, Mill Residential REIT are overfunding. MRR will overfund by issuing further share capital, not by diluting the equity of existing investors in this round.

You can read FAQs about the Mill Residential REIT here .

Real Estate Investment Trusts (REITs) are companies or groups that primarily hold investment properties for their rental return and long-term capital appreciation. UK REITs must be listed on a UK stock exchange.

In Q4 2014 the Mill Residential REIT aims to be the first UK residential REIT, listed on a UK stock exchange.

As it is intended that Mill Residential REIT will become the first UK residential REIT to list on a UK stock exchange, shareholders should benefit from liquidity (i.e. the ability to sell their shares) and be able to track share price movement. In practice, most investors are likely to want to invest with the longer-term in mind, and as the company grows in scale, it is expected that there will be more buyers and sellers actively trading in shares (although prices of shares will be subject to normal market factors).

As the company is intending to become listed on a public exchange, it is unable to publish any forecasts to potential investors, and so you will not find projections in the normal format found for private companies listed on SyndicateRoom. Please note that brokers reports are normally published after listing.

SyndicateRoom will hold investment monies in an escrow account until confirmation of a listing going ahead in Q4 2014. The REIT are making every effort to ensure that they will be listed by Q4 2014. However, in the unlikely event that this does not happen, all SyndicateRoom investment monies will be returned.

Mill Residential REIT’s strategy is to create a diversified portfolio of residential rental properties in the UK, initially focused in London, Southern England and other areas where attractive opportunities can be found.

Mill Residential REIT will be focused on the purchase of companies with portfolios of residential properties where REIT shares or REIT tax advantages can be made use of, going on to make the properties available for long-term rent, having developed the properties where required or advantageous. The Company will therefore contribute to the consolidation of the fragmented buy-to-let market.

This investment opportunity is looking to give individuals the chance to invest in property at a fraction of the usual cost and without the burdens and responsibilities of being a landlord.

You can also invest using your SiPPs and ISAs. For further information on how to do this please email REIT@syndicateroom.com.

Company Details

Mill Residential REIT plc

Alhambra House, 27-31 Charing Cross Road