Energy Royalty Trusts as an Alternative Investment Option

Post on: 7 Июнь, 2015 No Comment

For investors seeking alternative investments outside stocks and bonds, royalty trusts may offer a safe long-term investment with hefty dividends. Royalty trusts are publicly traded corporations with very few employees, mostly located in North America, investing in commodities such as oil, natural gas or metals. Trusts own the property rights to the wells or mines, and rely on an outside drilling or mining company to extract the resources. The outside company then pays a royalty to the royalty trust, the majority of which is redistributed to investors as dividends, which is the primary benefit of these investments. Royalty trusts are popular with investors seeking a direct line of investment to commodity sources, without the business middlemen of an energy company; in other words, investors directly own a piece of the underlying properties. They provide investors with diversification in their portfolios across multiple commodity properties, as most trusts are invested in more than one kind of commodity such as minerals, metals or oil. As shares of the trusts trade on the open market during market hours, they are also easier to trade than futures contracts the traditional way to invest in commodities.

Corporations have to pay corporate income tax on all profits, as well as taxes on dividends paid to shareholders, in a controversial practice called “double-taxation”. Royalty trusts are not taxed a corporate income tax but are legally bound to distribute the majority of their profits, up to 90%, back to investors through dividends. Therefore royalty trusts, similar to real estate investment trusts (REITs), pay out dividends much higher than traditional stocks or mutual funds, with an average yield between 10-15%. The tax liability is passed on to the investor, who can opt to reinvest the dividends through a dividend reinvestment plan to avoid capital gains taxes, or to use the cash dividend as a steady source of income and pay full capital gains taxes.

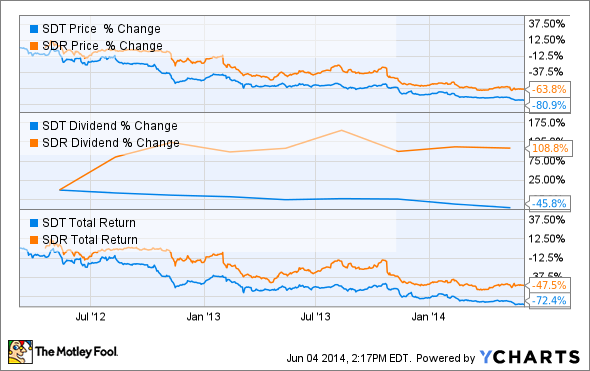

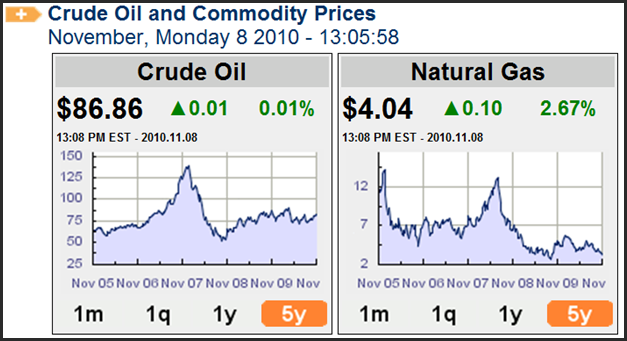

These dividends rise and fall with the underlying commodity price, as they are directly linked to the profitability of the trust, and can be paid monthly, quarterly or annually, at the discretion of the trust, but must satisfy the aforementioned set percentage rate of profit sharing. The total dividend yield of each share is determined by dividing the trust’s total annual distribution by its average annual share price.

Royalty trusts, while traded publicly like stocks on the open market, should not be confused with corporate stocks or ETFs, as trusts are overseen by a bank to insure the proper redistribution of its profits. The trade-off for high dividend returns is that the share value of the royalty trust is unlikely to rise substantially, due to the trusts’ dependence on the periodic dilution of existing shares in order to generate new capital for additional investments. Royalty trusts are often dependent on new investors, attracted by the high dividends, to maintain the share price as more shares are issued. Some royalty trusts will offer common and preferred shares, much like stocks, at different prices which come with different dividends and voting privileges. Investors should also take note of the production cycle of the underlying properties, as some royalty trusts, especially American ones, may be dissolved once the resources are depleted. In addition, the technical trading metrics of traditional stocks such as P/E or P/B ratios should not be used to accurately predict future value.

Shares of royalty trusts tend to rise in times of inflation, as commodities are often used as a safe haven as currencies fall. Rising interest rates will cause shares to decline, while falling interest rates will cause shares to rise. Large institutional investors such as mutual and hedge funds use royalty trusts as a hedging strategy against both inflation and fluctuating interest rates while reinvesting the large dividends. Well-known American and Canadian royalty trusts include Permian Basin Royalty Trust PBT and Advantage Oil and Gas AAV, respectively.

Most energy royalty trusts are located in the United States and Canada, but the regulation in the two countries differs greatly. American trusts are not allowed to acquire additional properties after the initial offering of public shares. This immediately limits the lifespan of the trust, as the resources will eventually be depleted, royalties will decline and the trust will cease to exist, but the business model remains simple and clear cut for investors. Canadian trusts are run as businesses and may acquire additional properties after their initial public offerings, which immediately increases the trusts’ lifespan and growth potential but also increases the inherent risks. Due to the higher growth potential and increasing size of Canadian trusts, they often pay out higher yields than their American counterparts. American trusts have very few employees, and in some cases no employees, but Canadian trusts may employ larger workforces to oversee expansion strategies.

Unfortunately for Canadian investors, new legislation set to commence in 2011 is set to cripple the original model of the North American energy royalty trust. Due to an accusation that trusts were costing the Canadian government $500 million yearly in lost revenue, Canadian trusts have now lost their double-taxation immunity and the tax rate will increase from the current 10% to the full 31.5% in line with other corporations effective January 1, 2011. This move was initiated by Canadian Finance Minister Jim Flaherty on October 31, 2006, and was dubbed by opponents as the “Halloween Massacre”, which caused the share prices of Canadian trusts to drop across the board. The opposition Canadian Liberal Party, backed by various energy interests in Western Canada has drafted a counter-proposal to the new tax rate, and may overturn the legislation if wins the 2012 elections.