Emerging Markets Growth Opportunities and Challenges

Post on: 17 Май, 2015 No Comment

Emerging Markets: Growth, Opportunities and Challenges

By Philip Guarino

In the not so distant past, military coups, hyperinflation and crippling foreign debt dominated our headlines when developing nations were discussed. Brazil was often lamented as the country of tomorrow, while the Chinese dragon and the Indian tiger were mere images for childrens books. The past decade has brought remarkable changes; a monumental shift in the economic balance of power that is already radically changing how and where we conduct business. Many would argue that the term itself may no longer always be appropriate; many emerging markets have already “emerged” and are soon due an adjustment in status. Choice of words aside, emerging markets have become integral players in the world economy. As growth has slowed in the US and Europe, it is critical for exporting businesses to understand the opportunities and challenges that these “new” markets provide and to implement effective business development strategies.

Rising Fortunes, Stronger Growth

As the developed world emerges from a particularly harsh recession, the US, Japan and Europe are likely to face a prolonged period of slow growth. The brutal correction of 2008/9 is largely behind us but many imbalances are still unraveling and will continue to keep markets on edge for the foreseeable future. Balance sheetspublic and privateremain strained, unemployment levels are high and consumer confidence is weak. Restricted credit and fears over jobs have caused many consumers to retrench, and consumption as a percentage of GDP has fallen. As companies look to grow, they may struggle to find enthusiastic consumers for their products and services at home.

While the developed world muddles along, emerging markets continue to roar, most having rebounded strongly from the 2008/9 crisis. In stark contrast to the “advanced” world, several key emerging economies such as China, India and Brazil are experiencing exceptional economic strength. The economies of the emerging countries are mostly highly export-driven with strong inflows of capital and investment and well-capitalized banking institutions. And as Figure 1 shows, near-term growth is forecast to continue to be strong. In fact, emerging markets stand to outgrow the developed counterparts by more than 4% per annum. More eye-catching is that over 70% of the world’s growth in the next several years will come from emerging markets[1] .

Source: IMF

The overall growth in wealth is staggering. Stories abound of jet-setting Chinese and Russian magnates snapping up pricey real estate, private jets and Lamborghinis. But perhaps even more relevant to most businesses is that vast segments of populations have enjoyed tremendous economic mobility in an environment of relative economic stability. Abject poverty in many countries such as India and Brazil has fallen dramatically over the past decade. Overall inflation, which frequently reared its head and depressed purchasing power-particularly for the poor- for decades, has dramatically decreased in the developing world. As many of these citizens are becoming part of a credible consumer class, a massive new critical wave of consumers has emerged. And as banking systems have incorporated these wealthier citizens, further growth will be buoyed through the expansion of new credit facilities.

It’s a Big World, Where are the Opportunities?

Any discussion of emerging markets as a unified entity is destined to be challenging. Geographically, these markets span the globe and possess vastly differing economic and political conditions. What truly constitutes “emerging” and what differentiates it from the “rich” world itself is a hotly debated topic. Several countries (e.g. Singapore, South Korea) are highly advanced but are often still “lumped” into discussions on the topic. Those economies outside of the developed world- US, Canada, Japan and Europe-are what are commonly referred to as the emerging markets.

Asia was the first region to rebound from the economic crisis, with many business people reporting a minimal slowdown in economic activity. China is the largest economy in the region, having surpassed Japan earlier this year in terms of nominal GDP. With a massive population of 1.3 billion people, its rapidly-expanding and export-based economy, China has emerged as a formidable economic powerhouse. At its current, stunning rates of growth, the size of China’s economy is set to surpass that of the US by 2017. Other economies too have gained significant steam over the past decade. Korea, Malaysia and Taiwan are strong performers with consistently strong growth since the economic crisis of 1997. High incomes, high savings rates, highly-educated workforces and open markets offer outstanding opportunities for companies looking to develop a presence in these favorable economic environments. Finally, a stronger Renminbi will increase the relative purchasing power for the Chinese and will make it more feasible for other countries in the region to revalue their currencies. This will create a favorable environment for North American and European exporters.

In Latin America, most major economies are enjoying far more economic and political stability (with Venezuela as the most notable exception). In Brazil, Latin America’s largest economy, enthusiasm is running high. Incoming foreign investment is boomingso much so that the Brazilian government has had to implement measures to stem fears of “hot money” and strength in the Brazilian Real. With its vast resources, large population and expanding middle-class, foreign firms are increasingly finding the need to be present in this key market. Mexico and Argentina are the two other regional heavyweights and both offer significant growth opportunities. In Mexico, growth has been slower due to its strong links with the US, but economic prospects remain good. Growth in Argentina has been particularly strong in the past decade after a disastrous recession in 2001. Additionally, although it boasts a much smaller market, Chile is a star performer that continues to attract investment from abroad due to its infrastructure, exceptional economic stability and high marks for transparency and ease of conducting business.

Hype and Reality

The vast potential created by buoyant economies should be cause for great enthusiasm among businesses. More open markets and new consumers with stronger purchasing power will create vast opportunities for exporting companies. But winning business strategies will also take into account that challenges remain. For example, while China most certainly possesses immense resources, in many ways it does not yet resemble a “developed” market. Although its population is many times that of the EU or the US, its per capita income is still less than 1/6 that of an average US worker. China shares a weakness with many emerging economies in its high disparity of wealth between city and rural areas. Poor domestic infrastructure limits evenly-distributed growth, inadvertently directing even further investment and development in many mega-cities. China is not alone in these challenges. Brazil, India and many other emerging economies face similar growing pains. Accordingly, the operational challenges for companies investing in China would be different from those seeking to invest in Chile.

Other issues such as weak institutions, personal safety and corruption continue to dissuade investors and make operating environments challenging. As countries continue to engage in a more international context, it is generally accepted that a gradual improvement in the level of transparency and legal protections will result. But journey will likely be a long one, and businesses would be best advised to understand the challenges unique to each market.

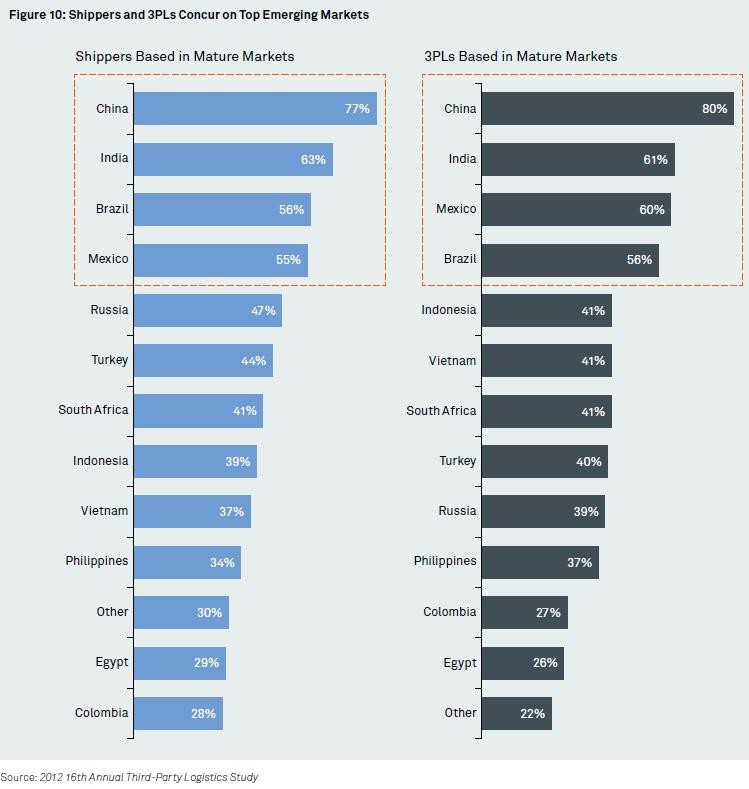

Go West, South, East? Discernment is Important

Within these vast geographical regions, there has been significantly more differentiation in terms of overall business climate and growth potential. While in the past, financial markets and foreign investors alike have tended to take regional views, many are now beginning to differentiate among regional markets more carefully. Successful businesses understand that while Asia is a strong market as a whole, there are vast differences between the attractiveness of say, the Philippine and Korean markets. It is critical for management to understand that there can be vast differences in the level of income or growth potential, in the stability or transparency of institutions, or the accessibility of distribution networks. And differences can be key elements of success in a given market. Developed distribution networks, for example, can allow business development to become more viable in a shorter period of time.

Of course, attractive market prospects are important. Deciding which markets are best suited for a firm’s activities requires a broad analysis of numerous factors-internal (business-specific) and external (market-specific). While there is much to be excited about, relying too much on raw economic indicators such as GDP, population size, etc. alone can lead businesses to make poor decisions. Keen market intelligence and soft skills such as language or cultural affinities can be particularly helpful tools for success in growing markets. And strong business relationshipsarguably to an even greater degree than in the developed worldcan give firms a particularly powerful tool to navigating successfully in challenging environments. A lack of familiarity, language or distance can be daunting to companies. With adequate talent, a carefully articulated strategy and deliberate execution, they are not insurmountable.

With the US and Europe now exporting more to the developing world than to the developed world, the economic clout of emerging markets is no longer in question. A profound transformation of economic fortunes is undeniably taking place that will affect the nature of markets and competition for years to come. Businesses should plan to seize these opportunities now.

[1] The Economist, Emerging Markets, April 15, 2010