Effective Diversification in Portfolio Management Asset Class Investing Blue Water Capital

Post on: 14 Июнь, 2015 No Comment

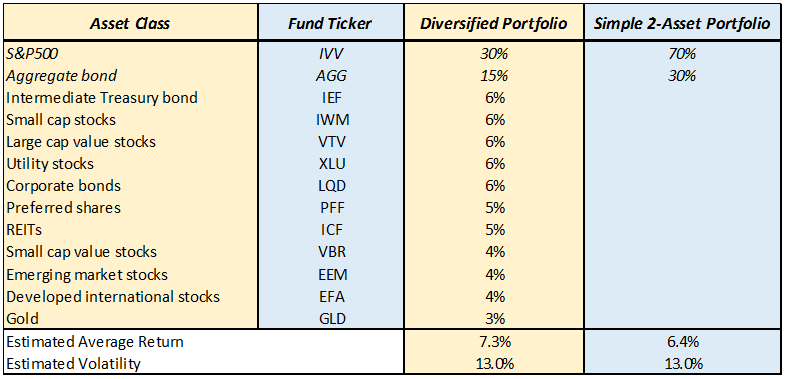

It is widely known that diversification is an important strategy to utilize in your portfolio. Diversification, however, is often implemented incorrectly. Randomly adding investments to a portfolio does not necessarily lead to diversification. It may only add to your risk. There are actually several things to consider before adding (or subtracting) an investment in your portfolio. The goal is not diversification, but effective diversification. Effective diversification is when each investment adds value, that is, they have a purpose in the portfolio. Investments should either be there to reduce your overall volatility (risk) or increase your expected return.

Steps Of Effective Diversification

- What asset class is it? Investments grouped in asset classes tend to move up and down in a similar fashion.

Example: Most technology stocks went up in the late 1990’s, and most went down in the early 2000’s. Similarly, most REITs (real estate) went down in the late 1990’s, but have surged since then.

- What is the standard deviation of the asset class? This can be translated into how volatile is it? The volatility alone of an asset class does not determine whether or not it should be included.

Example: Large-cap stocks are generally less volatile than small-cap stocks. Bonds, however, are generally less volatile than both large-cap and small-cap stocks. All three are important to a typical portfolio though.

- What is the correlation of the asset class compared to other asset classes? This can be translated as how likely is it to move up and down when other asset classes move up or down? A high correlation with another asset class is an indication that both investments will go up and down together, thus limiting the diversification effect. A low correlation is an indicator that it will provide better diversification.

Example: Over the years, the correlation between the U.S. Large Market (S&P 500) and the International Large Market (MSCI EAFE) has increased substantially. These asset classes consist of large companies with global operations. They are just as likely to be affected by international economies as they are domestically. Adding International Large Market to a portfolio that already holds U.S. Large Market adds very little benefit.

Example: Using the example from #1, many people dont realize that there were several asset classes that went up in the early 2000s. People that had these asset classes in their portfolio weathered that period far better than those who did not.

- How much exposure do I already have to that particular asset class? You may already be over-weighted to a particular asset class. Adding more to that asset class could lead to concentration and increased risk. Know what asset classes you are invested in; and know how much you own of them.

Example: For simplicity sake, lets say that your recommended allocation is 50% U.S. Stocks, 25% International Stocks, and 25% Bonds. You have an additional $25,000 to invest and youre wondering where to put it. The stock market has gone up the past 3 years, and you consider putting more into stocks. You arent sure though whether the stock market will continue to go up or if its about to drop. You wonder what to do.

Smartly, you decide to calculate your current asset allocation. Your portfolio is invested in 55% U.S. Stocks, 28% International Stocks, and 17% Bonds. You see that you are already over-exposed to stocks, so you decide to rebalance your portfolio by investing in bonds.

Good choice. This new investment not only increases your percentage in bonds, but it also dilutes your over-exposure to stocks because your portfolio is larger. You now have a more balanced portfolio in the likes of 52% U.S. Stocks, 26% International Stocks, and 22% Bonds.

At Blue Water, we practice effective diversification. All of our recommended portfolio asset classes have a reason why they are included. Over time, we expect them to either reduce portfolio volatility and/or capture additional return beyond the S&P 500. These expectations are a result of engineering the allocation for optimal long-term performance.