Ebay s Unannounced Restatement of Earnings

Post on: 16 Март, 2015 No Comment

The Accounting Cycle

Ebay’s Unannounced Restatement of Earnings

May 2003 Albert Meyer, the chief analyst at 2nd Opinion Research, recently noticed that eBay restated its pro forma SFAS 123 earnings, but didn’t tell anybody. Given the recent stigma attached to those business enterprises that restate earnings, it is understandable that the managers and directors of eBay would play such games and hope that nobody paid attention. But in this post-Enron era, they would have shown more valor if they had put such information in an 8-K.

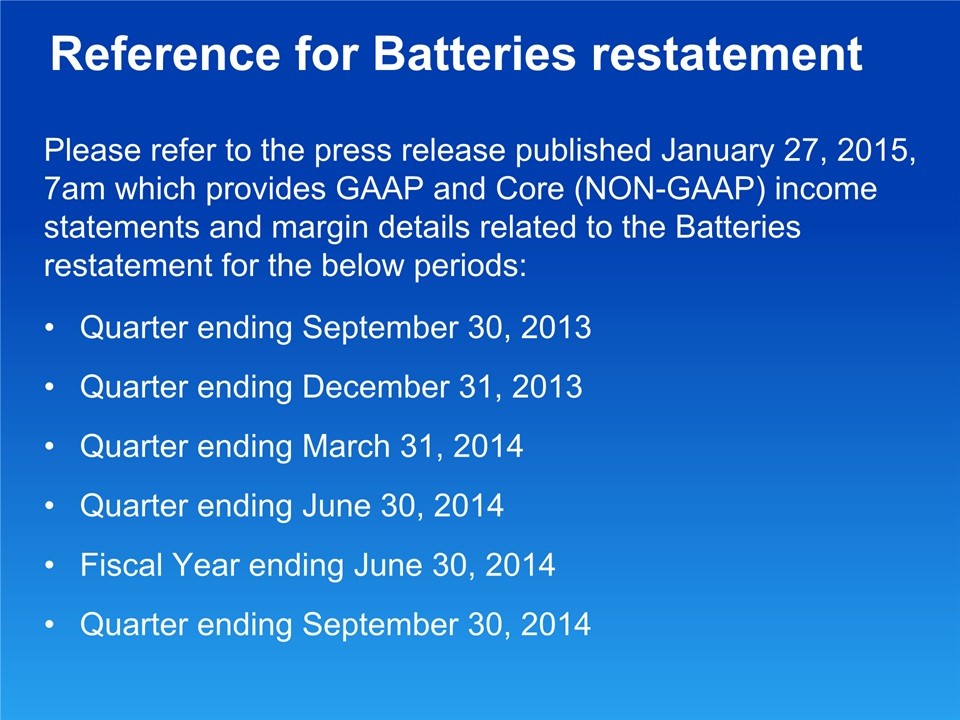

Before describing what took place, I first should explain that there are two different varieties of pro forma earnings. Let’s call them GAAP pro forma earnings and non-GAAP pro forma earnings. Both types of pro forma earnings are as if earnings; in other words, pro forma earnings equal the corporate earnings if the company measured income in this or that manner. The difference between the two categories is whether they are based on some formal accounting promulgation or are the product of some creative entrepreneur or investment banker or Andersen auditor.

GAAP pro forma earnings are the earnings of the company when the earnings are measured according to some method that an accounting standards-setting body designed. For example, APB Statement No. 3 issued in 1969 did not require but allowed firms to restate financial statements for general price-level changes. If an entity did prepare such statements, it would refer to them as pro forma earnings. In 1971 the APB in Opinion No. 20 required firms that changed accounting methods to report previous numbers as if the business enterprise had been applying the new method all along. The idea was to assist the readers in understanding what this change in accounting principle means. These new figures are also referred to as pro forma earnings.

Non-GAAP pro forma earnings, however, are not tied to any accounting pronouncement; rather managers and their advisors fabricate these compositions out of their own desires. Frequently, these constructions equal earnings minus anything that will makes the company look bad. The key feature is that nobody governs how these non-GAAP pro forma earnings are measured, so managers have a license to do anything they want in these so-called disclosures. Understandably managers have tweaked these things to a fine art by squeezing out anything that makes them look bad. In the process, however, astute readers have learned that these non-GAAP pro forma earnings are little white lies — or worse.

Most companies in the U.S. implement FASB’s Statement No. 123 by disclosing pro forma earnings and earnings per share — that is, earnings as if they deducted stock-based compensation as an expense. The important item to keep in mind is that this disclosure is a GAAP pro forma earnings. The FASB dictates how this number should be measured and how it should be reported.

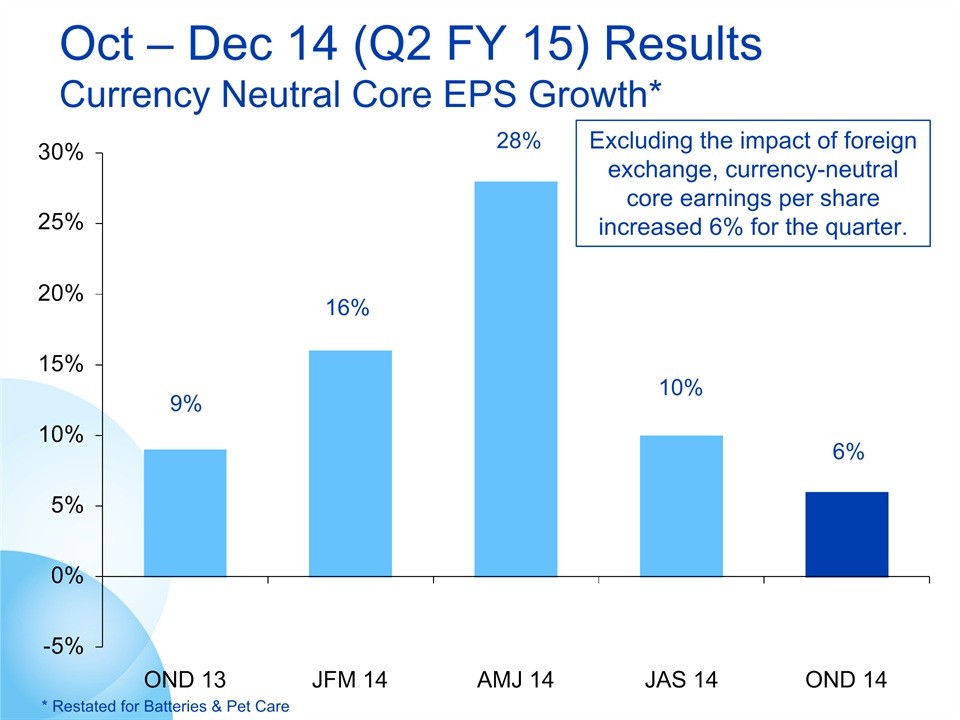

What eBay did, very simply, is report a certain set of pro forma earnings prior to 2002. In its 2002 annual report, eBay changed these disclosures and did not call attention to its accounting restatement. The numbers are (in thousands):