Don’t put all your eggs in one basket when you’re near retirement

Post on: 27 Июнь, 2015 No Comment

Last week, I chatted with Andrew, a long time reader, about his early retirement plan. He is planning to retire at 51 and has only a few years left to go. His expense is very low at about $12,000* per year and he probably can retire right now if he wants to. He mentioned that he plans to roll over his 401k into his Roth IRA and put a large percentage into a REIT. He thought he’d be able to take the dividend payout tax free from his Roth IRA for his cost of living. This is alarming in a number of ways.

*Note: Andrew has a partner to share living expense with. $12,000 is his share.

- He would have to pay income tax when he rolls over his 401k to a Roth IRA. This is a conversion. Anytime you move money from a traditional account to a Roth, it is a conversion. This could be quite expensive depending on how much money he made the year the conversion occurs. *I just found out that some qualified plan like the 403(b) dont have to pay tax when rolled over to a Roth. All the more reason to consult a tax professional.

- He would have to wait 5 years before taking money out from the Roth IRA to avoid the 10% early withdrawal penalty and taxes on the earnings. This is just the part that was converted from the 401(k).

- He’ll put a lot of eggs in one basket if he puts a large chunk into one REIT.

Roth IRA ladder

A better way to do it would be to rollover his 401k in to a traditional IRA. Then convert 20% (or less) of the traditional IRA to Roth IRA every year for 5 years. This way, he will minimize income tax from the conversion and after 5 years he can start taking distributions without having to pay the 10% penalty.

While he waits for his Roth IRA ladder to kick in, he can live off his taxable accounts and previous Roth contributions. Andrew updated me that he already has a substantial investment in his Roth IRA so he could withdraw his contribution to that part without any penalty. He also mentioned the possibility of consulting part time to earn some income.

Don’t put all your eggs in one basket

A more worrying part of his retirement strategy is the plan to put a large part of his investment (12% of projected net worth at retirement* ) into one REIT. REITs are attractive income investments because they can throw off 5-10% dividend income and Andrew could generate all of his living expense from just his Roth IRA.

*Note: I thought Andrew planned to invest about 25% of his net worth in one REIT, but he clarified that it will be about 12%.

However, this sounds like a risky plan to me. Andrew’s living expense is already so low and he should be able to easily generate $12k/year with all his accounts. By trying to generate $12k/year from just one REIT, he is taking on a lot of risk. What happens if the bottom drops out of the REIT sector again like it did earlier this year?

Andrew should reach Financial Independence soon if not already. Why take a lot of risk if he doesnt have to? Once he retires, his income will drop and it will be difficult to recover from a big setback. It’s better to invest conservatively and diversify his investments.

Have you heard of this old adage – “If you already won the game, why keep playing? ” When you are near or in retirement, it’s better to conserve your wealth than try to grow it. I still think it’s good to invest in the stock market, but you need to be diversified. Most experts recommend no more than 5% of your total portfolio in one stock.

Check if you’re diversified

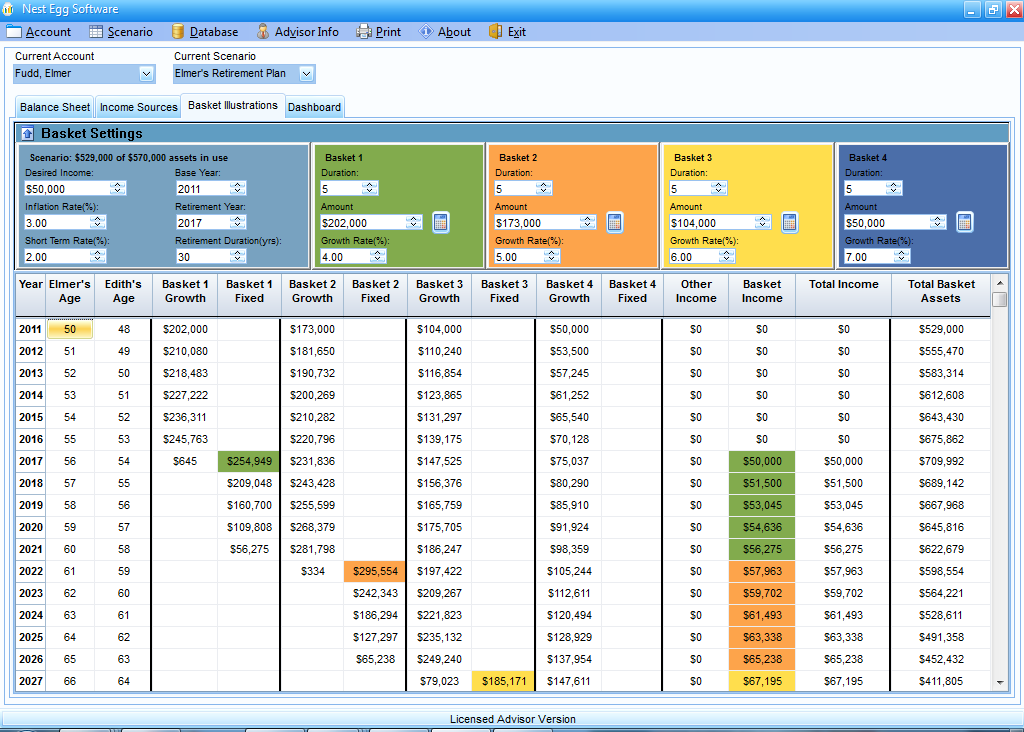

If you are near retirement (or FI), then there are a few things you need to do. The first thing is to figure out your asset allocation. Once you retire, your risk tolerance, investment horizon, and goals will change. There are many resources online to help you do this. I collected a few in this asset allocation article a few weeks back.

The next step is to check if your investments are diversified. There are a couple of good tools on the internet.

1) Personal Capital. You can sign up with Personal Capital and keep track of all your investments in one place. You can link all of your investment accounts and Personal Capital will keep track of the asset allocation for you. It’s very helpful to get a quick visual when you want to make a trade.

You can click through each section to see more detail at Personal Capital.

2) Morningstar Instant X-Ray has been one of my favorite tools on the internet for many years now. You manually input your holdings and it will show your asset allocation, stock style diversification, stock sector, fees, geography, and more. Its a bit of a pain to manually enter your holding though.

This is from my dividend portfolio. It looks like I have too much concentration in consumer products and energy. I need to pick up some utilities and communication stocks.

These tools are great because they will show you where your investments are concentrated. Diversification doesnt just mean buying different stocks. If you buy 5 REITs, then you are still overweight in the real estate sector. Ideally, you’ll want to be diversified in asset class, sector, and internationally as well.

Diversification is not easy. It can take many years to figure out your asset allocation and risk tolerance. It’s definitely not good to put too much of your assets in one stock though. One bad setback and you might have to go back to work. Luckily I learned this pretty early on in my investment career. At one point I had over 25% of my portfolio in Intel stock. Then the dot com bubble burst and it became an expensive lesson.

What do you think about Andrews plan? Whats the maximum that you would invest in one stock? Is 12% too much? I like the 5% rule of thumb.

Disclaimer: I’m not a tax professional and our reader will probably have to consult a tax professional before retiring. The whole Roth IRA thing can be a bit tricky.