Dollar Cost Averaging with ETFs Does It Work ETF News And Commentary

Post on: 16 Март, 2015 No Comment

Share | Subscribe

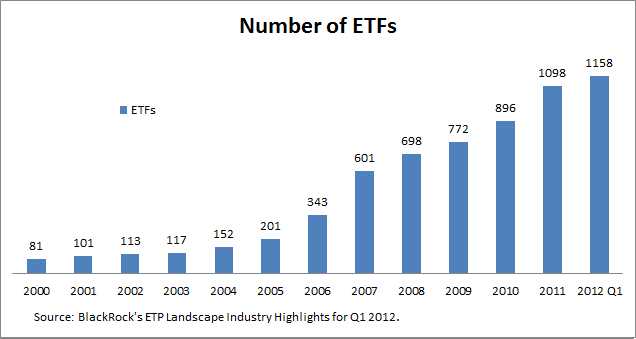

Sometimes, the behavior and scope of capital markets goes beyond conventional research and financial logic. This is one of the major reasons for huge volatility witnessed in the financial markets, and it has pretty much been the state of affairs for investors for quite some time now (read What Do Quarterly Trends Reveal about ETFs in Q4? ).

While there are tons of ways in which an investor can ride this uncertainty, not all of them prove to be fruitful. In the light of the above statement, we would like to discuss one such strategy which has time and again proven to be helpful to investors.

Dollar Cost Averaging

This investment strategy involves allocating a fixed sum of money to a particular investment avenue at regular intervals, irrespective of the bullish or bearish bias in the market.

For example, you allocate a sum of money (say $1,000) to buy shares of SPY on the 1 st of every month for 12 months. This implies that irrespective of the market conditions (i.e. bullish or bearish), you will buy equivalent number of shares of SPY worth $1,000 every month at a specified date.

As a mathematical implication of this phenomenon, with your investment amount being constant (i.e. $1,000), you will buy more shares when the prices go down and less shares when the prices are up (both offering substantial room for capital growth) (see more in the Zacks ETF Center ).

By doing this investors i) don’t have to worry about timing the market, ii) can potentially bring down their average cost of investment, iii) reduce volatility to a great extent.

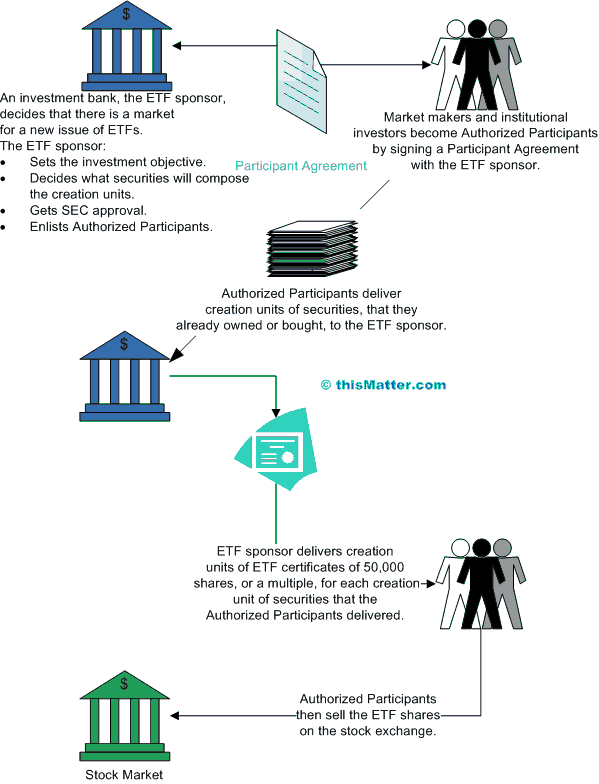

ETF Approach to DCA

This strategy can be applied to any investment vehicle; however, it is particularly intriguing when it is tried with ETFs. Their i) flexibility in terms of ease of trading ii) low cost structure and iii) basket approach which reduces concentration risk, make them appropriate avenues for dollar cost averaging.

Let us understand how this strategy would work with ETFs with a help of a real life example based on real events. The time horizon is 18 months from Jan 2011 to June 2012 and it is assumed that the shares are bought on the first trading day of each month at their then market value.

The time horizon taken into account was an extremely volatile period and three distinct broad market ETFs are considered as these ETFs would serve as a pretty good sample to reflect the total equity market sentiment in the U.S (read Comprehensive Guide to Total Market ETFs ). These ETFs are — Vanguard Total Stock Market ETF ( VTI ), Schwab U.S. Broad Market ETF ( SCHB ) and iShares Dow Jones U.S. ETF ( IYY ) .

The following table shows the number of shares bought monthly for $5,000 at the then market prices for three distinct broad market ETFs for a period of 18 months (i.e. 1.5 years). At any date, the number of shares is ascertained by dividing the investment amount (i.e. $5,000) by the current market price as on that date.