Do You Have an AgeAppropriate Portfolio

Post on: 13 Май, 2015 No Comment

Investors age 45 to 55 should continue to focus on diversification, pros say, and keep a healthy dose of equities in their accounts

People who have hit their middle years may be used to taking flak from their friends and children for not behaving or dressing appropriately for their age. (Picture a teenager rolling her eyes when she sees a track from one of her favorite bands on Dad’s iPod.) But is there such a thing as an age-appropriate investment portfolio?

There’s no one-size-fits-all approach to financial planning. Two investors who are the same age may have different time horizons in terms of retirement or different financial requirements for things like their children’s education. Folks in the 45-to-55 bracket, like other investors across the age spectrum, are best served by focusing first on tried-and-true portfolio principles such as diversification and balance.

Start with a good, hard look at your account statement. A common mistake is misunderstanding what it means to be diversified, which is different from owning lots of different funds in your 401(k)s and other employee retirement accounts. When a new client comes to her with existing accounts, Helen Modly, executive vice-president of Focus Wealth Management in Middleburg, Va. runs the holdings through a software program provided by Morningstar Inc. (MORN) to gauge the asset allocation. Employees are picking and choosing [from an array of actively managed funds], not realizing that if you took the lid off these funds, they’re all tracking the same index, often the Standard & Poor’s 500, she says.

Know What You Own

Modly suggests that investors first determine the overall exposure to equities they’re comfortable with and then decide how much additional risk to build in by including smaller-cap, small-cap-value, international, and emerging-market stocks as well as real estate and commodities. She’ll typically set up a core portfolio with a total market holding such as the iShares Russell 3000 exchange-traded fund (IWV) and then layer in small-value international stocks, REITs, and commodities, usually through mutual funds or ETFs.

In paring portfolios to eliminate the overlap among funds, she cautions investors to make sure they know what kind of shares they own. A-shares—those typically bought through broker-dealers—have a front-end fee and can be sold without penalty. But investors are likely to get slapped with a back-end, or deferred, charge if they try to sell B-shares within five to seven years of purchasing them.

Joyce Cole, an independent financial adviser in Saratoga Springs, N.Y. says the portfolio best suited to 45-to-55-year-olds is balanced but tilted toward equities. People in this age group are doing the home stretch, because a lot of people are retiring at 55 now without health benefits, she says. The portfolio she recommends has a 57%-to-60% weight in stocks, with her current bias toward large-cap stocks, whose dividend is helpful in difficult markets. With mega-cap growth-oriented stocks starting to perform better than value stocks, she is steering clients toward the bluest of the blue-chip stocks, she said.

How Conservative Do You Get?

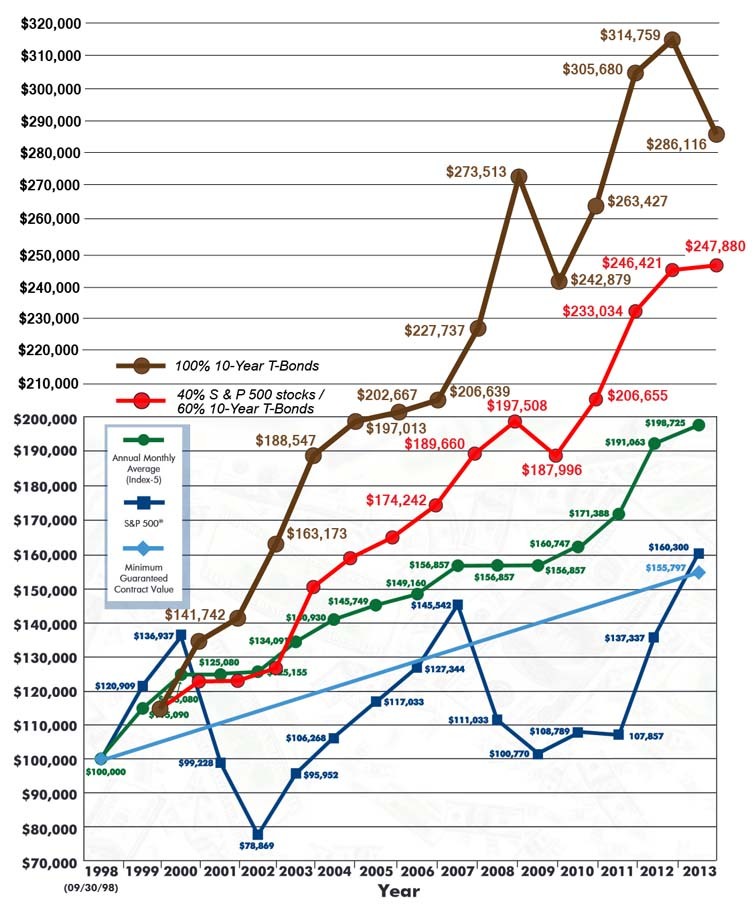

For Patrick Collins, a certified financial planner and principal at Greenspring Wealth Management in Towson, Md. it’s more relevant to base asset allocation on a person’s time horizon for starting portfolio withdrawals than on his age. People assume if you’re 45, you have 20 years until retirement, but if someone wants to retire at 55, his portfolio has to [reflect a different approach], he says. It’s common practice to shift portfolio holdings toward bonds and away from stocks the closer clients get to retirement. This locks in gains accrued over time and ensures the money’s there when the clients need it.

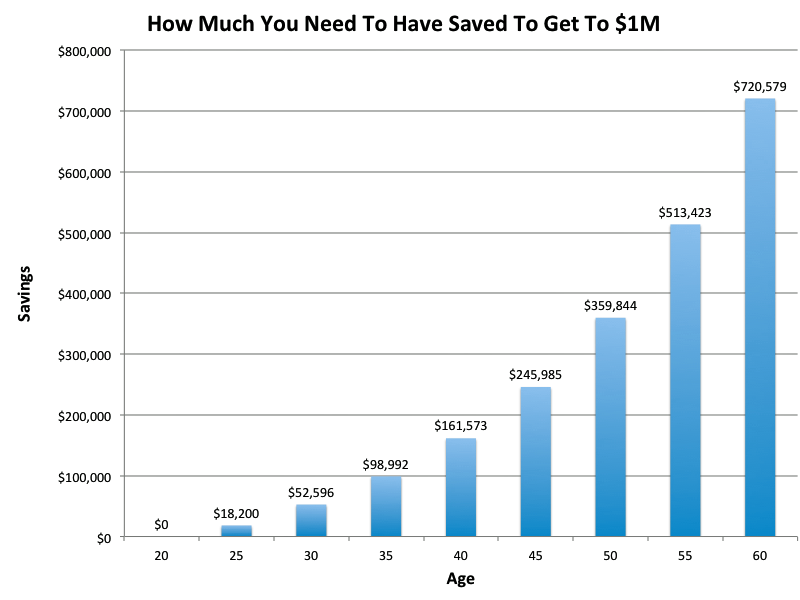

There’s a lot of debate among financial planners about how conservative someone between 45 and 55 should be. Kevin Brosious, president of Wealth Management in Allentown, Pa. usually assumes each client will live into his early 90s and believes portfolios need to be designed for the long haul. Don’t change everything to a conservative portfolio, he said, just because you’re getting ready to retire or are retired. You’re going to need [to plan for] the long term with growth [of assets] through retirement to maintain pace with inflation and purchasing power over that time.

Others, like Kirk Kinder, a certified financial planner at Picket Fence Financial in Bel Air, Md. advocate a more conservative allocation. Even people with 10 to 20 years of working salary ahead of them, he says, can’t afford a major setback like the 2000-02 bear market, which can seriously jeopardize their retirement, especially for the 55-year-old.

Riding Out the Choppiness

For investors with more time until retirement, the emphasis is more often on maximizing returns, typically with a portfolio skewed toward equities. That can be a hard sell amid a stock-market correction. Not giving in to emotional responses to market activity—rather than a strategy of fund selection or exotic investments—is what can add one or two percentage points to returns over time, says Greenspring’s Collins. The trick is to persuade clients—particularly those at the lower end of the 45-to-55 range, who can better afford it—to stay exposed to higher-yield assets instead of making the mistake of bailing out when the markets get especially choppy as they have this summer, he says. To do this, he includes alternative investments that can reduce volatility in an equity-heavy portfolio.

We want to find investments that have equity-like returns but aren’t correlated to equities and perform well over time, he says. To minimize volatility, he uses the Macquarie Infrastructure Trust (MIC), a publicly traded closed-end fund that generates income by providing services for entities such as airports and by owning parking lots and toll roads. The trust has a low correlation to any kind of equity. It yields about 6% per year and still has some growth potential, Collins says.

Publicly traded Canadian energy trusts can be even more attractive, with yields between 10% and 12%. Because their values are closely tied to energy prices, the companies also have a fairly low correlation to certain stocks, whose prices tend to fall on adverse profit outlooks whenever oil prices go up.

International securities are another way to diversify away from U.S. stocks. The more risk-adverse investor may want to stick to developed countries such as Japan and Britain, but for those hungry for bigger returns, emerging markets like China, India, and the Middle East are the places to be. Wealth Management’s Brosious urges clients to limit their exposure to these markets to 7% or 8%. Often, foreign companies have a low correlation to U.S. equities because they don’t hedge their currency risk. That’s why Modly prefers international small-caps to large-caps, which tend to resemble stocks in the S&P 500.

The Lowdown on Life-Cycle Funds

Life-cycle funds, which progressively change asset allocation as investors approach retirement, are also becoming popular, especially in 401(k) plans. Many financial planners think such funds should be used only by people in the 45-to-55 age bracket who either don’t have the understanding to assemble a portfolio themselves or the desire to hire a financial planner. The reasons I don’t like these funds, in general, is because no consistency exists [among] life-cycle funds from different providers, Kinder of Picket Fence Financial said in an e-mail message. The ratio of stocks to bonds differs for each fund family even for the same 55-year-old investor. That’s also the conclusion of a study by Turner Advisory Group, an investing consulting firm, and PLANSPONSOR, a retirement-planning resources firm, that says investors need to choose the right fund manager to get the most appropriate risk profile. In general, the study found there is too much equity and not enough fixed-income exposure in these funds.

Life-cycle funds may be in greater demand because they take the emotion out of the equation by adjusting according to a prescribed formula. But investors who have built custom-made portfolios can sit back and enjoy the ride to retirement no matter what the markets are doing—as long as they do their homework, get the proper diversification, and take time to regularly rebalance.