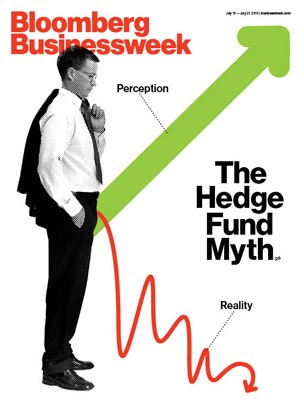

Do Hedge Fund Investors Get Their Money’s Worth

Post on: 16 Март, 2015 No Comment

August 30, 2013 Stephen Taub

A new survey finds high performance fees are a sign of high performance, but reality says it’s not so simple.

You get what you pay for. The rule applies as much to hedge funds as it does to the rest of life. At least that’s the conclusion from Preqin, the global data firm that specializes in alternative asset classes, in its latest annual survey of hedge fund returns and fees. Preqin found that the funds with the highest performance fees wind up posting the best net returns on average.

But as another rule of life warns us, averages aren’t the whole story.

According to Preqin’s research, the funds that have generated the highest net returns over both a three-year and five-year basis charge performance fees upwards of 20 percent.

Over the past three years, the average fund with a performance fee higher than 20 percent posted an annualized gain of 10.73 percent, compared with just 7.98 percent for funds with a 20 percent fee and 6.89 percent for those charging less than 20 percent. The comparable figures for the past five years are 10.55 percent, 8.34 percent and 7.31 percent.

What’s more, funds that have been trading for at least three years and have posted positive returns each month since inception charge an average performance fee of 19.50 percent. However, funds that made money in less than a quarter of the months charge an average performance fee of 16.67 percent.

Interestingly, Preqin found that 68 percent of the funds that charge performance fees north of 20 percent also impose hurdle rates on their managers, so that the fund manager has to beat a certain return rate in order to collect the fees. Funds that charge lower fees are less inclined to set such bars; only 39 percent of funds that charge performance fees of 20 percent and 51 percent of funds that charge less than 20 percent reported using hurdle rates.

Preqin’s link between performance and fees is especially compelling these days, considering that so far the average hedge fund is underperforming the global market indexes for the fifth straight year.

So it is not surprising that Preqin’s research indicates some loss of faith on the part of investors. In this year’s survey 64 percent of investors report that they believe fund manager and investor interests are properly aligned, a figure that has dropped from 74 percent in 2012. Investors also report that they are having some success in negotiating for fees lower than the popular 2 percent management fee and 20 percent performance fee arrangement. According to the study, 68 percent of investors report an improvement in management fees charged over the past 12 months and 58 percent see improvement in performance fees.

Where there have been improvements, many investors specified that these are often just for the larger investors, on smaller funds, or on funds which only produce ‘mediocre’ performance, the Preqin report notes.

Preqin does not identify the performance of specific hedge funds in its survey. Our own sampling of individual funds that charge performance fees of more than 20 percent turns up a far more nuanced picture and far more mixed results.

For example, Steve Cohen’s SAC Capital Advisors’ main fund has averaged a net gain of about 13 percent over the past three years. While that’s a respectable performance figure, investors might expect mega-returns as justification for SAC’s performance fee of nearly 50 percent, with no hurdle rate.

Alec Litowitz’s Magnetar Capital, which charges a 30 percent performance fee, posted gains in the mid-teens in 2010 and 2012, but a mid-single digit return in 2011.

D.E. Shaw, which several years ago cut its management fee to 2.5 percent and its performance fee to 25 percent from 3 percent and 30 percent. has also been through ups and downs in the past three years. Its Composite Fund posted an impressive 15.6 percent gain in 2012, but that was after low single-digit returns in each of the two prior years.

Shaw’s Oculus Fund fared better, gaining 21 percent in 2012 and 18 percent in 2011, but just 6.9 percent in 2010.

Other high-fee funds have not fared nearly as well.

For example, from 2010 to 2012, Paul Tudor Jones II’s Tudor BVI — which charges most investors a 4 percent management fee and 23 percent performance fee — racked up single-digit annual gains, averaging less than a 5 percent net return.

During the same period, Louis Bacon’s Moore Global Investments, which charges a 25 percent performance fee, posted single-digit gains in 2010 and 2012 and a 2 percent loss in 2011.

Glenn Dubin’s Highbridge Capital Corp. which charges a 25 percent management fee, has also stumbled of late. In the past three years it sandwiched two single-digit gains around a 5 percent loss.

And Caxton Associates founder Bruce Kovner, who retired at the end of 2011, charged a performance fee of close to 30 percent but posted single-digit gains in at least one of his funds in seven of his final nine years. Investors are now paying 27.5 percent in performance fees, according to SEC filings, and the results are still all over the place. Caxton’s funds were up only about 2 percent last year but have risen more than 15 percent this year through mid-August.