Dividend Payout Ratio_3

Post on: 18 Июнь, 2015 No Comment

A Dividend Payout Ratio Creates Income for Investors

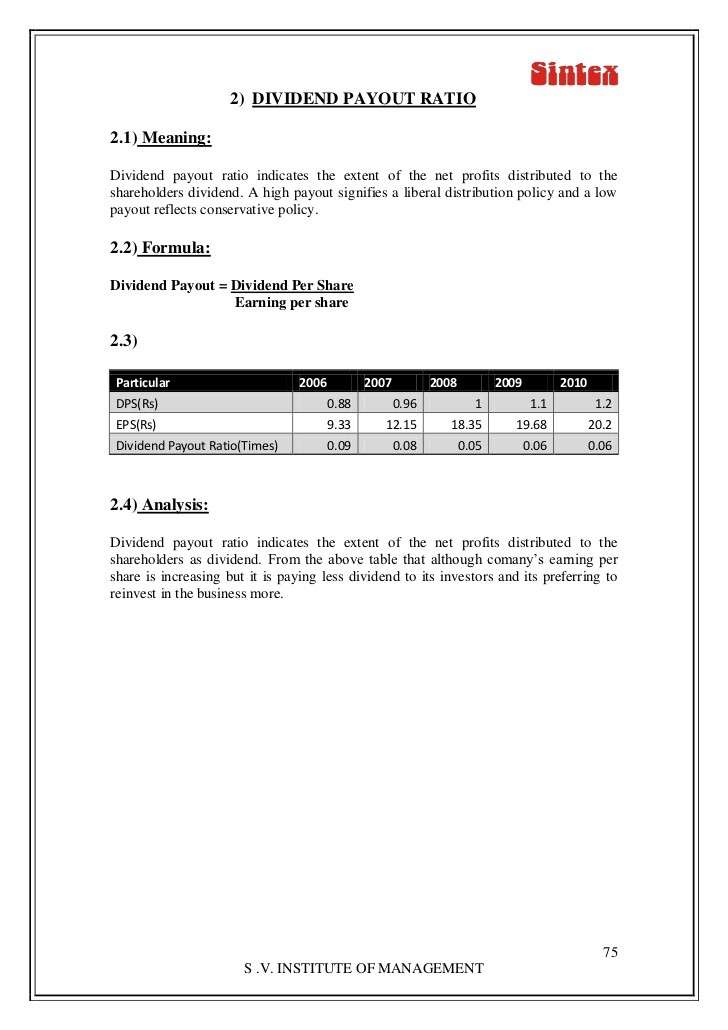

Investing money in businesses is a smart way to increase a financial portfolio. With this in mind, dividend ratio is one way to help determine whether or not the investment is profitable. This is the portion of the earnings that a company pays its stockholders in dividends. It represents a company’s annual dividends in relation to their reported earnings per share. However, the ratio should be used as an investment tool in conjunction with other data. Most financial websites or brokers have this information readily available to any potential investors.

What Information Helps to Determine the Payout Ratio?

Most investors look for a company that has a dividend ratio of between 40-60 percent. With this breakdown, shareholders earn a profit while still allowing the company to roll over the money to increase internal growth. Companies that have a higher payout ratio are investing less money into the company for growth. To determine the payout ratio the calculation Dividend Paid/Net Income per Share= Dividend Payout Ratio is used.

Why the Dividend Payout Ratio is Important to Investors

The dividend ratio helps investors determine how sustainable the company and the payout will be. For example, if a company exceeds 80% in dividend payouts, soon they will cut the dividend, increase earnings in turn decreasing the dividend payout ratio, or increase the dividends making the company unsustainable. The exception to this rule is the Real Estate Investment Trusts which are required to continually pay a 90 percent dividend payout ratio.

Examples of How a Dividend Ratio Works

Once a dividend payout ratio has been determined it helps an investor determine how much of a company’s net income is paid to shareholders. For example a payout ratio of 50 percent for a company that earns $10 million a year means that the company is paying out $5 million in dividends. However for a company that pays out $5 million a year, but earns $50 million, the payout ratio is only 10 percent.

Finding the Best Companies to Invest In

Finding the right company to invest in to get the best dividend payout ratio with the highest sustainability is not as easy as finding the company with the highest yield. It is best to find a company that has a solid history of dividend growth and low risk. This builds a solid, continuous stream of income. The dividend ratio is a tool to determine which companies are the best choice for an investment strategy and earning requirements.

Building a strong income portfolio requires knowledge, planning and patience. Using the dividend payout ratio to helps determine which investments are safe and consistent. The best dividend stocks are not necessarily the highest yield dividend stocks. Without doing the proper research and due diligence, an investor may find their money gone. Finding a company that balances acquisitions, capital investments and debt maintenance is a good investment bet and they should have room for further dividend increases in the future.