Dividend Growth Model

Post on: 16 Март, 2015 No Comment

The Dividend Growth Model, also known as the Gordon Model, is a fundamental analysis methodology for determining the value of a stock or business. This model is used as a strategy for investment based on the dividend yield. It values a company based on the dividends currently paid as well as the pattern of dividend growth that the company has displayed over time. Although not all investors are comfortable with this strategy, it is an important concept for dividend investors to understand.

Companies with decent average dividend yields and reasonable payout ratios are thought of as reliable and safe investments that offer income as well as an opportunity for capital growth. The dividend growth model reflects how a company has performed in the past.

Since it is just an indicator of past performance, it will not guarantee how a company will do in the future. However, we can only use the information that we have to make an informed investment decision. So, in making an investment, the dividend growth model is a very useful tool for the construction of your portfolio of investments that seek to provide a growing income stream. However, it is not the be all and end all of due diligence that should be performed on a company.

To calculate how much a stock is worth based on the dividend growth model, you will need these three things:

1.) Current dividend payout of the company

2.) Growth rate of the dividend

3.) Your required rate of return.

The current dividend payout and growth rate of a company can be researched online. I like to use Reuters as they display a lot of dividend information along with the other necessary financial information.

Your required rate of return is based on personal requirements for return on your investment capital.

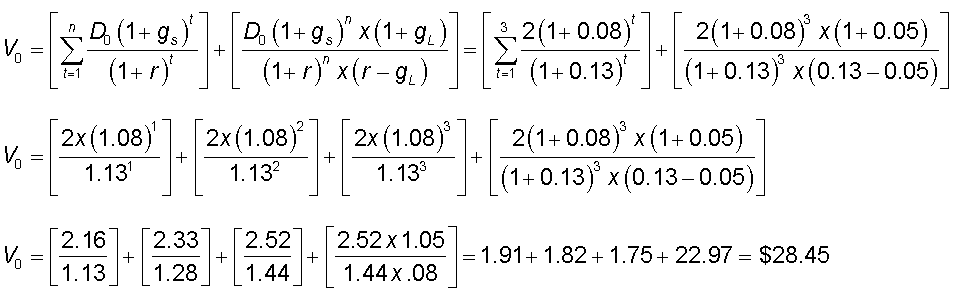

How To Calculate Value Based On The Dividend Growth Model:

- Add 1 to the dividend growth rate. For example, if the rate is 12%, add 1 to 0.12.

- Multiply the sum with the current dividend payout. For example, if the payout is $1.50, multiply that by 1.12 to get 1.68.

- Divide the product, 1.68, by your rate of return less the dividend growth. For example, if your rate if return is 20%, less dividend growth rate of 12% is 8%. Divide 1.68 by 8% or 0.08 and you get $21.

The above example values the stock at $21 based on a 12% dividend growth rate. Compare this value to the most recent closing price of the stock you’re considering. If the closing price is lower, then the model has indicated that this stock has met your criteria and is worthy of further consideration.

The dividend growth model relies on variables that can change over time and, as such, can only calculate how the stock should be valued at the current dividend growth rate. As we have discovered from the most recent market downturn, dividends do not grow at a constant rate in perpetuity, so the value that we calculate using the dividend growth model can change!

Of course, as with any valuation model, there are risks associated with investing based on purely the dividend growth model. It does, however, provide a good data point for your investment analysis.

To know if the dividend growth rate growth can be sustained for many years, one can also evaluate the sales growth and profit margin trends. As market conditions change, it is useful to continue to run potential investments through the dividend growth model, accounting for changes in dividend growth rate and the dividend payout.