DIVERSIFYING A PORTFOLIO ~ Safe Investing South Africa

Post on: 26 Апрель, 2015 No Comment

28 Jan 2015

DIVERSIFYING A PORTFOLIO

Readers of this blog are amazing. I am so privileged to get to know and interact with such inspirational individuals. Below is an email I received last week from a great young professional who is fast approaching his financial independence/ FREEDOM. I do not really have much to say to this reader other than to emphasise the importance of diversifying a portfolio. Learning to do this and occasionally re-balancing your portfolio could be the two activities that yield the highest returns in your efforts to build your wealth. I cannot think of any other point to raise, as this young man/ lady is intelligent enough to do their own research themselves.

Good morning

Thank you for having such an amazing blog. I really love it!

I am a 25 year old and started my first permanent job in October 2014. I can afford to save R5000 of my salary each month. However I am saving R3500 towards a car deposit and would like to invest the balance of R1500 each month. In addition I have a lump sum of R15 000 which I can add to my investment.

I have read your article about investing in your 20’s and ETFs. The ETFs got me interested.

Could you please advise on the following:

- Should I invest the lump sum and the monthly savings in ETFs or

- Should I invest the monthly savings in some other investment fund

- Also what ETFs should I choose or how do I go about choosing an ETF and which investment companies would you recommend.

Looking forward to your response.

Kind regards

Firstly, I have to salute and thank you for your email sir/madam. Keep moving. The sacrifices you are making will bear fruits later in your life. Equip yourself with knowledge that will enable you to take well informed decisions. I know the temptation to put all your money in an investment that is promising the highest returns ever. We all want maximum returns on our investments but using the highest growth as an only investment picking strategy can be detrimental to our wealth; in the event of an economic disaster. Diversification acts as a preventative measure for such dreadful events. Having all eggs in one basket could mean getting the highest returns possible or losing everything.

Diversification of asset classes like stocks, bonds, currencies, etc and diversification within each asset class like individual stocks or ETFs in various sectors (financials, resources, telecommunications, property, etc) are equally important. To clarify this point; buying into Nedbank, FNB, Capital Bank, Standard Bank and ABSA or MTN and Vodacom is not good enough as it is investing within the same industry. You cannot be invested in a single industry and consider yourself well diversified. Some economic tragedies sweep across the whole industry, like the most countries’ financial sector in the recession of 2008. No one industry is immune to economic disasters. This is what makes diversifying a portfolio one of the most important steps in reducing the risk your wealth is exposed to.

Let us use the most popular sector classification system by the global industry classification standard (GICS) just to shed some light on how one can diversify their portfolio within sectors and industries. They grouped industries (sub-sectors) into 10 sectors.

Sectors and Industries

1. Energy

2. Materials

3. Industrials

- Capital Goods

- Commercial & Professional Services

- Transportation

4. Consumer Discretionary

- Automobiles and Components

- Consumer Durables & Apparel

- Consumer Services

- Media

- Retailing

5. Consumer Staples

- Food and Staples Retailing

- Food, Beverage and Tobacco

- Household & Personal Products

6. Health Care

- Health Care Equipment and Services

- Pharmaceuticals, Biotechnology & Life Sciences

7. Financials

- Banks

- Diversified Financials

- Insurance

- Real Estate

8. Information Technology

- Software and Services

- Technology Hardware and Equipment

- Semiconductors and Semiconductor Equipment

9. Telecommunication Services

10. Utilities

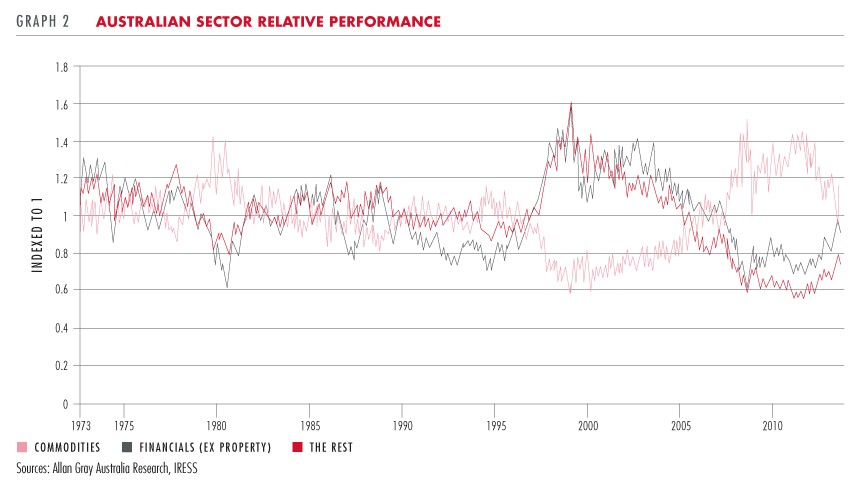

Not to confuse myself and the rest of us, the point that should be driven home is that one needs to have a clear plan of action that is informed by a deeper understanding of how the sectors of the economy work. Knowing your sector groupings and their historic performance can help you take an informed decision when investing, especially in Exchange Traded Funds (ETFs) and individual stocks. You may now go into each available ETF sector like Financials and compare their 3, 5 and 10 year performance to get the understanding of how they grow. Don’t leave out the other groupings of companies that are not sector specific like high dividend stocks.

Whilst conducting research, we often discover a sector which outperforms the rest and we are tempted to blindly put our lump sum in that one sector. Worse actually, we find one company doing extremely well and we put all our wealth in it. ETFs on the other hand are generally diversified per sector, performance (Top40s) or dividend payout. Whilst throwing money at them with no care is not advisable, they have a reduced amount of risk because they each are a basket of industries or companies. One can choose Industrials ETfs (with transportation, autos, etc) or financials ETFs (with banks, insurance companies, etc) for instance. Diversifying across all sectors could mean choosing your top performers, high dividend paying, international stocks per country, international stocks per continent, etc. Build a diversified portfolio, not necessarily including all sectors. You need to keep it low cost too. We will briefly touch on the dangers of being over diversified later in this post.

The young investor here is young enough to stomach quite a bit of risk compared to some of us. WINK. I would think dividing the R1500 into two or three ETFs may work. Just do your research and take a well informed decision. A response to any email here is never suitable for all of us. One’s age can be a determining factor. If our investor was older I would also highlight investing in the bonds. That laddered approach is great for any kind of periodical investing. Staying informed on financial and economic news is mandatory. No investment is completely passive.

Dangers of Being Over-diversified

It is possible to be more diversified than it is financially healthy. Remember that each of your trading has some fees and some even commissions. An over-diversified portfolio can be costly. It also reduces the potential returns because you may end with too many under-performing stocks and assets too. One does not need stocks in all sectors and industries nor all types of ETFs. You may need to prioritise a few sectors according to your research.

Note:

I have been away for a long weekend and swamped with work on my return. I try to have a post most weekdays. When you do not see me, know that I am dealing with matters beyond my control.

Feel free to leave a comment below to help the fellow investor out. And if you find this post helpful, be so kind to share it on your Facebook wall or other social networks using one of the buttons below.

- Facebook Twitter Google Buzz StumbleUpon Digg Delicious LinkedIn Reddit Technorati