Diversification and asset allocation

Post on: 23 Июнь, 2015 No Comment

Diversification and asset allocation are terms that you will often see applied to investing. They have similar meaning and may be used interchangeably. Let’s say that diversification is a concept and that asset allocation is a more specific application of the concept.

Diversification simply refers to not putting all your eggs in one basket. If your brother in law told you that MagicBullet, Inc. was about to announce a huge new contract with the US government and its stock was going to rocket and you put all your money into MagicBullet stock, this is not diversification. Instead this concept is that you should spread your investments across a broad spectrum of investments so that if any one of them suffers a significant drop in value your entire portfolio is not dramatically affected. This reduces the overall risk of your investments. Naturally, there are always those who see things differently. Some advocate that concentration is vital for bigger investment gains. They would say to select 2 or 3 of your very best stock ideas for your basket and watch your basket very carefully. There are very few of us that can tolerate this degree of risk.

When assessing diversification you need to consider the complete picture of your financial life. For example, some employers require a portion of your 401k to be invested in the company’s stock. This is generally not a good idea since your income and employment depends upon the continued viability of this company. To also have your retirement savings dependent upon the same factor leaves you open to the worst case scenario if the company fails. Here I would refer you to Enron if you seek an example. So this would also say that you may not want to invest additional money in the stock of your employer outside of your 401k.

Now let’s turn our attention to asset allocation . Proponents of asset allocation say that over time this factor is the most significant contributor to your portfolio performance. In fact, they say that it accounts for as much as 90% of your results. That’s pretty heavy stuff. So the mix of assets is possibly 9 times more important that the specific stocks, bonds and other assets you select. One of the basic tenets of asset allocation is correlation which is a basic building block for modern portfolio theory (MPT). If two investment alternatives (two stocks, two bonds, etc.) tend to move up and down in price to about the same degree during the same time, they are said to be highly correlated or to have positive correlation. If their prices move in exactly opposite directions and amounts then they are negatively correlated. When it comes to asset allocation, we want to understand the correlation of asset classes. For example, stocks and bonds generally have negative correlation. When stocks are doing well, everybody wants to own stocks, so they sell bonds (which will cause bond prices to go down) and they buy stocks (which will cause stock prices to rise). The basic principle of MPT is that if you combine a variety of asset classes which have low relative correlation you will reduce overall volatility and increase total returns. I’m attempting to summarize something about which there have been many years of academic research.

What we want to do then is to construct a portfolio which contains all of the major asset classes:

- Domestic stocks (small and large)

- International stocks (small and large, developed and emerging markets)

- Fixed income

- Real estate

- Commodities

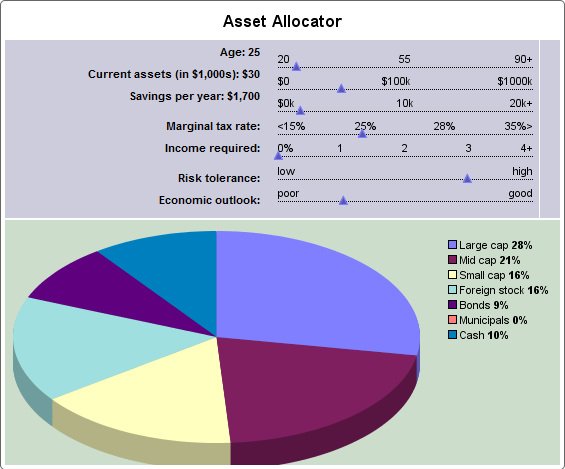

The relative quantities of each become a matter of risk tolerance and time horizon for when you will need to use the money you plan to invest. Your objective could be to save for a child’s education or for your retirement or to fund an inheritance for your children and grandchildren. For most of us our primary objective is to fund our retirement. The very broad “rule of thumb” is that your age is the approximate percentage of your portfolio that you should have invested in fixed income investments. Therefore, as you get older, more of your investments move to fixed income to provide greater security against big swings in the stocks. But you want to continue to maintain some exposure to stocks because of the growth opportunities. Naturally, your circumstances may vary and should be evaluated individually.

As for the stock portion, most suggest having about one half of your stock allocation in domestic stocks and one half in international stocks. Real estate and commodities would have a small allocation for most, but only after you have built a solid core portfolio of stocks and fixed income.

Let’s look at an example for a 50 year old saving for retirement:

- 50% fixed income

- 20% domestic stocks

- 20% international stocks

- 5% real estate

- 5% commodities

Now wouldn’t you know, the financial services industry has come up with solutions to satisfy your asset allocation needs? They are generally referred to as life cycle or target date funds. The large fund families, Vanguard, Fidelity, etc. have constructed these funds using a combination of their various funds in allocations meant to address your retirement savings. So if you intend to retire in 2030 for example, they will have a 2030 life cycle fund which will provide an asset allocation that they deem appropriate for that objective. Their pitch is that you can make one investment in this fund and be done with it. The allocations will change over the years and they will take all the guess work out of it for you. More and more employer sponsored 401k plans are offering these target date funds. They’re a good choice for most employees.

Personally, as someone managing my own retirement funds, I’m not a big fan of target date funds. There’s the issue of cost and that you’re stuck with the fund selections from the fund company’s line up. They may tend to use some of their actively managed funds in the selection which drives up the cost. Also, their small cap domestic fund (as an example) may not be very good but you don’t have the option to replace it with something better. Also, the allocation models can vary greatly from one fund company to another, so one size doesn’t fit all.

If you’re investing on your own, you can construct a well diversified core portfolio using two ETFs. I will use Vanguard ETFs by way of example: The Vanguard Total World Stock ETF (VT ) and the Total Bond Market ETF (BND ). Total World Stock tracks the FTSE All-World index which represents domestic US and international stocks including emerging markets in the following mix:

Total Bond Market ETF tracks the Barclay’s Capital US Aggregate Bond Index which includes government and corporate bonds.

Once you have established this core allocation you can then add elements for real estate, commodities, etc.

At least once each year you will want to re-balance your allocation. Simply put, each year the various asset classes will perform differently. This will lead to a shift in your allocations. If your objective is to have 60% in stocks and 40% in bonds but in a given year stocks may perform poorly and bonds could perform well. This would lead to your allocation being out of alignment, for example, 58% stocks, 42% bonds. So to bring your allocation back in line you would re-balance by reducing your bond holdings and increasing your stock holdings. If you are regularly adding new money to these investments you can accomplish this re-balance by adding money only to the asset class that has an allocation below your target.