Distributed Solar and Finance

Post on: 20 Август, 2015 No Comment

The United States installed 4,751 megawatts (MW) of solar photovoltaics (PV) in 2013, a 41% increase over 2012. That was enough to contribute 29 percent of all new electricity capacity installed in the United States last year, second only to natural gas.

While solar is growing fast in America, there are dark clouds on the horizon for the distributed or rooftop PV industry, according to Dan Reicher. an energy finance and policy expert and professor at Stanford Law School and executive director of the Steyer-Taylor Center for Energy Policy and Finance.

Speaking at the MIT Energy Conference in Cambridge, Massachusetts on February 21st, Reicher said that while solar has been booming in the United States, four challenges might dim PV’s prospects.

Four dark clouds on the PV horizon

First, the federal investment tax credit (ITC) for solar projects is worth 30 percent of eligible project costs, providing a critical boost to the industry.

In 2017, that tax credit is scheduled to phase-out for residential taxpayers and revert to a 10 percent permanent investment credit for businesses.

Unless solar project costs continue to fall, the phase-down of the ITC could take the wind out of solar’s sails.

Second, state renewable portfolio standards (RPSs), which obligate utilities to purchase renewable energy, have been the other major policy incentive for solar installations. A carve-out in the New Jersey RPS, for example, has created a special market and turned the Garden State into the second largest solar market in the United States.

Source: U.S. Energy Information Administration

Yet thanks in large part to solar’s recent success, utilities are getting close to filling their obligations for renewable energy purchases, Reicher warns. Once RPS markets fill up, solar PV will lose the important market pull these policies have historically offered.

Reicher doesn’t see too many states increasing the obligations on utilities. Recent efforts to roll back state RPS policies sponsored by the conservative American Legislative Exchange Council (ALEC) and the Heartland Institute have mostly failed, Reicher says, but they may have succeeded in stalemating efforts to further expand RPS targets.

Third, while solar module costs have plummeted in recent years, falling by 60 percent from 2011 to 2013 alone, those rapid declines may not continue, Reicher says.

As Chinese manufacturers clear out their oversupply and market demand picks up again, solar module prices will rebound somewhat, Reicher believes.

Whether or not technological innovation or economies of scale can continue to drive down PV costs is an open question.

Market analysts at GTM Research see further PV module cost reductions ahead, but at a far more modest pace than in recent years. In a June 2013 report. GTM projects “best in class” PV module costs will continue to decline somewhat, dropping from about $0.47/Watt in 2013 to $0.36/Watt by 2017, a further decline of 23 percent.

That said, PV module costs have become an increasingly small fraction of total solar project costs. The average PV system installed in the United States in 2013 cost $4.53/Watt, according to data collected by the National Renewable Energy Laboratory. An $0.11/Watt decline in module costs by 2017, as GTM projects, would only reduce total PV project costs by 2.4 percent, a far cry from the 20-30 percent increase in project costs coming due to the expiration of the current ITC.

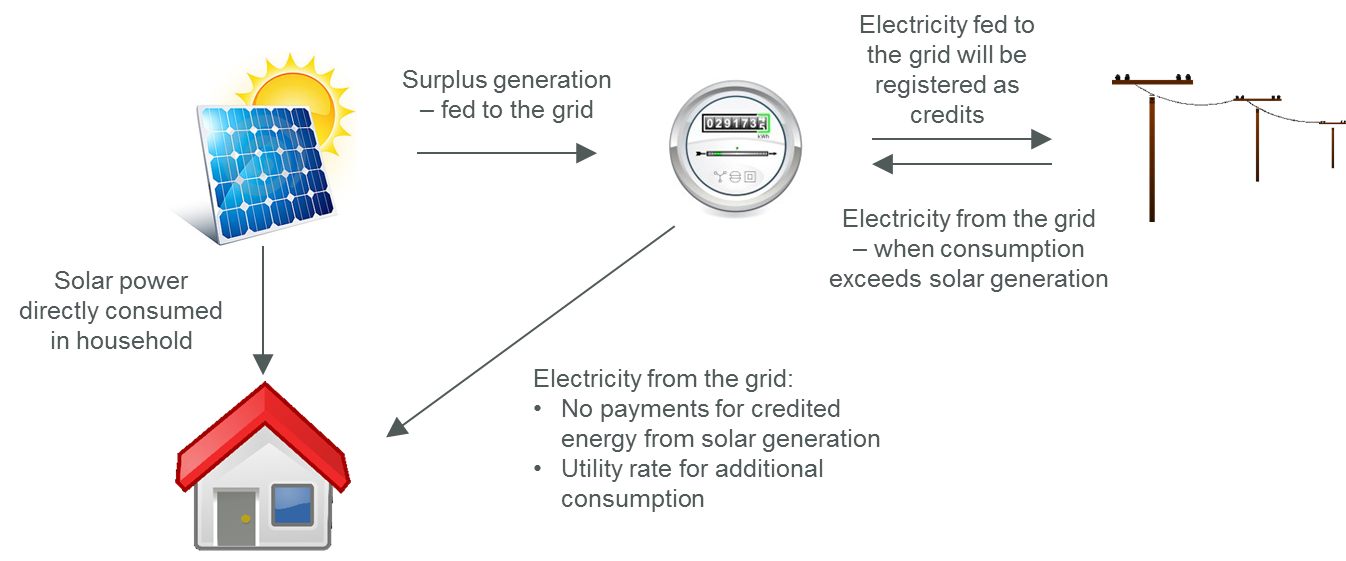

Finally, net metering laws have been another cornerstone for the growth of PV. These laws allow which solar panel owners to be credited at the going retail electricity rate for their solar output and have been key to opening markets for rooftop solar.

Yet as solar grows from a blip on the radar to a real force to be reckoned with, utilities and regulators in some states are increasingly concerned that net metering may destabilize utility revenues and distort energy tariffs by letting PV owners avoid paying for the costs of the power grid they use to export and back up their solar output while shifting grid costs to non-adopters.

Several states have recently begun proceedings to adjust, alter, or replace net metering laws, casting further uncertainty over the future of rooftop solar.

Can financial innovation keep solar shining?

20securitzation%20costs.jpg /%While dark clouds loom, solar’s future can stay bright, according to Reicher and other panelists at the MIT Energy Conference. The key: financial innovation that can lower the cost of finance and keep the installed costs of solar falling.

There are two ways to reduce the costs of a rooftop solar project, explains Albert Luu. Vice President for Structured Finance at SolarCity, the largest rooftop solar installer in the country: you can cut the actual costs of the panels and installation, or you can cut the cost of financing the project.

If you cut the cost of capital by 1 percentage point, or 100 basis points, that’s worth 1.5 to 2 cents per kilowatt-hour off your PPA [power purchase agreement] price, Luu told conference attendees.

With typical residential rooftop solar PPA prices in California in the range of 14 to 15 cents per kilowatt-hour, reducing the cost of capital can translate to substantial declines in total project costs.

Solar City’s target is to reduce installed costs of their rooftop solar projects by 5 percent per year in order to prepare for the step down of the ITC in 2017. Financial innovation will be the key to meeting those costs, Luu said.

Panelists at the MIT Energy Conference discussed several innovative models for solar finance that could keep the costs of solar falling and the industry growing despite new headwinds.

Master Limited Partnerships and Real Estate Investment Trusts

Stanford’s Reicher has been a big advocate of extending the ability to form Master Limited Partnerships. or MLPs, and Real Estate Investment Trusts (REITs) to the solar industry.

As TheEnergyCollective.com contributor Kristopher Settle explains. “An MLP is a business structure that is taxed as a partnership, but whose ownership interests are traded like corporate stock on a market. Whereas profit from publicly traded C-corporations is taxed at both the corporate level and the shareholder level, income from MLPs is taxed only at the shareholder level because it is treated as a partnership for tax purposes.”

That lower tax rate makes MLPs a more attractive investment vehicle, and lowers the cost of raising capital via the MLP structure.

MLPs are a common investment vehicle open to oil, gas, and other traditional energy infrastructure investments, but have been off-limits to solar so far. Several bills introduced in Congress would change that, bringing parity to fossil and renewable energy investments.

REITs similarly allow individual investors to buy shares of commercial real estate assets, like commercial development projects.

“REITs are attractive to many investors because they are required to distribute virtually all of their net earnings to shareholders, and to the extent they do so, they are only subjected to a single level of tax,” explains Josh Freed. director of the Clean Energy Program at Third Way.

Making solar projects eligible to raise money as an MLP and REIT could open up large new pools of investors at an attractive cost of capital, lowering total solar project costs.

Given the sorry state of Congress these days, however, Reicher isn’t holding his breath for Congress to pass the legislation required to open MLPs and REITs up to solar any time soon. It would be smart policy, Reicher told the audience, but that requires Congress to be up to the task of legislating.

Correction: While the U.S. Treasury Department could make REITs a viable option for solar investment simply by clarifying federal rules, Congressional action is needed to open up MLPs as a solar finance vehicle. While Congress has not been up to the task of legislating much lately, Reicher says he is modestly optimistic that Congress will, in fact, adopt legislation opening up MLPs to renewables. This could happen as part of a package of legislation extending recently expired tax credits, part of broader tax reforms, or as a stand alone bill.

Whether or not Congress or Treasury acts on MLPs and REITs, several other innovations are also gaining traction.

Mosaic: crowdfunding solar investment

Mosaic made waves in 2013 when it launched a new online platform to crowdsource rooftop solar project funds from hundreds of individuals making investments as small as $25.

Following on increasingly popular crowdfunding platforms like Kickstarter, Mosaic wants to open solar project investing “to the masses,” thus tapping another large pool of potential investment capital.

Mosaic advertises an internal return on investment of “up to 4-6 percent,” and after taking a 1 percent cut themselves, can still offer solar PV projects an attractive 5-7 percent cost of capital.

Mosaic recently partnered with solar installer RGS Energy to offer another new investment option, the “Mosaic Home Solar Loan.”

Mosaic and RSG’s loan offers homeowners the chance to install and own solar with no money down, while repaying the loan over time. The new loan product is an attractive alternative to traditional solar lease offerings. in which a third party retains ownership of the solar system and leases it to the homeowner.

Mosaic will offer investments in the Home Solar Loan products via their online crowdfunding platform, with the loan repayments from homeowners offering a return on these investments.

“Homeowners gain all the benefits of ownership with the simplicity of a lease,” said Billy Parish, Mosaic’s president and co-founder, “while investors gain access to transparent and tangible investments in the booming home solar market.”

While Mosaic had typically offered financing to larger rooftop projects on commercial or institutional buildings, this new Home Solar Loan product will open up crowdfunded loans to the residential segment as well.

RGS Energy plans to offer the new loan product to California homeowners starting in the first half of 2014.

SolarCity: securitizing solar assets

The biggest innovation in solar project finance may be the securitization of solar assets. a feat recently accomplished for the first time by SolarCity.

“In the most basic form of solar securitization, the holder of a portfolio of solar assets bundles contracted revenues from a group of projects and sells that revenue stream to a special-purpose vehicle – an entity that exists solely to buy or finance specific assets,” explains Elias Hinckley, a strategic advisor on energy finance and a contributor and advisory board member at TheEnergyCollective.com.

By bundling and pooling hundreds or thousands of individual solar projects together, securitization can achieve both the large scales and lower risks that are attractive to institutional investors. That could open up tens of billions of dollars or more in potential solar project investment, according to SolarCity’s Luu.

Institutional investors allocate as much as 40% of their assets to these types of securitized investments, totaling on the scale of $37 trillion at the outset of 2014, writes Travis Lowder of the National Renewable Energy Laboratory. (See NREL infographic at right for how securitization works).

SolarCity raised a more modest $54 million through its first series of securitized notes backed by solar power contracts, which it offered to investors in late 2013. The ten year notes pay 4.8 percent. After fees, that could give SolarCity a cost of capital in the neighborhood of 6 percent.

Still, there are challenges ahead for SolarCity and others to prove that solar securities are reliable, “investment grade” assets. The first notes offered by SolarCity were rated BBB+ by Standard & Poor’s, a relatively investment-grade rating. At $54 million, the offering was also much smaller than typical securities, which are typically denominated on the $100 million scale.

As SolarCity gains practice in vetting and securitizing solar assets and institutional investors get more comfortable with this new asset class, that rating may improve over time, offering even more competitive costs of capital.

A race against time

These financial innovations has the opportunity to shave off a significant portion of overall solar project costs.

Yet the U.S. rooftop solar industry is in a race against time to drive down costs before the impending 2017 drop-off in the value of the investment tax credit.

“The big question is whether financial innovation can overcome the 20 percent effective cost increase created by the ITC’s expiration,” says Shayle Kann. Senior Vice President of Research at GTM Research. “That is a high bar to set, and clearing it requires fast action between now and 2017.”

Correction. The original version of this story incorrectly stated that Congressional action would be required to allow solar companies to use Real Estate Investment Trusts (REITs) to raise financing for projects. The United States Treasury Department could issue clarifying rules opening REITs to solar projects without Congressional action. The original story also mischaracterized Dan Reicher as not holding his breath for Congress to pass legislation enabling MLPs for solar. In an email, Dan clarified that he is modestly optimistic that Congress will adopt legislation opening up MLPs to renewables.