Distressed Investing Olshan Frome Wolosky

Post on: 25 Апрель, 2015 No Comment

Alerts & Publications

Instability and uncertainty in the capital markets can unnerve some investors while creating significant investment opportunities for others. At Olshan, our goal is to help our clients capitalize on these prospects with our support for distressed investing.

Drawing on our deep knowledge of the market and our experience in business reorganization, finance, and corporate and tax law, our Distressed Investing Group attorneys counsel clients in the buying and selling of distressed assets, advising on due diligence, testing of investment theses, trading issues, loan-to-own strategies, asset purchases, and out-of-court business restructuring and bankruptcy cases.

Our attorneys have the perspective to effectively assess a distressed investing situation, act quickly while minimizing risk, and navigate the often complex rules that characterize bankruptcy cases, foreclosures, UCC sales, liquidations, Section 363 sales, reorganization plans, receiverships and other scenarios involving the disposition of distressed assets.

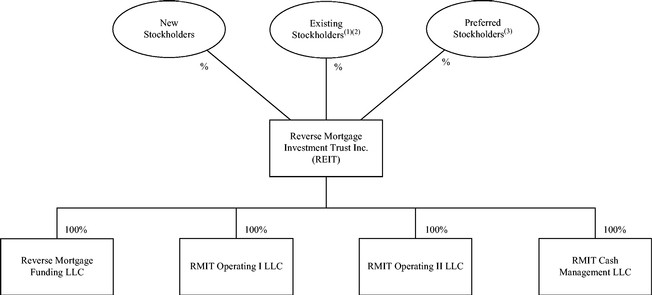

Analysis of Capital Structure in Distressed Investing

When analyzing a distressed investment opportunity, we thoroughly review a companys capital structure, including the relative rights of the stakeholders, outstanding debt and equity securities, intercreditor agreements, loan agreements, debt covenants, and governance provisions. We are also adept at analyzing multi-lender syndicates and developing strategies to maximize returns to our clients.

Analysis of Litigation & Due Diligence

Credit and equity values often correlate to the markets view of bet the company and other significant litigation. We have extensive experience analyzing these situations as information becomes publicly available, helping distressed investors to further valuate their investments. We also advise on all aspects of the due diligence process.

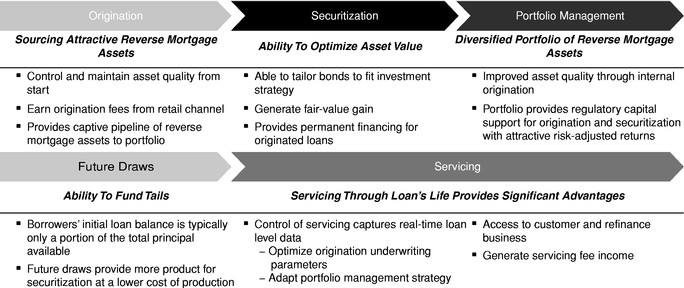

We guide investors in developing and implementing alternative investment and financing strategies, including out-of-court foreclosures, distressed debt purchases, credit bids, and the utilization of existing debt securities to confirm a reorganization plan. We also represent private equity, hedge fund and other private investors in distressed merger and acquisition transactions, whether as a stalking horse bidder, an auction participant or by way of sponsored or stand-alone reorganization plans.

In some cases, UCC and state foreclosure and receivership laws favor an out-of-court transaction. Based upon our analysis of the legal issues, costs, risks and benefits, we can help clients determine whether an out-of-court restructuring or sale is advantageous, and if so advise them in all aspects of the process, including corporate governance and securities law issues, amendments, consent solicitations or exchange offers and the related tax implications.

Sometimes an investor requires the certainty or other advantages of a Chapter 11 transaction. Our attorneys have extensive experience implementing pre-packaged or pre-arranged Chapter 11 cases, with the goal of achieving contractual restructurings in an efficient and cost-effective manner.

We regularly represent the buyers and sellers of distressed real estate assets and mortgages both in and out of court. Leveraging our knowledge of traditional real estate law with cutting edge insolvency strategies, we assist our clients in best positioning themselves to dispose of or acquire these assets.