Direct Real Estate Investment vs REITs

Post on: 9 Июнь, 2015 No Comment

As Ive stated many times on this blog, I am a huge fan of dividend growth stocks (SQUEE!! ). However, I am also interested in diversifying my capital into other income producing assets. Of particular interest to me is real estate investing. There are two primary ways to get serious about real estate. First, through holding shares of real estate investment trusts, otherwise known as REITs. Or second, through direct investment in real estate, that is to say becoming a landlord.

Ive been wondering how REITs and direct real estate investment compare to one another and compare to my existing dividend growth investing strategy. So I decided to do some investigating.

A few words of caution before we proceed. First, all real estate is local, so consider the following as guidance not as gospel. Go do the same exercises for your local area and see how well real estate stacks up as an investment. Second, Im not a real estate professional. Ive done the best I can to kludge together data and methodologies scoured that I was able to access on the web. If you are a real estate professional, I would love to hear your opinions on the comments. And if you could hook me up with some additional data, I would be very thankful.

So lets start this out with a high level overview of the respective merits of REITs and direct real estate investment.

Advantages of REITs

- Low entry cost. It doesnt take much money to get started in REIT investing. No need to spend years scraping together a down payment. If you have a thousand bucks laying around, youre good to go.

- Highly liquid. You can sell you shares in a REIT at any time, the same as you would with any stock.

- No maintenance. Outside of occasionally checking on your investment, no substantial maintenance or effort is required to hold a REIT. Compare this to rental property that requires you (or someone in your employ) to perform requested maintenance, collect rents, find tenants, and keep the property functional.

- Diverse properties. The average real estate investor is not going to be able to branch out much further than single family homes and small multi-family homes (2-4 plexes). However, with REITs you can easily invest in skyscrapers, nursing homes, industrial properties, shopping malls, etc.

Advantages of Direct Real Estate Investment

- You have control. Being a landlord is basically running a small business. The business of renting out your property. As it is your business, you get to call the shots. Want to spruce up your property as an excuse to raise the rent? No problem. You get the idea.

- Tax advantages. There are a myriad of tax advantages to owning real estate, such as being able to write off depreciation. From what I can discern so far, these tax advantages can greatly increase your cash flow from real estate.

- Leverage. By virtue of taking out a mortgage (say 70-80% the value of the property), you get to use leverage to increase your real estate returns.

Capital Appreciation

For this exercise, we will compare price appreciation observed with the S&P500 to a REIT index fund and to housing prices. Since my current investing strategy closely parallels the S&P500 with respect to capital gains, I believe that these are fair ways to compare my dividend growth strategy to real estate investment options.

To begin with, lets compare the capital appreciation of the Vanguard REIT index mutual fund (VGSIX) to the S&P500 index ETF (SPY). VGSIX is composed of a variety of different REITs.

Over the last 10 years, REITs have outperformed the S&P500 by about 20% in terms of capital gains. The current yield of the VGSIX is

3.4% compared to

2.0% for SPY. So REITs have been performing very well in terms of both capital gains and income. Its also pretty apparent from this chart that REIT values tend to track with the overall stock market. So if we get another recession, you can probably count on a REIT portfolio losing money as well.

The next step is to compare the S&P500 to housing prices. The below chart was kludged together using data from Robert Shiller .

What are the take messages from this chart? First, that stock investing is vastly superior to real estate in terms of capital appreciation. Second, that real estate, even when the collapse of the housing bubble is considered, produces far more stable appreciation, that is not correlated with the overall stock market.

I should also point out that this figure represents the national average for housing price appreciation. Some real estate markets are flat, some tend to skyrocket, and others even go down. The appreciation or depreciation of prices in your local area may vary significantly from what is presented here.

Real Estate Yields

As I am particularly interested in increasing my passive income streams, yields are going to be a major factor for consideration when it comes to investing my money.

- Dividend Growth Portfolio - At present my dividend growth portfolio is pulling in well over 3% annual yields, with the YOC being a bit higher.

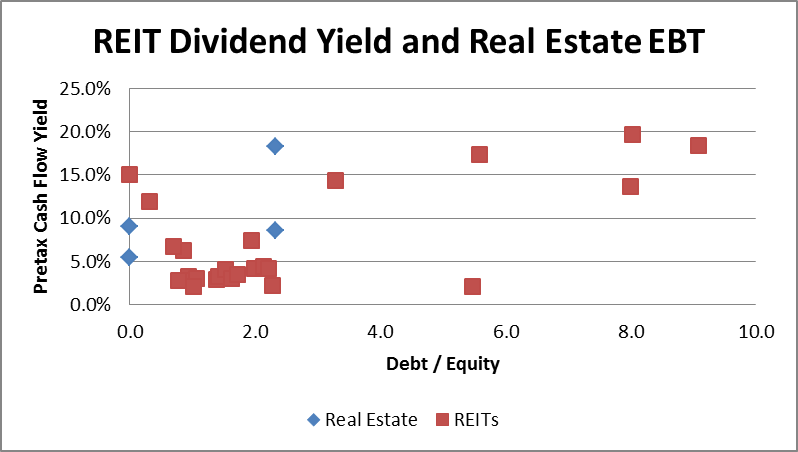

- REITs - Generate yields that range from near 0% all the way to over 10%.

- Real estate Rental Yields - I am finding it particularly difficult to find meaningful information on the kinds of yields one can expect from being a landlord. Anecdotally speaking, the internet reports yields around 7-8%. But some reports go as low as 2% and as high as 25%.

All real estate is local, so the kinds of reports mentioned above arent particularly useful to me since what I really want to know about is rental yields in my local area . So I decided to kludge together my own system for estimating rental yields based on the going rent for a single family home (either a home or condo) and the sale price of comparable (*) single family houses.

Building the estimate:

- I found my way Craigslist (to find rental units) and Zillow and Trulia (to find the price of houses). These are all free and relatively easy to use.

- I limited my search to single family homes, townhomes, and condos, since information on these is plentiful.

- The comparison strategy is simple. Find a single family home for rent. Make a note of the rent and then see how much comparable nearby houses sell for.

- Try to account for as many of the main costs of ownership as possible. Home insurance, property taxes, mortgage interest, rental management fees (assume 8% of the rent), and maintenance (assume 1% of the purchase price).

[googleapps domain=docs dir=spreadsheet/pub query=key=0AgAj3_kEuSr2dG1ZZmZpYzlYYXk0MzFhTFoxOEtzcUE&output=html&widget=true width=650 height=300 /]

Of particular interest is the fact that I found two exact matches. Basically I was able to find a unit for rent right next to a unit for sale. Since they were both condos they are, for all intents and purposes, the same thing.

All of the four comparisons that I made had negative rental yields. That means that every month cash is flowing out of my pocket. This is not what an investor focused on building income streams wants. To be fair, these are hardly comprehensive comparisons. In the real world, I could try to negotiate a lower purchase price and/or charge a higher rent. I also did not account for any of the tax deductions that may be available for real estate investors. But I also didnt account for vacancy rate.

Also worth noting is the observation that as the purchase price decreased, the rental yield increased.

Conclusions

REITs appear to closely mimic the overall capital gains produced by the S&P500. While REITs often produce substantially higher dividends than the S&P500, it does not appear that they are a substantially different asset class. My opinion is that REITs are best used as a small portion of a standard dividend growth portfolio rather than in place of direct real estate investment.

Direct Real Estate Investment

While the numbers in my local real estate analysis are very rough, they do point out that if you are able to produce positive cash flow from a property in this area, its probably not going to be very high. You could probably achieve a 3% yield with direct real estate investment, which is similar to the yield of my dividend growth portfolio. However, I am not convinced that the added hassles of dealing with real estate are adequately compensated for by a 3%-ish yield.

The numbers also suggest that looking at properties in the sub $200,000 range might be good for generating cash flow.

(*) In the world of real estate, comparable is a bit vague. The idea is to find houses that are as similar as possible to each other. It is unlikely, but not impossible, that you will find two units that are exactly the same.

Readers: Whats your opinion of REITs and direct real estate investment? Do you invest in one or the other? Why or why not?