Differences Between a Tangible an Intangible Asset

Post on: 13 Май, 2015 No Comment

Tangible Assets

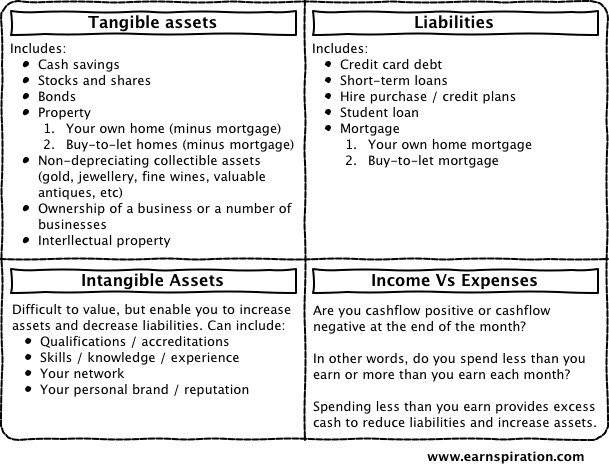

Tangible assets have a physical and financial value. Tangible assets can be divided further into two categories: financial capital or assets that have a monetary value based on their physical valuation, such as infrastructures and buildings. Other forms of tangible assets can include machinery and equipment or any payments owed to individuals. Asset managers specialize in the appraisal of tangible assets; they help protect their clients’ net worth. Having tangible assets appraised is an important step for tax and financial reporting. Tangible assets that have accurate valuations can be used as collateral for financing.

Differences

The main difference between tangible and intangible assets lies in the issue of ownership of resources. Because intangible resources do not have a physical presence, individuals who own intangible resources may not be able to reap the full benefits of their assets; they may be faced with problems of appropriation and misuse of their assets. Although intangible assets can be valued and used for commercial gain, similar to tangible assets, they cannot be controlled to the same extent as tangible resources.

Considerations

References

More Like This

Advantages and Disadvantages of Tangible and Intangible Assets

You May Also Like

In business, accounting and taxes, property assets fall into different categories. Those that are tangible tend to be rather obvious. However, there.

When choosing where to work, people weigh tangible and intangible benefits. In some cases, a person may choose work she despises performing.

In terms of definitions, inventory consists of physical objects, while assets pertain to both tangible and intangible qualities. While all inventory might.

Tangible property is usually defined as property that you can touch such as money, real estate, a car, jewelry or furniture. Items.

Every business has various types of resources and assets, some of which are clearly visible and others of which are less obvious.

Depreciating intangible assets makes balancing the accounting books somewhat complicated. While tangible assets consist of known costs and values, intangible assets.

Amortization and depreciation seem like similar functions because both methods are used to allocate the cost of assets over their useful lives.

An asset can be categorized as any item owned by an individual or business that can be assigned dollar value. An asset.

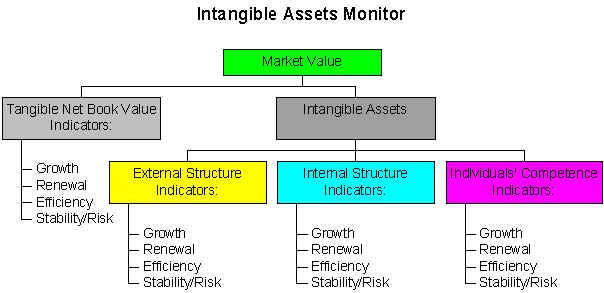

Organizations of all types have both tangible and intangible properties, integrating the two properties as parts of a system or process for.

A trustee manages assets for the beneficiaries of a trust, estate or other party. A custodian is the organization that actually holds.

Whenever two humans come together, there is liable to be conflict, and where there is conflict, negotiation is a common tool to.

Difference Between Capital & Assets. Capital and asset are business terms. They may be used in slightly different contexts, depending on the.

A tangible asset is anything that is physical in nature such as machinery, supplies and land. According to Investopedia.com, whether an asset.

A crucial aspect of tax preparation is to offset as much income as possible with deductions. However, many tangible and intangible items.