Depreciation Methods (MACRS)

Post on: 25 Апрель, 2015 No Comment

There are various methods for deducting the cost of equipment, fixtures, and vehicles you use in your business.

- First-year expensing (Section 179): Lets you deduct up $500,000 in 2013. Lower deduction amounts apply to certain vehicles.

- Bonus depreciation: This is another first-year deduction that allows a deduction for 50% of the cost for new property place in service.

- Regular depreciation. Most business equipment is depreciable under MACRS depreciation (Modified Accelerated Cost Recovery System — pronounced MAKERS).

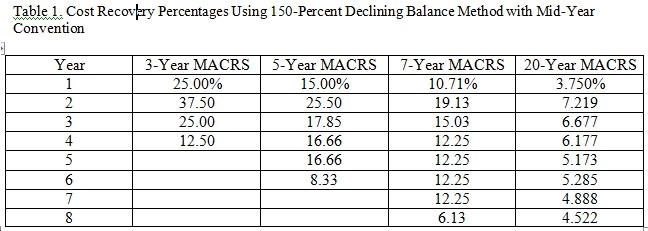

- MACRS includes an accelerated method, which produces higher deductions in the early years of the property’s recovery period than the MACRS straight-line method. Straight-line depreciation produces equal amounts of deprecation over the property’s recovery period

About MACRS

MACRS is actually composed of two depreciation systems:

- The General Depreciation System (GDS)

- The Alternative Depreciation System (ADS)

The difference between each depreciation system is in the number of years you may depreciate an asset. Generally, the GDS uses shorter recovery periods than the ADS.

However, certain assets have the same recovery period under either system. For example, cars, light duty trucks, and computers have a 5-year recovery period under either system.

Form 4562, Depreciation and Amortization

You make the election to use either GDS or ADS on Form 4562. Whichever you choose, the election is irrevocable.

Use Part III, Section B for GDS and Part III, Section C for ADS. For either method, except for real estate, the election applies to all property within the same class placed in service during the taxable year.

How the General Depreciation System and Alternative Depreciation System Differ

The General Depreciation System (GDS) and the Alternative Depreciation System (ADS) differ in two ways.

- GDS uses:

- Accelerated depreciation (200% and 150% declining balance)

- Straight-line depreciation, and

- Shorter recovery periods .