DDB Calculating depreciation using the doubledeclining balance method from the Course Excel 2010

Post on: 16 Март, 2015 No Comment

FAQs

Watch the Online Video Course Excel 2010: Financial Functions in Depth

2h 18m Intermediate Jun 28, 2011

Viewers: in countries Watching now:

DDB: Calculating depreciation using the double-declining balance method

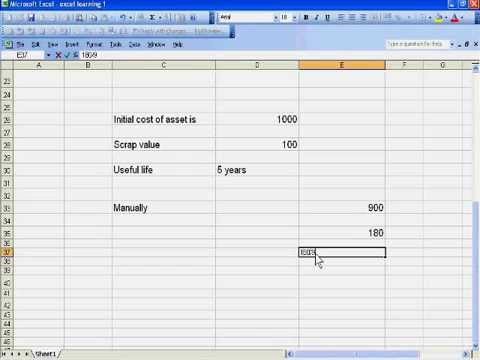

The declining balance method of calculating depreciation enables companies to accelerate the rate at which they claim the tax benefits inherent in asset depreciation. As the name implies, the double declining balance depreciation method doubles the rate at which the declining balance method calculates an asset’s depreciation. To calculate depreciation using the double declining balance method, you use the DDB function and the DDB function has five arguments. The first is the Initial Cost of the asset, in this case 34 million.

Then the Salvage Value and that is the value for which you can sell the asset as scrap at the end of its economic life. That’s $1 million. Then we have the Economic Life and for a building that’s assumed to be 30 years. And then the fourth argument is the Period and in this case it is years. So I have a series of years in cells d6 through d15, for years 1 through 10 of this 30-year economic life. And then finally we have cells to calculate the depreciation using the DDB function.

Now the fifth argument we’re not going to use and that is called a factor. The factor allows you to identify how quickly you want the declining balance method to work. So for example, the double declining balance method has a factor of two and that’s assumed it’s the default value; however if you want to use triple declining balance method then you could make the factor 3. But in this case, we’ll stay with the basic double declining balance method, so in cell E6 I’ll press of the equals key and then type ddb and then a left parenthesis and now I can start adding my arguments.

So the cost is in cell b7, type a comma. Salvage value is B9, then a comma. Then the life is in cell b11. That’s the economic life, the number of years the asset has economic value. And then finally the period and that is in cell d6. Now before I type a right parenthesis and press Enter, I need to make a couple of changes to my references. When I complete this formula and press Enter, Excel will copy it down to the remaining rows in this column of the table. When it does that, the references for B7, B9, and B11 will change because I currently have them listed as relative references.

To make them absolute references I need to do a little something with them. So to change B7 from a relative reference to an absolute reference, I click in the reference itself and then press F4 and the dollar signs indicate that it’s now an absolute reference. I’ll do the same for B9. Click inside the reference and pressing F4 and the same for B11 because I don’t want those references to change. Now d6 I can leave as-is and the reason is that as the cell formula gets copied down, I want the reference to change from d6 to d7 so it uses 2, d8, so it uses 3, and so on.

So with that formula in place, I can type a right parenthesis, verify one more time that everything looks good, and press Enter. And when I do, Excel calculates the double declining balance depreciation for each of the first 10 years. The double declining balance method assigns a high percentage of an asset’s depreciation to the first part of its economic life. As with the declining balance method, companies can use their depreciation and related tax savings to invest in other areas.

Find answers to the most frequently asked questions about Excel 2010: Financial Functions in Depth .