Dave Ramsey Pay Off Your Mortgage Early or Not

Post on: 18 Апрель, 2015 No Comment

Should You Pay Off Your Mortgage Early? This is an age-old question with no definitive answer. There are people who believe paying off mortgage as fast as possible is better, and there are people believe investing the difference is better. Dave Ramsey advocates paying off your home loan early in his book The Total Money Makeover . I believe this to be a great advice given his audience. In general, if you are uncomfortable with investing for the long-term, youre better off prepaying your home mortgage. However, investing instead of prepaying could be a financially sensible option for many people.

Advantages and Disadvantages of Mortgage Prepayment

Since the right answer depends on so many factors, I cannot say that mortgage prepayment or investing is better. Instead, lets examine the key factors that will help you make the final decision for yourself.

Advantages of Prepaying Your Mortgage

- Interest payment savings I believe this to be the most significant benefit of prepaying your mortgage. Youll ended up saving a good amount of money on interest payments. The money saved is risk-free and guaranteed. Not to mention youll get out of a major debt obligation and own your home sooner.

- Investment risk Since you cant beat prepaying with risk-free investments like certificates of deposit. money market and savings. youll have to utilize investments that provide higher returns, such as investing in the stock market. With prepaying, theres no investment risk involved.

- Investment gains are taxable Your investments gains are taxed at your marginal tax rate for dividend and interest gains, and at 15% for long-term capital gains. Therefore, you do not recognize the full value of your investment gains. For instance, if your investment gained $6,000 in value and you have to pay 18% on taxes (average), thats only equivalent to $4,920 net gain.

Disadvantages of prepaying your mortgage

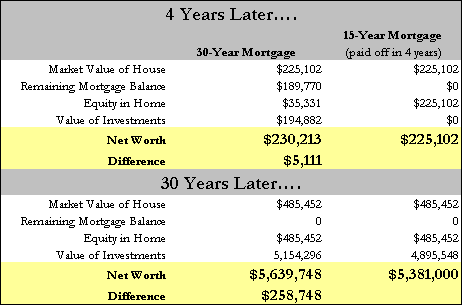

- Opportunity cost Depending on your interest rate, investing could provide you with superior return on your investment. So its possible to come out financially behind if you prepay.

- Lack of diversification Your house could be a significant portion of your assets (it is for me). By prepaying, you are not increasing your real estate investment (its still the same, you are just lowering your debt). By opting to invest your money elsewhere instead of prepaying, you are increasing your investment in other asset classes, thus effectively reducing your real estate exposure and overall financial risk through diversification.

- Tax deductions Your interest payment could be a significant portion of your tax deductions (it is for me). If you prepay, you are also reducing the amount you could use for tax deductions. For example, if you saved $5,000 on interest and your marginal tax rate is 25%, youll lose $1,250 in tax deduction therefore, your net saving is only $3,750. Since long-term capital gains is only 15%, to match the $3,750 savings, youll need an investment gain of about $4,412 = $3,750 / (1 0.15). However, this factor also depends on how much you itemize because the IRS offers standard deduction as such, your true deduction is only the difference between your itemized deductions minus the standard deduction.

- Inflation When you owe money and you pay back over the course of 30 years, inflation is your friend. Assuming an average 3.5% inflation rate, your $1,000 mortgage payment is only worth about $340 on the 30th year. If you prepay, you will lose this advantage, and it in fact, works against you.

- Liquidity Your mortgage is a secured loan. Prepayment doesnt earn you any favor with the bank. The bank still owns your house until you pay off that last penny. So if you hit some rough patches down the road and cannot make your payments, you could lose your home. By investing instead of prepaying, you maintain liquidity and give yourself a little insurance against potential financial hardship. Sure, you could sell your home to avoid foreclosure but selling under pressure is not fun.

Swing Factors It could go either way

- Mortgage type There are many types of mortgage. That, and the prepayment clause, could play a major role in you prepaying versus investing decision.

- Mortgage maturity The age of your mortgage determines how much interest savings you will realize. Prepaying newer mortgage is more beneficial than prepaying mortgage that only has a few years left.

- Mortgage Interest Rate Obviously, its better to prepay (or refinance) a mortgage with high interest rate. Since the long-term return on investment for the stock market is about 8-10%, its most likely better to prepay if your mortgage interest rate is higher than about 6%. On the other hand, if your mortgage interest is lower, its probably better to invest.

- Investing skill The premise of this argument depends on your investing skill. If you cant, and unwilling to hire someone to help, the point is moot and youre better of prepaying.

- Financial Stability As mentioned earlier under liquidity, if your financial situation is unstable, its probably better to invest and stay liquid. This gives you some cushion against financial emergencies or losses.

Is it better to pay a house off or not?

To sum it up, there are many factors that affect your decision to prepay your mortgage or invest your money. In order to find the right answers, all of these factors must be considered carefully.

Personally, my mortgages have low interest rates (4.75% and 5.25%), I am in a high tax bracket, and I have long investment horizon; so here is what I do:

- Make sure I have plenty of emergency fund ,

- Make sure I fully fund my retirement savings in tax-advantaged accounts. and

- Make small prepayments along with my normal mortgage payments.

Essentially, I chose not to make any commitment to one specific area and spread my money out.