Custodian Self Directed IRA LLC v IRA

Post on: 9 Июль, 2015 No Comment

Home Blog Blog Custodian Self Directed IRA and Checkbook IRA: Factoring in the Difference

Custodian Self Directed IRA

There are various investment account options that you can look into when you’re trying to make solid investments for the future. You may find yourself being told that one is right for you, when in reality another option would work far better. This happens all the time, but what is not always publicized is far simpler, which is the fact that you may not always qualify for a checkbook IRA. It’s that simple truth that may guide you in selecting a Custodian Self Directed IRA and then later find out that this is not a good option after all. This type of solution is not a productive plan of action as you’ll end up with many issues associated the alternative.

Custodian Self Directed IRA vs. Checkbook IRA

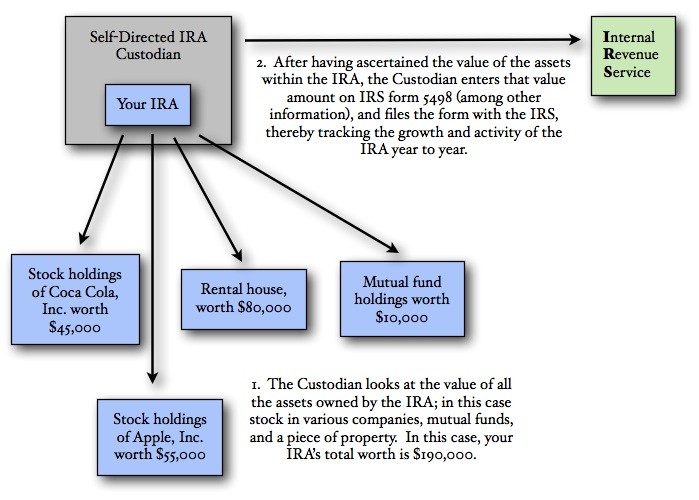

Understanding the difference between a checkbook IRA and a Custodian Self Directed IRA, in line with IRS rules may seem daunting and even frustrating at first, but it can easily be deciphered with a little bit of explanation. Narrowing things down can be helpful, which is why it’s important to look at some of the short sighted issues that are involved with making the mistake of jumping into a self-directed IRA custodian account.

The first thing that should be noted is the cost associated with financial investments. When you aren’t going for the checkbook control option, you’ll have to pay upwards of 3 times more out of pocket for financial investing than you would otherwise. If you have a Checkbook IRA LLC, the savings could be significant by comparison and are well worth looking into on how to get into that type of account, instead of desperately moving towards an alternative.

When surveying what clients think about the way many custodian accounts are set up, they are chock full of the same complaints which are mainly that people in charge of these accounts aren’t always on top of things or even know what they are doing. That makes for much dissatisfaction detailing the nightmare of paperwork, inefficiency to direct funds towards real estate and delays in timing when trying to move certain pieces. Not only that, there is a higher cost of operation delineated for the privilege of having someone help, which can be even more frustrating because it is being paid for out of pocket.

Conclusion

It can be difficult to narrow down all the differences between the two aforementioned accounts, but it’s imperative to note that self directed custodian options could come with far more headaches than self directed Checkbook IRA paths.

One of our retirement plan experts can help you navigate through the options that are available to you. Please contact us today!