Currency wars and the emerging markets

Post on: 3 Август, 2015 No Comment

Search form

Currency wars and the emerging-market countries

Richard Portes 04 November 2010

The headlines shout “currency wars”. The US believes China engages in “currency manipulation”. The authorities hesitate to declare this to the US Congress, and the Secretary of the Treasury says “competitive non-appreciation” instead. China accuses the US of excessively loose monetary policy, flooding the world with liquidity. There is some truth in both charges, but some exaggeration.

This is one of the key issues facing the G20. Exchange-rate pressures, global imbalances and rebalancing, spillovers and the desirability of policy coordination – these are at the centre of the economic interdependence between the developed and emerging market countries. All this is in the context of weak US and European recoveries from the Great Recession, the risk of deflation, and the likelihood of more quantitative easing (QE) by major central banks. Domestic issues and inability to get direct action on exchange rates has led the US to propose internationally agreed targets for current-account imbalances. The wheel goes round – these proposals bear some resemblance to those of Keynes at Bretton Woods, which the US then opposed.

Policies such as these cannot be properly assessed without an analytic framework. In the current discussion, the furthest this has gone is evocation of the “trilemma”: the impossibility of simultaneously maintaining open capital markets, nominal exchange-rate stability, and monetary policy autonomy. (We hear little of the “inconsistent quartet”, which adds trade openness to these three – but protectionism is indeed a potential weapon in the currency wars, and we must not disregard that threat.)

While policymakers in both developed economies and emerging markets are aware of this trilemma, they are not fully conscious of the international repercussions of QE by the largest economies when they are at the zero lower bound for interest rates. This column will explore these issues.

The US dollar has already experienced a real effective exchange-rate depreciation of over 10% since early 2009, almost bringing it back to the low of early 2008. The Federal Reserve Bank of St. Louis has calculated that much of this is due to QE — the Fed’s $1.725 trillion asset purchases resulted in a 6.5% depreciation of the dollar (Neely 2010). The Bank of England has estimated that its QE resulted in a 4% depreciation of sterling (Joyce et al. 2010). So domestic QE does seem to have substantial international implications.

But the communiqué of 23 October 2010 by G20 finance ministers from their meeting in Gyeongju, while condemning “competitive devaluations”, avoids direct discussion of this spillover of monetary policy – which some might reasonably call a “competitive devaluation”: To quote the communiqué:

“Specifically, we will… continue with monetary policy which is appropriate to achieve price stability… move towards more market determined exchange rate systems that reflect underlying economic fundamentals and refrain from competitive devaluation of currencies. Advanced economies, including those with reserve currencies, will be vigilant against excess volatility and disorderly movements in exchange rates…”

This suggests that as long as QE does not lead to “disorderly” exchange rate changes, the monetary authorities can ignore its international effects. We shall examine whether this view is justified.

What is happening on the ground? The Bank of Japan has intervened to limit appreciation of the yen and may do further QE. The Bank of England is actively considering additional QE beyond the £200 billion in asset purchases it has already made. The European Central Bank (ECB) is reluctant to expand its balance sheet further, but it may be forced to buy more Greek, Portuguese, Irish, and Spanish bonds if the markets turn against any or all of these sovereign debtors. And if the euro were to appreciate substantially against the dollar, threatening the weak European recovery, the political pressure on the ECB for some form of intervention would be hard to resist. Meanwhile, the only uncertainties about further QE by the Fed are how much and at what speed.

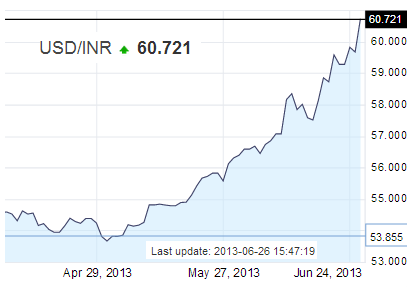

China, for its part, continues to resist both political and market pressures for more rapid nominal appreciation of the renminbi. The East Asian countries that have effectively pegged to their currency to the US dollar stand firm. Others have experienced substantial appreciation (Indonesia, Malaysia, Thailand, and Korea). Brazil had a massive appreciation in 2009 and imposed a transactions tax on capital inflows, which has just been raised, since the inflows have continued, intervention has accumulated large reserves, monetary aggregates are rising rapidly, while inflationary pressures have led to interest rate increases. Thailand has also imposed a tax on foreign holders of domestic securities, and Indonesia is considering capital inflow controls. Singapore has widened its exchange-rate band. Countries from Israel to India and South Africa are facing similar pressures: large short-term capital inflows, exchange-rate appreciation, and inflationary risks.

Monetary expansion in the developed economies has confronted emerging markets with the trilemma. If they resist currency appreciation, they lose monetary control and get inflation and asset price bubbles (as well as political pressure over trade competitiveness). The alternatives are equally unpalatable. Reverse the trend of the past two decades towards freeing capital markets that has nurtured financial development; or accept exchange-rate appreciation and loss of competitiveness. The conventional prescription is to permit the appreciation – after all, it raises real incomes, and competitiveness is underpinned by rapid productivity growth – and switch away from export-led growth to more reliance on domestic demand. But many countries, China most vocally, are concerned that significant appreciation will hit marginal exporters, slow growth, and create unemployment.

In this context, we now explore the implications of QE, first in a small open economy, then for a big country, then for a set of big countries. We assume the interest rate is constrained at the zero lower bound, there is a “liquidity trap”, economic activity is weak, and there is some threat of deflation.

In a small open economy, when the central bank brings the interest rate to the zero bound, the exchange rate depreciates. The monetary authorities can threaten to intervene or actually do so to keep the exchange rate down. In this case, the weak currency is not “competitive devaluation” – it is just a normal part of an easy monetary policy. In any case, there is little effect on the rest of the world. And if the monetary easing raises domestic demand, including demand for imports, that is good for the rest of the world. Hence there is no beggar-thy-neighbour aspect of policy.

Now consider a single large open economy. The analysis is due to McCallum (2000) and Svensson (2001) – the latter proposed the “foolproof way” of avoiding deflation and restoring growth in Japan. The authorities need to create inflationary expectations, and they must accept a short-run inflation rate above their long-run target. So they should go to a price-level target with a jump: bring down the exchange rate, if necessary with (unsterilised) intervention. This also expands the monetary base and their holdings of (typically) short-term foreign government securities (e.g. the UK and Germany). If the exchange rate does not depreciate, then the markets do not expect inflation – the policy has failed, or the extent of intervention has been inadequate and should go up. It is very important to note that this is not QE, as the authorities are not purchasing domestic long-term assets.

There are spillovers, of course, and they are beneficial. Escaping the liquidity trap at home does not hinder other nations from achieving their monetary policy objectives, unless they too are in a liquidity trap (of which more below). And if they are, then expansion in the home country (escape from the liquidity trap) raises the world natural rate of interest and hence alleviates the others’ liquidity traps.

Now move to a world of big countries, all at the zero bound. Ideally, all should inflate in a coordinated fashion, so that exchange rates are not affected. Uncoordinated policies could bring currency volatility. This destabilises markets, creates a highly uncertain environment for business, and raises pressures for trade policy interventions. With simultaneous QE, there might not be first-order effects on the exchange rates between the big countries. And simultaneous QE could achieve simultaneous expansion, which would have first-order effects on the natural rate of interest, helping to restore more normal monetary conditions.

Although simultaneous QE in all big economies might wash out in exchange rates, there are also many small economies – including the emerging market countries. What happens in such a world? Some of the additional liquidity in the economies at pursuing QE at the zero lower bound flows to countries with higher interest rates. Their currencies appreciate, and expected appreciation attracts more capital flows. (Yes, the carry trade is indeed profitable; uncovered interest parity is violated.) Global liquidity goes up, foreign-exchange reserves rise in those smaller countries that intervene to try to resist appreciation. The big economies are exporting bubbles. But global rebalancing should be achieved by raising consumption in the rest of the world, rather than investment in financial assets and real estate.

Meanwhile, if one large economy does not participate (e.g.. the Eurozone), then its currency will also appreciate, with accompanying political and trade tensions. And volatility between exchange rates of large countries is more harmful than if it is confined to small countries.

Here, it is vital to see that simultaneous QE is not the same as simultaneous exchange-rate intervention. In the latter case, central banks will typically hold reserve increments in foreign short-run debt (as noted above). If all do this, the net effect is that of domestic open-market operations in short-dated government securities. At zero interest rates, these securities are perfectly substitutable for money. There is a liquidity trap, so exchange-rate intervention at the zero lower bound achieves nothing – whereas QE does seem to have an impact on both interest rates and exchange rates (see e.g. Joyce 2010).

If the large developed market countries do more QE, however, then the flow of liquidity to the emerging markets may force the latter to respond. They may try to resist exchange-rate appreciation by intervening in the foreign exchange markets. Here we do have competitive devaluation – the “currency wars”. And if the emerging market countries do not sterilise the intervention, or if sterilisation is at least partly ineffective, then they experience inflationary pressures. So capital inflow controls look tempting – but experience suggests they may not be very effective, unless there is much broader financial repression (e.g.. China).

This is why we see statements like “The US will win this war: it will either inflate the rest of the world or force their exchange rates up against the dollar” (Wolf 2010). But there is a potential downside for the US. Substantial dollar depreciation will weaken the global position of the dollar, as it did in the late 1970s (Chinn and Frankel 2007).

Now consider fiscal austerity with zero interest rates. Suppose one large economy implements a fiscal contraction with all countries at the zero lower bound. Normally, Mundell-Fleming would say that fiscal contraction lowers the interest rate, hence brings exchange-rate depreciation, hence contraction abroad (and at home too, where the increase of net exports does not fully compensate for the fall in net government expenditures). But at the zero lower bound, there is no effect on the interest rate, so no depreciation through that channel. But there is still a risk premium in the uncovered interest parity condition: expected depreciation equals the risk premium (where this is the combined risk premium on the exchange rate and on the interest rate – bonds). Then all depends on whether austerity raises confidence. Does the risk premium rise or fall with expectations of future economic activity, and how does austerity affect those expectations?

If fiscal consolidation does not raise confidence in the home economy, then other nations take a double hit – a fall in activity in their home economies and exchange-rate appreciation against them. How might the rest of the world respond? Exchange-rate intervention – another salvo in the currency wars!

So what policies may we expect, and what will be their consequences? Bergsten (2010) and Gros (2010) have proposed “unconventional” ways in which the US might try to force China to allow faster appreciation of the renminbi. Bergsten suggests “countervailing currency intervention”, in which the US would buy renminbi in response to Chinese purchases of dollars. But this supposes that China’s capital controls can be circumvented – possible for marginal flows, but not for the $1 billion per day that China is currently buying. Gros suggests that the US (and Japan, which has complained about Chinese purchases of JGB) could “limit sales of their public debt henceforth to only include official institutions from countries in which they themselves are allowed to buy and hold public debt”. But this could apply only in the primary market – the secondary market for US government debt is wide-ranging and anonymous, not likely to be controllable in this way. And even if it were feasible, the interest-rate and exchange-rate effects of such a policy, not to mention the response to such “financial protectionism”, are sufficiently unclear as to make it highly risky.

The Fed will proceed with QE. It will not accept foreign constraints on its monetary policy, nor will it run an internationally “coordinated” or “cooperative” monetary policy. Its decisions will be determined by its view of how best to achieve its mandated goal: maximum employment with price stability, which the Ben Bernanke has just defined as “about 2 per cent or a bit below” (Bernanke, 2010). He also observed that actual inflation was significantly lower. There is nothing in the mandate about effects on the rest of the world except insofar as these effects might feed back onto economic activity and inflation in the US. And indeed they might if, for example, Fed policy were to affect the currency composition of emerging-market central bank portfolios. If a major further expansion of the Fed’s balance sheet were to provoke a shift out of dollar assets, US Treasuries in particular, that would affect US interest rates and the dollar exchange rate. But so far, the Fed’s policymakers, including its chairman, have shown no concern for this possibility.

That is perhaps short-sighted. The bond market vigilantes have ignored fiscal policies – they seem as insubstantial as the confidence fairy. But as noted above, the currency vigilantes have already responded to monetary policies. So do asset markets throughout the world. As Reuters reported on 15 October 2010: “Brazil’s benchmark Bovespa stock index hit a new high for the year on Friday as US Fed Chairman Ben Bernanke said current economic conditions warranted further monetary policy easing.” Indeed, global stock prices respond strongly to changes in US monetary policy (Laeven and Tong 2010).

If US monetary policy eases further, it will get the exchange rate depreciation that it wants. It will indeed win the currency wars. Conventional wisdom is wrong: The US can, after all, devalue the dollar. But there are costs:

- A wave of trade protectionism is not excluded, although its probability is low;

- More likely are capital account protectionism, in the form of emerging market capital controls; and

- Damaging exchange-rate volatility, including among the large countries, if QE is not coordinated (simultaneous).

Moreover, in the longer run, this could substantially weaken the hegemony of the dollar in the international financial system.

John Connally, then US Treasury Secretary, famously said in 1971: “The dollar is our currency, but your problem.” Like most aphorisms, the obvious truth in this remark conceals complexities. The “exorbitant privilege” that accrues to the issuer of the major international currency is not to be conceded lightly (Gourinchas and Rey 2007). And the consequences for emerging market countries and the global economy of a shift to multipolarity in international finance, like the shift of weight towards emerging markets in global growth and economic impact, will be very far-reaching.

Bernanke, B (2010), “Monetary Policy Objectives and Tools in a Low-Inflation Environment”, speech at FRB Boston conference, 15 October.

Chinn, M and J Frankel (2007), “Will the Euro Eventually Surpass the Dollar As Leading International Reserve Currency?”, in R Clarida (ed.), G7 Current Account Imbalances: Sustainability and Adjustment. University of Chicago Press.

Gourinchas, P-O and H Rey (2007), “From world banker to world venture capitalist”, in R Clarida (ed.), G7 Current Account Imbalances. University of Chicago Press for NBER.

Joyce, M et al. (2010), “Financial market impact of quantitative easing”, Bank of England Working Paper 393.

Laeven, L and H Tong (2010), “US monetary shocks and global stockprices”, CEPR Discussion Paper, forthcoming.

McCallum, B (2000), “Theoretical Analysis Regarding a Zero Lower Bound on Nominal Interest Rates”, Journal of Money, Credit and Banking. 32(4):870-904.

Neely, C (2010), “The Large-Scale Asset Purchases Had Large International Effects”, Working Paper 2010-018B, Federal Reserve Bank of St Louis.

Svensson, L (2001), “The Zero Bound in an Open Economy: A Foolproof Way of Escaping from a Liquidity Trap”, Monetary and Economic Studies. 19(S-1):277-312,

Wolf, M (2010), “Why America is going to win the global currency battle”, Financial Times. 13 October.