Crowdfunding for equities Fool s Gold Yahoo India Finance

Post on: 23 Апрель, 2015 No Comment

Any time both Democrats and Republicans fall over each other to pass a bill, it’s likely that political posturing rather than sensible substance is involved, and you should hold on to your wallet. A case in point: the Jumpstart Our Small Businesses Act, known as the JOBS Act.

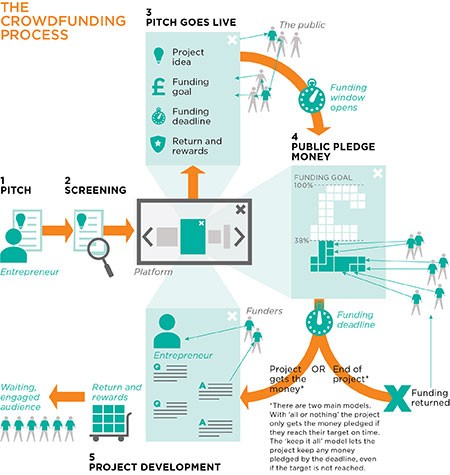

In March 2012, the U.S. House of Representatives approved the measure 390-23, the Senate followed with a 73-26 vote, and President Obama signed off on it soon after. A comment period on proposed U.S. Securities and Exchange Commission (SEC) rules to implement the crowdfunding part of the law ended Feb. 3. The idea is that a company can post a business opportunity on the internet to give the public — the crowd — a chance to invest after sharing information and evaluating the idea. An SEC spokeswoman says it’s not clear when a vote on final rules will make it on to the commission’s calendar. (See How to Use Crowdfunding to Start Your Business .)

The law is a combination of a bunch of bills designed to pare back investor protections to make it easier for startups to raise funds from a lot of Joe Sixpacks instead of the rich, “accredited” investors who typically bankroll such efforts. Lawmakers wanted to democratize investment and let everyone in, just like everyone has the freedom to sleep under a bridge. You know who fares well in such situations — and who doesn’t. Eventually, according to one backer of the legislation, some genius, probably a Capitol Hill staffer, renamed the bill to make it easier to sell by making it look as if it’s about creating jobs. If history is any guide, the only jobs involved will be those investors have to find after they lose their shirts.

Bad Legislation

The law exempts crowdfunding transactions from SEC registration requirements if the amount a company raises doesn’t exceed $1 million in a 12-month period. It also limits individual investments in a 12-month period. If you make or are worth less than $100,000, the limit is the greater of $2,000 or 5% of annual income or net worth. If you make or are worth $100,000 or more, the limit is 10% of earnings or net worth and a maximum of $100,000 a year. It’s not clear how anyone will monitor those limits. The trades have to go through a registered broker or new online entities called “funding portals.”

Why is this such bad legislation? For starters, it solved problems that either didn’t exist or were typical, self-correcting business cycle problems. Venture capital, for example, was hardly scarce. According to PitchBook, the last three years were the industry’s best in the last decade. And while bank lending to small business has slowed, BLS data show that the pace of startups has picked up, rising from a trough of 169,000 in September 2009 to 201,000 in December 2012. And there are plenty of other funding sources: relatives, peer-to-peer lending, micro-lending, and other exemptions the SEC provides if the investors are accredited investors (income exceeding $200,000 or net worth exceeding $1 million). Non-equity crowdfunding raised $1.5 billion in 2011, according to an industry report.

Even if we assume the JOBS Act could marginally help startups, it is poison for investors. That’s why a roundtable sponsored by the Milken Institute and Georgetown Law School recommended a warning label for these investments similar to the Surgeon General’s for cigarettes. Think skull and bones. The reason is that most of these investments are doomed to fail.

Half of Startups Fail

According to the Bureau of Labor Statistics (BLS), roughly half of all startups are out of business after five years. Venture capital investments, which attract the smart money, fare even worse. Up to 40% lose investors’ entire investment, up to 80% don’t hit the projected return on investment, and up to 95% don’t meet other projections, according to Shikhar Ghosh, a Senior Lecturer at Harvard Business School (HBS) who studied more than 2,000 startups. He told the publication HBS Working Knowledge: Failure is the norm. Because crowdfunding investments will be at an earlier stage of development than venture capital investments, the SEC believes “issuers that engage in securities-based crowdfunding may have higher failure rates.”

Making matters worse, because there is not a liquid, transparent market for the shares, you will have no idea if the price you can get for your shares is reasonable — if you can find a buyer at all.

Despite these considerable drawbacks, lots of people will take the plunge. As behavioral economists have shown in such books as Duke Professor Dan Ariely’s “Predictably Irrational” and Nobel Laureate Daniel Kahneman’s “Thinking Fast and Slow,” we are not rational economic actors. As Kahneman puts it: “When the top prize is very large, ticket buyers appear indifferent to the fact that their chance of winning is minuscule.” Investors focus on Google and Facebook instead of the innumerable companies that went belly up when the dotcom bubble burst in 2001 and in every year since.

Hope Isn’t a Strategy

But hope is not a strategy or a wise investment policy. Yet it will be a strategy many people adopt. Consider the comment to the SEC of an ebullient Robert Romano of Manassas Va. who said crowdfunding may “free up some $6 trillion in savings to be used readily in investments, and potentially create millions of jobs.” Or the comment from Darrell M. Stafford, a certified managerial accountant and real estate broker from Arroyo Grande, Ca. “Why not allow the little guy, with the big idea, to offer the little guy, with a little money, an opportunity to make some money (more than the 1% the banks pay)?”

Not only is there intense interest in investing, pressure is building for the SEC to roll back even the modest regulations it is proposing. The SEC plans to require companies to provide a description of the business, its debt, the results of previous crowdfunding activity, use of the proceeds, and names of officers and directors. Financial statements, depending on the offering’s size, must be certified by the principal executive officer, reviewed by an independent accountant, or audited.

Better Off in Index Funds

That’s too much for some, who evidently would like a return to 1928 laissez-faire. You know how that ended. For example, Paul Trowe of Austin,Texas-based Replay Games, a development, publishing, and financier for independent game developers, complained to the SEC: “It looks like the only jobs you’ll be creating with these new rules are for SEC attorneys. Seriously, are you guys on our side or what?” The National Association of Homebuilders declared that “the proposed rule’s intense focus on investor protection does not follow the intent of Congress to ease capital access for small businesses.” And David R. Burton, a senior fellow at the conservative Heritage Foundation, warned that “the sum total of the costs that will be imposed by the proposed rule are likely to be near, or exceed, the point where issuers will find crowdfunding to be uneconomic.”

We can hope that Burton is right and that the SEC withstands the drumbeat for softening the rules. Investors will be better off putting money into market index funds so something will be there when they want to get the money out. And they will find a buyer. They should not delude themselves into believing that, like the lottery ticket they just bought, an investment in a startup will pay off big time. It won’t.

More From Investopedia