Credit Suisse Making Fat Tails Work for You

Post on: 15 Июль, 2015 No Comment

Both theory and empirical evidence on the success of certain modified risk techniques show that they can do what they are designed to do. They can accommodate fat tail events and diversify a portfolios sources of return.That is the gist of a Credit Suisse (NYSE:CS ) white paper prepared by Yogi Thambiah and Nicolo Foscari.

The paper is entitled, New Normal Investing: Is the (Fat) Tail Wagging Your Portfolio? a title that neatly encapsulates two bits of finance jargon. First, there is the phrase new normal, coined by PIMCO in 2009, to express the view that investors and managers shouldnt wait for any return of the good-old-days of the boom in real estate and its derivatives. They should, rather, accustom themselves to the world that the bust-ups of 2007-08 have created.

The new normal, on Thambiahs and Foscaris account, includes an enhanced role by central banks, implementing monetary policies through open market operations, closer interconnections of banking institutions worldwide, much painful de-leveraging, and persistently high levels of unemployment.

The Tails on a Bell Curve

The second buzz phrase, fat tail, is drawn from the world of statistics, and plays off the familiar Gaussian distribution, or bell curve.

In this distribution, more than 68 percent of outcomes will be found with one standard deviation of the mean, and 95 percent of the outcomes will be found within two standard deviations. The tails, the bits of the curve at or outside three standard deviations, are then quite skinny.

But finance is not a Gaussian world. Extreme events simply occur more frequently than they would in such a world. It isnt quite right to say that in the old normal distribution was Gaussian and in the new normal it isnt. The distribution of outcomes in finance may never have been Gaussian. They certainly didnt seem Gaussian in October 1987 for example. But various models and equations in modern finance theory incorporate Gaussian distribution at least as a matter of convenience.

It is fair to say that the financial world from circa 1973 to 2007 was one in which many participants (wrongly) assumed skinny tails. That old normal wont return. As the renowned mathematician Benoit Mandelbrot has explained. the volatility of a market exhibits a power law, i.e. a correlation in which the size of a price change varies with a power of the frequency of the change.

To render this idea intuitive, consider the possibility that ABC Inc.s share price will change from $75 to $76 in the course of an hours trading. Now, consider the possibility that ABC Inc.s share price will change from $76 to $176 in the next hours trading. Even non-quants would consider the latter much less likely than the former. The larger price changes are much less frequent, for any fixed amount of time, than the smaller ones.

How much more frequent? This is the question of identifying the power for the power law. The bell curve is but a special case: one in which the power equals -2. Another special case, the Cauchy distribution, one with much greater volatility, is what results if we set the power as -1. We can call -2 the mild power and -1 the wild power.

As a matter of empirical fact, the fluctuation of stock prices exhibits a fractional power, somewhere between mild and wild. This isnt quite how Thambiah and Foscari put matters, but at least part of their underlying point is Mandelbrots.

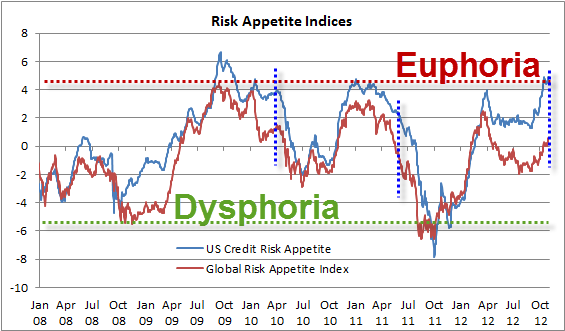

Since the Crisis

They also maintain that underlying realities have changed since the crisis and as a consequence thereof. The tails, always perhaps fatter than theory would have it, have become fatter than they were. Governments responded to the crisis of 2007-08 by borrowing large sums of money. This will eat into the growth of their national economies in the years to come. The new normal will see a persistence of high unemployment.

The consequence, as the Credit Suisse authors observe, is that investors relying on mean-variance optimization and normal distribution models can potentially underestimate a portfolios drawdown risk and end up with sub-optimal portfolio allocations.

What to do? Institutional investors can protect themselves against fat tails by using derivatives to hedge against volatility (variance swaps); or by using tail-risk protection indexes that aggregate variance swaps; or by following equity options strategies such as traditional put options, or option collars.

Also, these authors suggest, investors can make use of extreme value theory, and Conditional Value at Risk (CVaR) optimization, not merely to protect against the fatness of tails but to make that fatness work in their favor.

For illustrative purposes only, the authors have designed a portfolio that, on their calculations, ought to provide investors with a better return than has the S&P 500 index as a matter of history and that ought to do so while significantly reducing risk as measured against the same benchmark.