County Tax Liens A Good Way to Acquire Cheap Property

Post on: 8 Июнь, 2015 No Comment

County Tax Liens for Acquiring Property?

One of the greatest misconceptions in the real estate investing world is that county tax liens lead to cheap property acquisition. All on an ongoing basis, for pennies on the dollar.

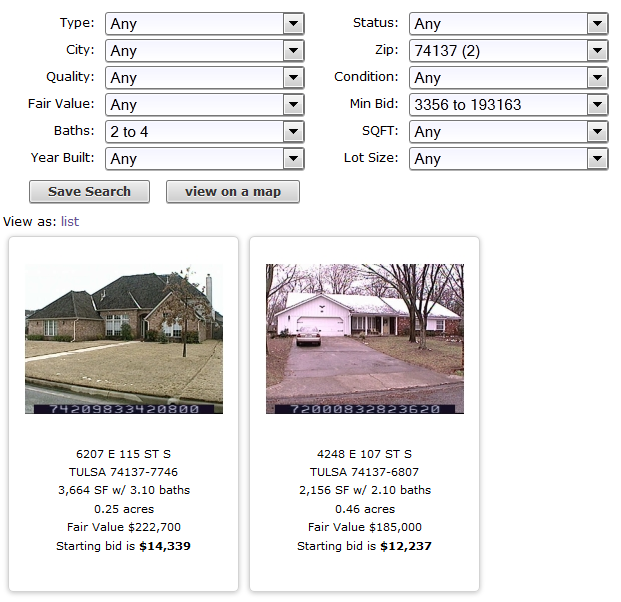

Examples are given on late night TV and other sources of properties worth $30,000 $200,000, being obtained for as little as a few hundred dollars over and over again. Nothing could be further from the truth.

In the real world, county tax liens on property provide an above-average return on investment. It looks especially good versus traditional guaranteed investments like bank accounts and CDs. But this is when the investment in the county tax lien is properly managed.

Tax lien gurus often cite that county tax lien investments are guaranteed by the government. This is also false. County tax liens are guaranteed by the underlying property only. And only if the tax lien buyer follows proper procedure throughout the process.

In exceedingly rare cases, a county tax lien may go to maturity and lead to acquisition of the underlying property. And in these cases, the underlying property CAN BE worth many times the investment in the lien.

However, the underlying property may actually be worthless, or worth little more than the investment made in the lien itself and subsequent costs.

In order to obtain the underlying property if the taxes are not paid, strict procedures must be followed by the lien buyer.

Therefore, county tax liens are not a passive investment at all. Significant time must be spent prior to the investment, performing due diligence.

Due diligence consists mostly of making sure that any county tax liens purchased are against properties worth at least as much as the investment in the lien and subsequent costs.

Many tax lien lists consists of thousands of properties, all of which must be analyzed prior to the sale.

Because several bidders may want the same group of county tax liens at the sale, there is usually a bidding method at the sale. Either the cost of the lien is bid up, or the interest rate is bid down.

In either case, the investment becomes less attractive as the bidding continues. Not all liens you may desire to purchase will be available for the minimum bid or maximum interest rate.

County tax liens are really only worth getting involved in if you have a large sum (well in excess of 6 figures) to invest. You must also be willing to take an active role in the management of the investment.

An investment of less than 6 figures provides only several percentage points difference over a federally guaranteed investment. Therefore only a few thousand dollars difference in return is realized. The added risk and due diligence needed to participate in any kind of tax sale is not worth the extra return.

For larger investments, especially in the millions of dollars, its more efficient to do the research and the effort can be worth the while.

At every large sale, its inevitable that several properties, or even several dozen properties, will be lost by the owners as a result of the sale.

However, to have a chance at acquiring all of these properties by buying tax liens, you would have to buy every single county tax lien offered at the sale.

In order to actually acquire properties for pennies on the dollar, just stay out of the sale and let all of the other investors buy the liens offered.

Let them do the due diligence and determine which liens are worth investing in (many times 50% or more of the county tax liens offered at a sale dont even sell).

Then, once the redemption period is about to expire, see which liens are still unpaid. Simply approach any property owner with a lien remaining with a last-minute proposal to buy the property or get it under contract before it is lost.

Youll save 95% of the due diligence time, and you wont have to invest any money. You wont have to follow procedures like noticing. You wont have to get a quiet title on the property.

You can just get involved at the last minute, and buy unwanted properties for a token amount or get them under contract and flip.

Profit from county tax liens like the pros get my Underground Tax Sale Secrets guide now (below).

Profit From Tax Delinquent Property NOW!

This little-known source of distressed property is the absolute best way to profit in real estate today. Why? Most properties that are about to enter the tax sale process are free and clear! I’ll show you why, and how to profit from them, in this free download!

Enter your email address below for FREE Instant Access to my Underground Tax Sale Strategies Insider’s Guide: