Costly Investment mistakes to avoid at all costs Part I

Post on: 5 Июнь, 2015 No Comment

.

Life can only be understood backwards; but it must be lived forwards.

In the process of investing, one often makes mistakes. There is nothing wrong in it. However, repeating the same mistakes should be avoided. This is so much easier said then done. Never-the-less, we can always try. So, Here are some of the most common investing mistakes which investors generally make and some of which even I had made in the earlier part of my investment years.

I have been investing since 1997. Earlier part of the investment was when I was in US and then later after moving to India in 2005. I have been investing in both shares and real estate.

Of course, learning from the mistakes, continually, the investing experience has truly been rewarding experience. You can also cultivate good habits of investing by avoiding the following most common mistakes.

So here goes..

#1. Investing without a Goal

If one does not know to which port he is sailing, no wind is favorable.

Beginning investors often begin by Casual Investing without any goals. This quite often leads to pain and heartburn because, without any goals, investments are treated as speculation instruments solely aimed at making more money in a shorter span of time, by chasing market performance and acting on market swings, something similar to get-rich-quick scheme. (Speculation is a different ball game and of course, many people do succeed at it. However as in Investments, there are different set of rules, full time efforts, and a different mind set and discipline which needs to be followed.).

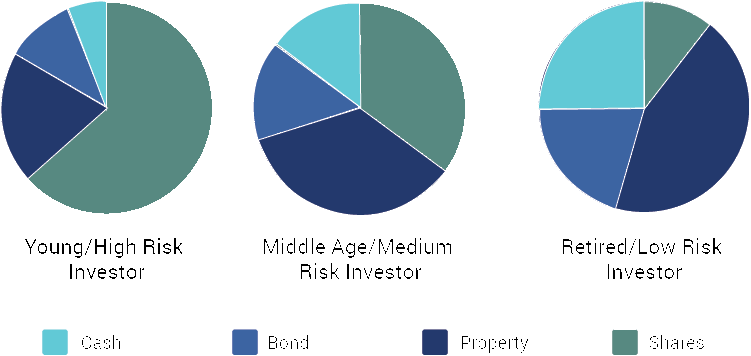

Different goals require different strategies. Broadly goals can be divided into three types according to time frames.

Long term Goals — typically 7+ years (e.g. retirement corpus, child education, child marriage etc.) should invest in Long term high risk/high return growth investment assets.

Medium term goal — typically 2 7 yrs (e.g. deposit on house, planning a sabbatical from work etc.) Require balanced risk investment strategy,

Short term goals — typically less than 2 yrs (e.g. overseas holiday, purchase of car, any major house improvement expense etc) require conservative investment strategy.

So, Some of the following questions have to worked upon and answered to full satisfaction before setting out for investment: What am I investing for (Goal)? How much do I need for the goal to be met? What is the time frame of the investment going to be? Where do I need to invest? Should I do lump sum investment or Periodic investment? And so on

Remember, failing to plan is planning to fail

#2. Not Starting to invest Early enough

This is one of the most common mistakes made by investors. Most of us keep waiting for the right time, or the right price, or the right time to begin investing. Remember, Time in the market and not timing the market is the simple way to success in investing. Please read my earlier post on Invest early, Invest Wise, Utilize the power of compounding.

#3. Emotional Investing. being short -sighted, falling to greed and fear, Not following the Investment Plan

A wise man should have money in his head, but not in his heart. –Jonathan Swift

Investing is a long term deliberate process. Long term investment strategy may not make you super rich overnight, but it will not make you a pauper either.

Getting emotionally involved with the portfolio movement is another mistake committed by many. Becoming greedy when markets rise or fearful when markets drop. Paper Money plays on emotions. Investors begin to time the market. Emotional buying and selling of shares based on sentiments often leads to selling low when market sentiments are bearish OR buying high when market sentiments are bullish.

This often results in additional costs, lost opportunities. And of course, if at all the investment was to meet some goals, and then all of that goes for a toss.

To be contd. Part II. You can read Part II of this series here. (Costly Investment mistakes to avoid at all costs Part II)