Correlation Between Stock Prices Earnings

Post on: 25 Апрель, 2015 No Comment

Identification

Corporations with publicly traded stocks report their financial results quarterly, or four times per year. At this time, investors hold a high interest in the reported earnings per share (EPS)—the net income for the quarter divided by the total number of company shares outstanding. The total of four quarters earnings makes up the annual earnings per share, while the annual is the number reported by financial websites such as Yahoo Finance and Google Finance on the stock price screens for the individual companies.

Considerations

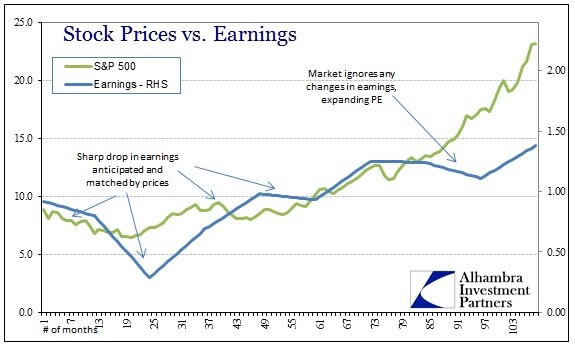

In all cases, P/E remains a relative value measurement. Investors can use it to check a company’s current P/E to the historic average, or they can compare P/E with that of competitors or the overall market, or analyze it in relation to the growth in earnings per share. Growth stocks have high P/Es, as investors bid up the share price to participate in the future growth of the company.

Types

The classic P/E ratio is based on trailing earnings, or the earnings from the past four quarters. This P/E ratio shows the relationship of the current share price to the previous year’s net earnings. Many investors like to look at the forward P/E—the current share price divided by the projected earnings for the next four quarters. The forward P/E gives the investor an idea of the company’s value based on its probable future profits. Not all companies can make the projected earnings, however, so forward P/E gives just a possibility of the stock’s future performance.

Significance

References

More Like This

The Importance of a Price/Earnings Ratio

How to Write a Sales Strategy Plan

What Is the Relationship Between Profits & Dividends?

You May Also Like

Companies use stock splits for a number of reasons, and it is important for all investors to understand how those stock splits.

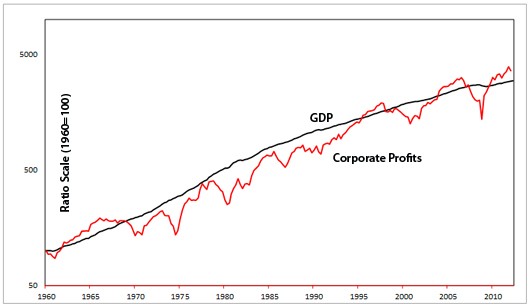

Economic growth and inflation go hand-in-hand. Real estate and stock market prices are two indicators of economic performance. Of course, the true.

When a company issues additional shares, it affects both the existing shareholders and the new shareholders in terms of how the value.

The purpose of calculating a correlation coefficient between stocks, or between a stock and the market, is to find the strength of.

Determine the company's earnings per share. This value, often abbreviated EPS, tells us how much the company earned last year per each.

In financial theory, the value of a stock is closely tied to the expected dividend stream. Consider stocks A and B, such.

Investors use price-to-earnings ratios, or P/E ratios, to determine the relative value of a share of stock. A stock's P/E ratio measures.

Stocks represent a unit of ownership in a public company. In general, an increase in demand for the stock also increases the.

Bonds are issued with a fixed rate of interest payment called the coupon rate. A $10,000 face amount, 6 percent coupon bond.

In June 2010, a U.S. equity strategist for Barclays, Barry Knapp, told Bloomberg that correlation is one of the great lessons of.

Corporate finance has a definition of any financial or monetary activity that deals with a company and its money. Typically, the finance.

When a publicly traded company reports its quarterly earnings, one of the metrics that it provides is the earnings per share. Professional.