Connecting ProfitLoss P&L and Balance Sheet

Post on: 14 Июль, 2015 No Comment

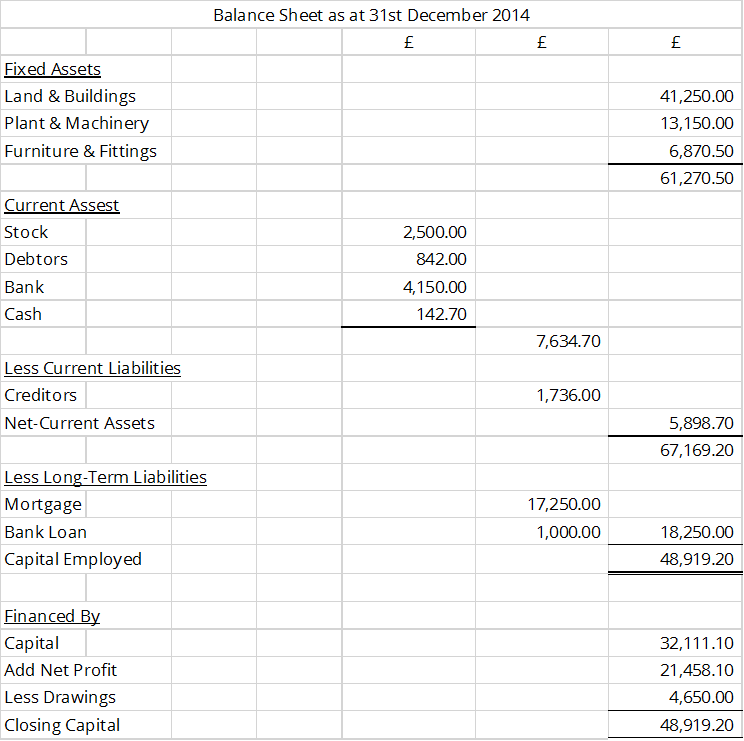

Financial reports don’t show lines of connection between the Profit and Loss [P&L] and Balance Sheet. Each financial statement is on a separate page in most financial reports, so drawing lines of connection would be awkward. Because you see no visible lines, you have to make connections between sales revenue and expenses and their related assets and liabilities. In other words, you have to know how to match up items in the P&L with items in the balance sheet. Accountants who prepare financial statements presume that users know these critical links between the P&L and balance sheet. Accountants don’t provide a roadmap of the arteries between the profit report and financial condition report. At the same time, many financial analysis ratios are based exactly on these connections. For example, the asset turnover ratio hooks up sales revenue and total assets .

Advertisement

The P&L statement in deviates from standard practice in one respect: Just one total amount for all operating expenses, excluding depreciation, is disclosed. The P&L reports of most businesses usually include several operating expenses in addition to depreciation. For the purpose of this chapter, however, we need just one total amount for all operating expenses excluding depreciation.

Say that te business is organized legally as a corporation, and you own a sizable percent of its capital stock shares. The majority of shares are owned by outside investors who aren’t involved in the management of the business, although they sit on your board of directors.

What do the financial statements reveal about your business? The financial statements say that you made a profit for the year and that your business’s financial condition is reasonably healthy. Your bottom-line net income equals 3.75 percent of sales revenue. Net income divided by owners’ equity at year-end equals 26 percent, which is a respectable rate of return on owners’ equity capital. These are two very important benchmarks of financial performance. You need to earn a satisfactory return on sales (profit as a percent of sales revenue) in order to earn a satisfactory return on equity capital (profit as a percent of owners’ equity).

Knowing connection between the Profit and Loss and Balance Sheet addresses a different financial management imperative :

- Is your balance sheet in proper alignment with your P&L statement?

- Are the balances (amounts) of your assets and liabilities consistent with the amounts of your sales revenue and expenses?

- Are you controlling your assets and liabilities?; or

- Are you letting them float around without close management attention?

Changes in assets and liabilities during the period affect cash flow from profit (operating activities). The chapter also explains that depreciation is not a cash outlay in the period in which depreciation expense is recorded. Understanding cash flow from profit is extremely important .

This post, outlined the relationships between sales revenue and expenses and the assets and liabilities directly connected to the profit-making activities of a business . If you don’t control the sizes of your assets and liabilities, then your financial condition can end up in deep dodo.

Following are the key connections between the P&L statement and the statement of financial condition :

- Sales revenue, being the overall size measure of a business, is an indicator of how much cash a business needs.

- Making sales on credit generates the asset accounts receivable.

- Products sold to customers, the cost of which is recorded in cost of goods sold expense, typically are from a stock of products held for immediate delivery to customers; the cost of unsold products awaiting future sale is in the inventory asset.

- Retailers and wholesalers use credit to purchase the products they sell; the liability for unpaid purchases is recorded in the accounts payable account.

- Certain operating costs are paid in advance, before being recorded as expense; the amount of these prepayments are held in the asset prepaid expenses.

- Many operating supplies and services needed to run a business are purchased on credit and aren’t paid until later; the costs are recorded in the accounts payable liability account.

- Some operating expenses are recorded based on calculations and estimates of costs as they accumulate and accrue over time that will not be paid until later; the amounts of these unpaid costs are recorded in an accrued expenses payable liability account.

- The cost of fixed assets (except land) is allocated to depreciation expense over their estimated useful lives.

- The amounts of short-term and long-term notes payable and the interest rates on these debt instruments determines interest expense.

It’s a normative, or ideal, balance sheet — as if all your assets and liabilities are in precise agreement with your sales revenue and expenses. The following explain each connection in more detail.

Some portions of your cash account balance [balance sheet] comes from the sales revenue [Profit & Loss] directly. Consider below entry will be made every cash based sales made :

[Debit]. Cash = $10

[Credit ]. Sales/Revenue = $10

Meaning that balance of cash account is increased by $10 due to $10 sales revenue have just made.

Credit Sales Revenue and Accounts Receivable

A business offers to sell its products (and services) on credit to other businesses. A credit sale is recorded as soon as the sale is consummated, which generally is when the customer takes possession and the title passes to the customer. Depending on the credit terms, the seller does not receive cash until later .

Every credit based sales [profit and loss] made will increase the accounts receiveable [balance sheet] balance. Consider the following journal entry:

[Debit]. Accounts Receivable = $50

[Credit]. Sales [credit based] = $50

Meaning, the $50 credit based sales creates $50 increase on the accounts receivable.

Cost Of Goods Sold and Inventory

Businesses sell products from inventory or on order. In other words, a business has an inventory of products ready for immediate delivery to its customers, or it takes orders for later delivery. (A business can do both, of course).

Decrease in inventory balance [balance sheet] increase cost of goods sold [profit and loss]. The following journal entry is made when moving your inventory to your customers [sales]:

[Debit]. Cost Of Goods = $100

[Credit]. Inventory = $100

Meaning, cost of goods sold is increased by $100 due to the inventory decrease [since you move them to your customer, or sales happened] by $100 .

Inventory and Accounts Payable

Most business-to-business selling and buying is based on credit. If your credit rating is very poor, then your sources may ship products only COD (cash on delivery). If your credit rating is good, your vendors may give you 30 days credit, or one month, to pay for your purchases .

Every credit purchase [either raw materials, supplies or finished goods] will increase your accounts payable [balance sheet], and every purchase made increases the inventory [balance sheet] of course. So some portion of your accounts payable caused by inventory increase.

Let’s assume Lie Dharma Putra Company purchase 10 units iphones at $9,000 in 30 days credit. Lie Dharma Putra records this purchase as follows :

[Debit]. Inventory [10 unit iphones] = $9,000

[Credit]. Accounts payable = $9,000

Operating Expenses And Prepaid Expenses

Businesses pay in advance for certain expenses. Insurance premiums, for example, are paid for before the cost is allocated to expense over the life of the insurance policies. A business stockpiles office, computer, and shipping supplies before they’re actually used and charged to expense. In some locales, property taxes are paid at the start of the tax year, and the amount is allocated to expense each month or quarter. When prepaid, the costs are recorded in an asset account called prepaid expenses. At any one moment in time, this asset account has a balance, which is the amount of prepaid costs that haven’t been charged to expense yet. This particular asset is listed last in the current assets section of the balance sheet.

Operating Expenses And Accounts Payable

In contrast to prepaying some expenses, a business records many expenses before they’re paid. Unpaid operating expenses are recorded in the liability account called accounts payable . If your business has a good credit rating and you have a long record of paying your bills on time, you’ll have no trouble buying services and operating supplies on credit.

Say that you buy utilities (gas, electricity, telephone, Internet, and so on) on credit. Your lawyer and CPA extend 30 days credit to your business, as do virtually all your vendors and suppliers. One other point: Your business has invoices for the amounts recorded in accounts payable. As a matter of fact, the bills (invoices) received from your vendors and suppliers are the source documents used to record the expenses.

Could the amount of accounts payable for operating expenses in the balance sheet ever be zero? Well, it is unusual, but we can think of two opposite situations in which it would be true, or almost true. One is when the credit rating and bill paying history of a business is so bad that no one will extend credit—the business has to buy everything COD. The opposite case is one in which a business has an excellent credit record, but is so conservative that it pays every invoice the same day the invoice is received.

Operating Expenses and Accrued Expenses Payable

Certain operating expenses accumulate, or accrue, in the background as it were. The business doesn’t directly purchase these things and doesn’t receive invoices for them. For example, your business gives employees two weeks vacation per year and pays for sick leave. Suppose that your real estate taxes are paid once a year in arrears, or at the end of the tax year. As you progress through the year, you’re approaching the date when you’ll pay the annual property tax. You sell products that have to be serviced after the point of sale under terms of the warranty and guarantee on the products. In short, the amounts of certain expenses pile up during the year, which will be paid sometime later.

A basic principle of profit accounting, known as the matching principle, is that the full amount of expenses should be recorded in the same period as sales revenue. It doesn’t make sense to record revenue from sales of products in one period, but to delay recording some of the expenses of making the sales until the next period. This is good theory, without a doubt. But recording all expenses that should be matched against sales revenue for the period is easier said than done. The crux of the problem centers on those expenses that accrue like a thief in the night, as it were. The amount to record for utilities expense is simply the amount on the invoice from the gas and electric company for the month.

In short, your Controller makes estimates of those operating expenses that gradually accumulate during the year. These are real liabilities that will have to be paid sometime later. The liabilities for these expenses are accumulated in the accrued expenses payable account. The actual titles for this liability vary widely from business to business. You see quite a range of titles. (In contrast, the title accounts payable is fairly standard for purchases on credit).

The size of a business’s accrued expense payable liability can range from relatively small to fairly large. Based on the experience of your business, this liability tends to run about six weeks of your annual operating expenses.

Accounting for accrued operating expenses is very tricky and open to manipulation (not that you would even think of fiddling with your books, of course). We won’t bore you by discussing technical details regarding estimating accrued operating expenses. If you have a free moment (not too likely, we assume), you can ask your Controller for a briefing regarding the main issues in estimating operating expenses for your particular business.

One or two major issues may deserve your attention. Frankly, many small businesses don’t make much of an effort to record these types of expenses, given the difficulties in estimating the costs. Generally speaking, accountants tolerate not recording the accrual of such costs. The expenses are recorded on a when-paid basis, which is too late. Not recording the expenses on time causes somewhat of a mismatch between sales revenue and expenses, but as you’ve heard said, “It’s close enough for government work”.

Fixed Assets and Depreciation Expense

Most businesses own at least some, and perhaps all, of the long-term operating assets they need to make sales, maintain an office, store inventory, deliver products to customers, and so on. These resources are informally called fixed assets because they’re relatively fixed in place and aren’t held for sale in the normal course of business. Examples of fixed assets include land and buildings, furniture and fixtures, land improvements (paved parking lots, landscaping, sidewalks, and so on), computers, delivery trucks, tools, computers, and many types of equipment. Interestingly, accountants generally don’t use the term fixed assets in a balance sheet. Rather, the more common title for these assets is property, plant and equipment .

The cost of a fixed asset (except land) is allocated to depreciation expense over the estimated useful life of the asset, which can be as short as three years to 39 years (for buildings). The useful life estimates permitted for realistic estimates for the actual useful lives for its fixed assets. A building is depreciated over 39 years, whereas its actual use may run 50 years or more. Also, the income tax law permits front loading of depreciation; more depreciation expense is recorded in the early years than in the later years.

This tilting of depreciation expense toward the early years is called accelerated depreciation. The main alternative is the straight-line method, in which an equal amount of depreciation expense is recorded in each year of the useful life of the fixed asset .

In recording depreciation expense, the accountant doesn’t decrease the cost balance of the fixed asset account, which you may think would be the way to do it. The fixed asset is wearing out or losing its economic usefulness to the business. So why not decrease the fixed asset account by the amount of depreciation expense? Instead, depreciation expense is recorded in the contra account called accumulated depreciation. The balance in this account is deducted from the cost balance in the fixed asset account.

The main purpose is to report fixed assets at their original cost in the balance sheet and to show how much of the original cost has been deducted over the years as depreciation expense. The idea is that the original cost of fixed assets has information value to users of the financial statement. Deducting the balance of accumulated depreciation from the original cost balance gives the book value of the fixed assets. In any case, the cost of fixed assets drives depreciation expense.

Notes Payable And Interest Expense

The total amount of borrowings (typically on the basis of notes payable and a line of credit) and the interest rates on the debt drive the amount of interest expense. Many lenders operate on the assumption that the risk in loaning money to a small business is greater than to a larger business, which has more financial management sophistication. Also, there is the size factor. Small business loans are smaller than large business loans, of course, which means the lender has a smaller base to work with relative to its loan-processing costs. So, the lender compensates for the smaller loan base by charging a higher interest rate. Also, the lender may tack on other loan costs, such as origination fees, and these tend to be a higher percent of the loan compared with a larger loan that is

charged the same fee.

Side-Stepping Around Two Other Connections

At the end of the year, your business probably had a small amount of accrued interest payable on your short-term and long-term notes payable. Accountants calculate the exact amount of interest expense that has accrued to the end of the year since the last interest payment was made in order to record the full amount of interest expense for the year .

The accrued amount of interest is recorded in the accrued interest payable liability account. Also, a small fraction of your income tax expense for the year may still be payable at year-end. The unpaid amount is recorded in the income tax payable account.

Accrued interest payable and income tax payable are in the same nature as the accrued expenses payable account discussed for operating expenses. In fact, many companies lump together all accrued expenses in one liability account — although financial reporting practices vary quite a bit in this regard. In most businesses, accrued operating expenses payable are much larger than accrued interest and income tax payable. (If a business is a passthrough tax entity, it doesn’t have income tax expense).