Comparing BRIC by BRICS

Post on: 16 Март, 2015 No Comment

Home Foreign Policy Comparing BRIC by BRICS

Posted By TIE on Sep 14, 2013 | 0 comments

By Satyajit Mishra

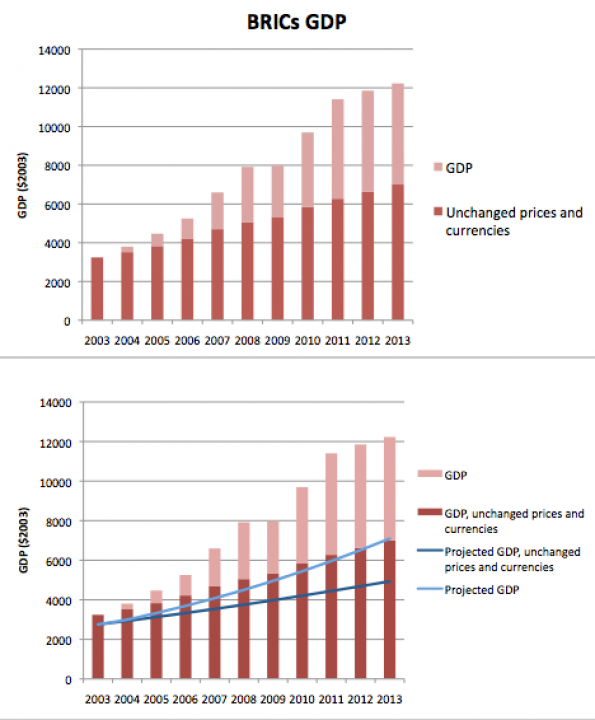

Initially known as the BRIC an acronym for the emerging economies of Brazil, Russia, India and China combined; started gaining prominence as BRICS, with its newest entrant South Africa in 2010. This group of newly industrialized countries have significant influence on global and regional affairs. The emergence of BRICS represents an important change in the global economy; BRICS countries have been credited with nearly 50 percent of the world’s economic growth. They make up over 25% of the world’s GDP. Collectively they represent new opportunities, new resources and new terms of engagement.

But how big a part does South Africa have in all this?

South Africa’s growth rate of 2.1% is well below the BRICS average. Their share of BRICS GDP is only 2.5% while their share of world GDP is a paltry 0.7%; the lowest share amongst the BRICS. In fact South Africa is the only BRICS nation whose share of world GDP has kept falling over the years.

While much of the emerging world is struggling with current account deficits, external debts and fluctuations in currencies, South Africa seems to be more vulnerable than others.

(Data Source: The Economist, Sept 7 th 2013)

A large current-account gap implies lots of net borrowing from abroad, which could be a warning of a credit crunch if funding dries up. At 6% of GDP South Africa has the highest deficit. Foreign investors, who have pumped capital into South Africa to drive economic growth beyond what it could achieve on its own, will begin to question whether economic growth can provide an adequate return for their investment.

While Brazil and India have had disastrous falls of 16.2% and 20.7% respectively, South Africa has had it even worse. Its currency has fallen 21.6% since the start of the year, and unlike the Real and Rupee who have taken policies to fix this fall, the South African Rand is set to fall even further.

South Africa is the only BRICS nation to have a fall in the private sector credit. A 22% fall over the previous year only goes to show the poor investor confidence in firms and asset prices. It is getting increasingly hard for the private sector to operate and expand. Smaller firms face a lot of difficulties in financing their working capital requirements. Quite unlike the other BRICS nations.

(Data Source: The Economist, Sept 7 th 2013)

A high level of external debt, relative to a government’s stock of foreign-exchange reserves means that an economy lacks the means to tide borrowers through temporary difficulties. While the BRIC traditionally have moderate to high external debts; for South Africa this figure at over 70% is dangerously high. Debt will continue to accumulate because of servicing requirements and the principal itself. Instead of helping bridge the resource gap with external debt, external debt is now acting as a major constraint on capital formation in South Africa. No other BRICS nation faces such a challenge.

In order to combat the unexpected pullback of U.S monetary stimulus, the BRICS group of emerging economies are set to contribute 100 billion USD to create a fund to fight and stabilise the currency markets. While China is set to contribute 41 billion USD; Brazil, Russia and India will contribute 18 billion USD each. South Africa on the other hand will contribute a relatively measly 5 billion USD. A clear indication that South Africa simply isn’t big enough to be a member of the BRICS.

The only possible advantage South Africa could give the BRICS is access to the regional grouping SADC Southern African Development Community; a group of 15 countries with a total GDP of around $575 billion and a population of about 260 million, where South Africa is the driving force.

However, this advantage may be a curse for South Africa and the rest of Africa as a whole. Traditionally, the reward of selling the vast natural resources of South Africa and other Sub-Saharan African nations have gone to the political elite of the African nations and in turn to the Chinese. Not the people of Africa. South Africa may be opening up to a new form of imperialism, where China takes the primary goods and sells the manufactured goods.

Additionally, South Africa is increasingly being accused of being a puppet in the hands of the Chinese. Any policy formulation or action by the BRICS won’t represent a true and fair view; as China will have an automatic ‘yes’ vote on their side in South Africa. Thus along with the rest of Africa, the other BRIC nations may also be in trouble.

South Africa simply doesn’t stack up with the BRIC nations in GDP or other demographic terms. It’s interests are diverse and divergent from the BRIC and is a commodity exporter. Not an importer. South Africa has little importance as of now in BRICS funds as their portfolios show negligible investment in the Sub-Saharan giant. The BRIC funds have practically zero exposure to South Africa. Any investment that does come to South Africa creates ‘jobless economic growth’, companies benefit from new technology and foreign investment but they do not create jobs. For a country with an unemployment rate higher than that of Greece, this is very worrisome. South Africa’s growth is wracked by high unemployment and industrial unrest. It’s economic health is weak. Millions of poor South Africans want better wages, more job protection, pensions and higher taxes to improve public services. Many are getting restless, resulting in public sector strikes and growing land occupations. Even by BRIC standards the income inequality in South Africa is abnormally high. Since 1994, the income of the top quartile has risen at nearly 30% a year while that of rest at just 6%. South Africa is like a double-decker bus travelling with the rich on top and the poor at the bottom; however, the bus has no stairs. While South Africa may not be able to match up to the size and magnitude of the other BRIC economies, it is still the largest African nation. Instead of being a part of the BRICS, South Africa should address their economic problems and eventually as the dominant force in Africa help unify Africa by promoting strong cross border trade and infrastructure links.

It’s time to reform the reforms and compare BRIC by BRICS.

Satyajit Mishra: Currently in 3rd year of B.Com under Calcutta University specializing in accounting and finance. Also pursuing Chartered Accountancy. Reading research and analysis of the global economy, political matters that influence our economic decisions, game theory and strategies in war, strategy formulation and implementation and contemporary issues in marketing interest him a lot.