Commercial real estate market What to expect in 2014

Post on: 16 Март, 2015 No Comment

There is much speculation on what the commercial real estate market will bring in the new year. What will happen to interest rates? Are vacancy rates expected to increase or decrease? Although many questions arise, there is a positive outlook for the New York commercial market in 2014 and many believe we can see a noticeable increase in overall activity from 2013.

In the last months of 2013 it seems as though we have seen an increased push for acquisitions. Suppose it could be the fear of climbing interest rates sparking urgency in buyers. It could be the recovering economy expected to bring strong job numbers in 2014, which in return could give the FED more reason to raise the interest rates in belief that the economy could handle it. Because of this urgency we could see buyers looking to close transactions quickly with fear of interest rates reaching past 6 percent, which could further lead to a slowed market, a transition of increased cap rates and inventory.

However, there is mixed opinions of whether the interest rates will increase enough to slow down the market. According to Fred Peter, CEO of Warburg Realty Partnership, “unless the economy really picks up steam, I would be surprised if we saw any dramatic shift in rates.” It looks like the economy may play a big role in interest rate growth but this instilling fear and anxiety in buyers may cause a very busy market in the beginning of 2014 and very well through the rest of the year.

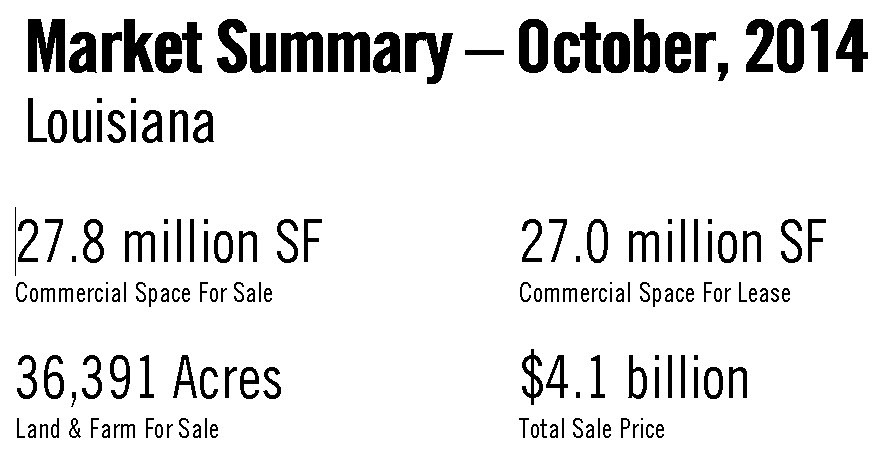

We will see some emerging markets in 2014. The industrial market is expected to boom with the expansion of e-commerce. The market is expected to see a high demand for warehouse and manufacturing space due to a number of factors. Online retail giants like Amazon.com are looking to expand warehouse space to make for more efficient and quicker distribution. It is possible to also see a comeback in manufacturing due to the increased labor costs in China according to a study by Urban Land Institute. The retail market is also expected to see growth more so in high-end urban areas rather then the previously expected suburban areas like Long Island. The employment increase should also help to keep retail in demand but it has to compete against the rise in e-commerce which has lowered the demand for brick and mortar locations.

The multi-family market this year has seen an extreme lack of supply, especially in Queens. Inversely, the demand for multi-family has remained high which we can expect to continue to see going into 2014. Most qualified owners are still achieving record low rates in the low 3 percent range for multi-family purchases. These levels of interest rates and below 1 percent vacancy rates entice current apartment building owners to refinance instead of testing this white-hot market which feeds into the complete lack of product in this asset class.

With interest rates expected to have less of an impact than previously noted and a recovering economy we can expect to see a busy start to 2014 in the commercial real estate world.