Commercial Real Estate Investing Lingo For Dummies

Post on: 17 Июнь, 2015 No Comment

Commercial real estate investing is all about numbers. In order to evaluate and analyze a commercial real estate investment, you need to know a few important numbers, what they’re called, and how to figure them. Having these terms under your belt is crucial on two fronts:

- Most likely, you’ll use a real estate broker to help you locate and close the deal. Real estate brokers know and use most of the terms mentioned here. If you can speak their language, you gain instant credibility and a relationship advantage over someone without this vocabulary.

- Just by increasing your word power, you gain increased confidence, which enables you to make sound, efficient investment decisions and gives you an increased ability to hold your position, especially in negotiations.

Here are the names, numbers, and equations you need to know:

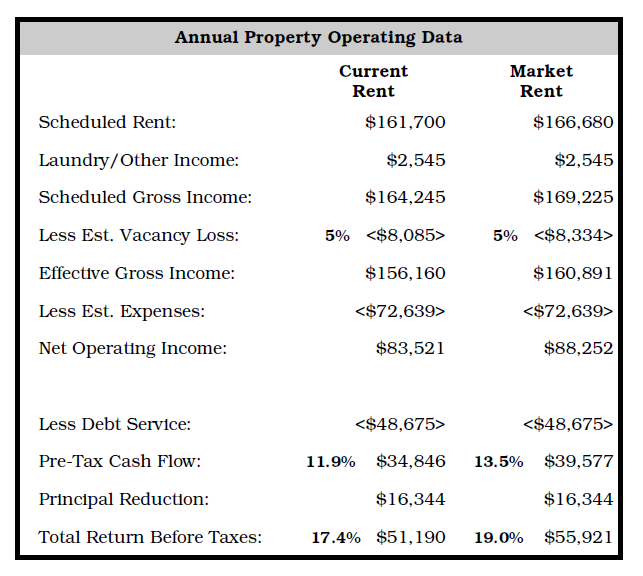

- Capitalization rate: The capitalization rate is a measure of a property’s performance without considering the mortgage financing. Also known as the cap rate, it’s your net operating income divided by the sales price. Cap rates tell you how much you’d make on an investment if you paid all cash for it:

Cap rate = net operating income sales price

Annual cash flow = net operating income debt service

Monthly cash flow = annual cash flow 12

Cash-on-cash return = annual cash flow down payment

Debt service = monthly mortgage amount x 12

Effective gross income = income (vacancy rate % x income)

Net operating income = effective gross income operating expenses

Vacancy rate = number of vacancies number of units

- Add a Comment Print Share